It looks like you're new here. If you want to get involved, click one of these buttons!

W/E September 6, 2024..... Weak equity = +++ returns for quality bondsMy intention, at this time; is to present the data for the select bond sectors, as listed; through the end of the year (2024). This 'end date' will take us through the U.S. elections period, pending actions/legislation dependent upon the election results, pending Federal Reserve actions and market movers trying to 'guess' future directions of the U.S. economy. As important during this period, are any number of global circumstances that may take a path that is not expected; and/or 'new' circumstances. In the 'cooking pot' we currently have the big ingredients of the middle east and also, how much damage Ukraine may inflict upon Russia and the response.

Long-standing anti-bank bias. (and I'm in DC/NoVA)Nothing against Duke as a company - I'd rather buy a note from them than a Wall Street company.

Senior unsecured Duke notes are rated Baa2 (Moody's) and BBB (S&P); current Goldman Sachs new issues (Fidelity listing) are rated A2 (Moody's) and BBB+ (S&P).

Hometown bias?

What's the risk?Called "variable denomination floating rate demand notes," the securities are basically unsecured bonds, paid by the company's cash from operations. There is no public market and investors can typically withdraw their money at will. Rates can be changed at any time by the company, which can call the securities at its discretion.

https://thebulletin.org/2020/02/the-us-government-insurance-scheme-for-nuclear-power-plant-accidents-no-longer-makes-sense/[The] Price-Anderson [Act has since 1957 freed] nuclear plant operators and all firms involved in nuclear construction and maintenance of any liability for offsite accident damage. The only chance for additional compensation lies in the act’s declaration that if accident damages exceed the legal limit “Congress will thoroughly review the particular incident” and will “take whatever action is determined to be necessary” to provide full compensation to the public. In short, a Fukushima-level accident would toss the costs of compensation and cleanup unto the lap of Congress.

Comment: Knowing Trump, I'm sure he's using this paper loss to offset actual income somehow, somewhere.Stock plunge wipes out Trump Media’s extraordinary market gains

Shares in Trump Media & Technology Group (TMTG ), owner of Truth Social, closed below $17 on Wednesday, reversing all their gains since the company’s rapid rise took hold in January.

The former president has been prohibited by a lock-up agreement from starting to sell shares in the firm until late September. While his majority stake in the firm is still worth some $2bn on paper, its value has fallen dramatically from $4.9bn in March.

As a business, TMTG is not growing rapidly. It generated sales of just $4.13m in 2023, according to regulatory filings, and lost $58.2m.

Nor is Truth Social growing rapidly as a platform. While TMTG has not disclosed the size of its user base, the research firm Similarweb estimated that in March it had 7.7m visits – while X, formerly Twitter, had 6.1bn. That same month, however, TMTG was valued at almost $10bn on the stock market.

It's still $15.98 overpriced though....DJT closed at $16.98 per share, down another 6% today, Wednesday Sept 4. It's obvious that Biden and the Democrats HAVE RIGGED THE STOCK MARKET TOO !!!!!

Nice feature ain't it? The kids can rearrange the deck chairs to suit themselves.It is our goal to leave taxable investments to our heirs.According to Section 1014 of the Internal Revenue Code, if a person holds property at death, it will receive a new basis equal to the fair market value of the property at the person's date of death. In the case of appreciated assets, the rule allows people to inherit the assets, such as stocks or real estate, without inheriting the tax burden that's triggered by capital gains. This is known as a step-up in basis. In states that recognize community property laws, married couples stand to benefit greatly.

It is our goal to leave taxable investments to our heirs.

https://fidelity.com/learning-center/personal-finance/what-is-step-up-in-basisAccording to Section 1014 of the Internal Revenue Code, if a person holds property at death, it will receive a new basis equal to the fair market value of the property at the person's date of death. In the case of appreciated assets, the rule allows people to inherit the assets, such as stocks or real estate, without inheriting the tax burden that's triggered by capital gains. This is known as a step-up in basis. In states that recognize community property laws, married couples stand to benefit greatly.

https://ir.ofscreditcompany.com/shareholder-services/dividend-reinvestment-plancommon stockholders may now receive a number of shares based on 95% of the market price per share of common stock at the close of regular trading on The Nasdaq Capital Market on the valuation date fixed by the Board for such distribution

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/customer-service/brokerage-retirement-cust-agree-and-commission-sched.pdfNote ... that the stock price at which your reinvestment occurs is not necessarily the same as the price that is in effect on the dividend payable date. This is because we generally buy the shares of domestic companies two business days before the dividend payable date [likely now one day before with T+1], at the market price(s) in effect at the time, in order to help ensure that we have shares on hand to place in your account on the dividend payable date.

https://admainnew.morningstar.com/directhelp/Glossary/Performance/Total_Return.htmReinvestments are made using the actual reinvestment price,

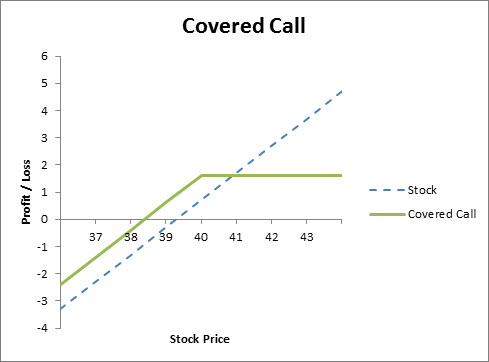

I will do this on positions with large gains that I wish to protect (ideally a zero-cost 'collar'), such as large dividend payers. I don't do it very often, but it can work well in that scenario. But CCs alone are rarely worth doing unless it's on a stock that doesn't really move very much -- which also means the premium you might get for the call makes it more trouble than it's worth.From the article,

"In years where stocks declined, eg the global financial crisis in 2008 or the bear market in 2022, the call options expired worthless but did provide investors with additional income that reduced the drawdowns*."

*(YBB Note) By tiny amounts. Basically, covered calls didn't provide downside protection unless some puts were bought using the covered call income.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla