It looks like you're new here. If you want to get involved, click one of these buttons!

Just because we may watch the market closely and debate what happens, and just because we follow politics closely and debate what happens doesn’t mean the market cares one wit about politics. It doesn’t. Thinking it does misunderstands how the market works and how the government works.

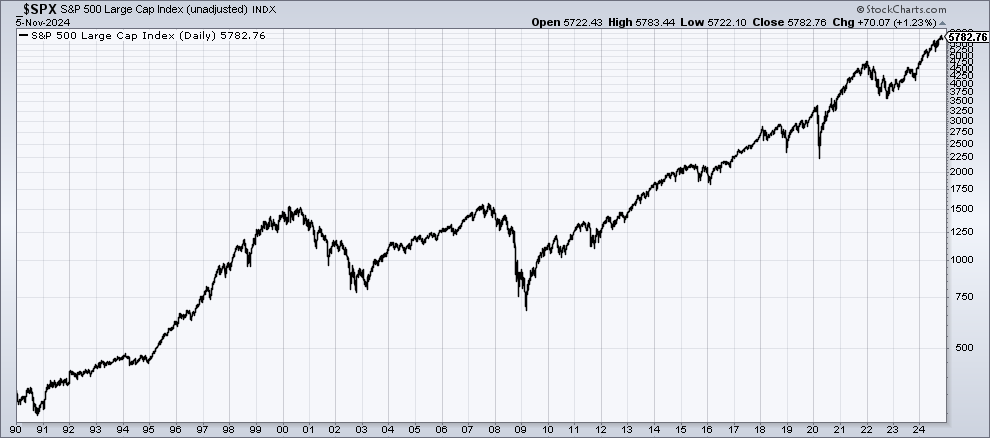

A simple lesson is to look at long-term stock charts and see if you can pinpoint election dates. You probably can’t.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments

(I gave up trying to predict major market moves years ago.)

A good investor is like a Dr who is capable of taking on a critically sick family member as a patient.

I've written several times over the years of 'this time is different' and adjusted a portfolio as necessary.

I'll stay with 'this time is different' ,at this point in time.

Everyone will seek their investment path, as needed.

https://stockcharts.com/h-sc/ui?s=$USD&p=D&b=5&g=0&id=p25084282008

Investopedia Article examines the politics of the election and its impact the markets:

how-the-outcome-of-the-presidential-election-could-affect-your-stock-portfolio

He stayed out of the race this year, but organized fundraisers in previous years for Obama and Clinton. It seems that his recent investment strategy has been partly influenced by his political prognostications. It will be interesting to see how he adjusts course going forward. He’s very pragmatic and never one to ignore reality.

Buffet "only" missed 56+% in the last 2 years for his favorite advice, the SP500.

https://schrts.co/SNtMNdYU

Sounds just a bit like the ”trend following” tactic discussed by Meb Faber in this week’s Barron’s. (Perhaps once known affectionately as “Student body left! Student body right!”)

I just noticed NSRGY is down to $88. Hopefully, everyone in this forum got out of that sucker with their toes and limbs intact.

Got me wondering. How have various Presidents / Administrations affected our investment fortunes over the time most of us have been investing? Keep in mind, please, that (political) decisions made today may have economic ramifications that last far longer (sometimes decades) beyond the tenure of the politicians that enact them (reasI oppose term limits for Congress.

What I remember about different administrations since I began watching the markets in the 1950s:

Eisenhower - Increased infrastructure spending. The interstate highway system we enjoy today was undertaken. Consider the effects on commerce. Also helped in the post WWII reconstruction of Japan and Europe. Costly of course.

JFK - Promised to land a man on the moon by the end of the decade (60’s). It was costly and so strained the budget. But we continue to enjoy the benefits of the progress made in using space for our betterment. (GPS for instance). Consider all the economic benefits. Also, JFK was leary about getting deeply entrenched in Vietnam. Imagine how history and economics might have evolved had we not.

LBJ - His legacy may well be our deepening involvement in Vietnam. Costly in lives as well as money. May have planted the seeds of the coming inflation - although demographics played a part. LBJ’s “Great Society” undertook increased Federal spending the country could ill afford at the time. This helped stoke the rising inflation.

Nixon - Wage and price controls. A placebo / bandaid approach to combating inflation which was still in the 4-5% range. Significant in that it awakened public interest in the issue. Also, under Nixon the U.S. largely withdrew from Vietnam. Also, under Nixon the fixed price of gold at $35 an ounce was ended by international agreement.

Ford - With the help of wife Betty, Ford introduced the “WIN” pin. (You can still buy one on eBay.) WIN stood for ”Whip Inflation Now” Another placebo approach. We Americans prefer easy solutions.

Carter - With inflation raging (double-digits) Carter appointed Paul Volker Federal Reserve Chair in 1979. The rest is history.

Regan - Increased defense spending sharply stoking inflation. But under Regan the steep Federal Reserve interest hikes led to a sharp recession beginning in 1981 - the worst downturn up to then since the Great Depression. Unemployment surged to 10.8% in 1982. But if you had money to invest you could pull 15% in a money market fund. Who needed stocks?

In August 1981 Regan fired striking members of the Professional Air Traffic Controllers Organization (PATCO) after they went on strike violating a federal law against strikes. My personal view is that was the leading edge of an attack on organized labor that lasted decades. Over many years pensions were gutted and wages fell as labor’s ability to negotiate benefits waned. But this probably was beneficial for stock investors. The loss of defined benefit retirement packages also helped propel the rise of the 401-K. Some think this investment vehicle has led to a “boom” for index investing - though that’s a far reach.

Also - In 1987 Regan appointed Alan Greenspan to Federal Reserve Chair. Under Greenspan equity markets surged. Greenspan’s tenure ended in 1986. Critics sight his monetary policy as too lax and stoking inflation in later years.

Bush 1 - Negotiated and signed NAFTA, expanding global trade. This has paradoxically been blamed by some for loss of jobs in the U.S. - although unemployment remains low. I think the ongoing political repercussions from NAFTA do reverberate through the economy today. But they are hard to quantify.

Clinton - We actually achieved a balanced budget under Clinton. But his personal problems partly overshadowed his accomplishments.

Bush 2 - In Bush’s term a global recession of great magnitude ensued which cost equity (index) investors around 50% before it ended 15 months later. Junk bonds were hit hard. The Fed undertook strong monetary stimulus. The effects of those Fed stimulative measures are likely still being felt today. Federal spending increased sharply. “President George W. Bush's economic policies added $6 trillion to the national debt by funding two wars and three tax cuts.” (from the balance money.com).

I’ll stop here. I think the effects of the last three Presidents are too recent to fully access, and very controversial, as all three continue to be actively involved in the politics of the day. Further - a global pandemic that began in 2020 greatly altered the stage. Any administration would have had trouble coping with the economic challenges. Fiscal and monetary emergency measures during the pandemic are seen as one cause of the recent inflation - along with the distortions created by the pandemic itself.

-

Question: Would knowing in 1950 (err … pick your start date) what future politicians would do have affected the way you would have chosen to invest for the long term?

Remember the now-classic warning from Eisenhower (elected 1952) about the Military Industrial Complex? If someone had no compunctions about it, investing in defense/military equipment stocks would have reaped you a fortune--- provided you sold Boeing before the current corporate meltdown. Eh?

Yes. It made the evening news that day. Remember it well. All the networks carried it. (Tuesday January 17, 1961). And we discussed it in our 8th grade Civics course the following day.

@Crash. War will always be a good investment. Look for SpaxeX to go public sometime in the next few years. Investors will rush to buy. It is deeply involved in military applications although most details are kept secret. A military outpost (perhaps an invincible “doomsday” command center) on the dark side of the moon sometimes in the next 10 years is not beyond the realm of possibilities. With the advent of remote drone warfare the location of a command center can be thousands (or hundreds of thousands) of miles distant. Fortunes will be made. (Poor Ike had no idea.)

I checked. It takes only 1.2 seconds for a radio wave to travel from moon to earth.

Lastly, investing based on politics is really bad idea, especially when you have XXX.

"but this time is different"....every day is different. everyday something happens in the world in a way that hasn't happened before. they may not be categorically black swan events, lets call them grey swans. and yet the world markets have prevailed. sure their gains and profits have swung to and fro but they have prevailed.

”Some political leaders around the world (including in the U.S. and certain European nations) have been and may be elected on protectionist platforms, raising questions about the future of global free trade. Global trade disruption, significant introductions of trade barriers and bilateral trade frictions, together with any future downturns in the global economy resulting therefrom, could adversely affect the financial performance of the Fund and its investments.”

Principal Risks of Investing in the Fund / Geopolitical Risk

@bee / The concern noted would seem to be right down your pipe. Obviously Cohen & Steers felt a need to caution investors that politics might indeef “interfere with your investing.”

(Duly warned, I went ahead and initiated an investment in this fund today.)

@Baseball_Fan - You have in the past invested with John Hussman. Has he had any comments lately re the election outcome and how it may affect the investment landscape? Just curious if you happen to know. I don’t know if you still read Bill Fleckenstein. I continue to, despite being miles apart politically. I do learn a lot about investing from him. I mention this, because some of your wild assertions like ”you have yellen issuing multiplies of standard deviation of short term tbills to keep bond volatility and rates suppressed to allegedly get her gal elected” appear to be right out of Bill’s playbook.

(Generally, we capitalize the first letter of a proper noun. So your “yellen” is an unusual departure from standard English - whether intentional or by oversight.)

It seems to me politics deserves some consideration -- at least at the margins -- when portfolio adjustments get made.

https://finance.yahoo.com/quote/ET/

Gas is under 3 bucks for the first time since we moved to the Phoenix metro eight years ago. Under the circumstances, why would they want to drill?