It looks like you're new here. If you want to get involved, click one of these buttons!

Oh, dear. Quite a story. As for inheriting MLP units: we always use the same tax professional, anyhow. She ought to be able to provide any IRS-required numbers without any trouble, eh? The difference between true dividends and return of capital takes a bit of thinking-through.What @rforno says about the “dividends” is true. My father-in-law received physical checks from such energy partnerships as well as regular stock dividends. Family members recall him running down to the mailbox just after mail delivery to grab his checks, lest someone pilfer the mail. Those were the days preceding electronic trading and, most importantly, electronic brokerage record keeping. Upon his demise, it was necessary to report to the green-eyeshade types the current value, and the cost basis, for each holding. It turned out that the filing system was a pile of Manila file folders with a record, in pencil, of each periodic payout. Since each payout from a LMP reduces the cost basis of the security, up to 100%, the family paid for more than a little forensic accounting and lawyering. Payment of income taxes was obviously delayed, at least from the perspective of the deceased, but someone else got stuck with the chore of reporting to the IRS. Taxes delayed ain’t necessarily good for everyone.

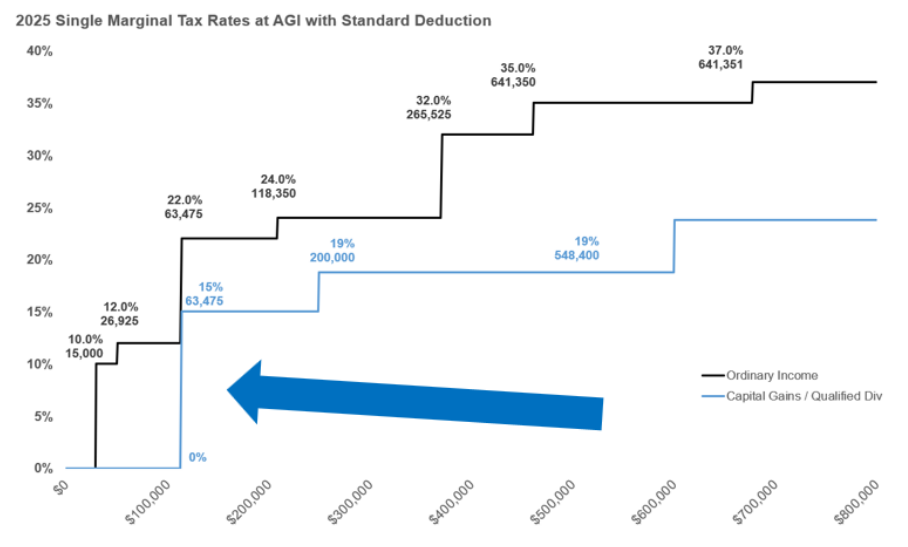

Thanks @msf, I am still digesting what you wrote. Wondering if RMDs could be worked into this "Capital Gains Year" strategy where by:I'm playing this game by bundling cap gains into some years and ordinary income into others.

A few techniques to bundle ordinary income

- Do Roth conversions in "ordinary income years".

- Buy short term (1 year or less) CDs/T-bills in "cap gains years" that mature in "ordinary income years"

- Invest in muni (MM, bond) funds in "cap gains years", and taxable (Treasury, corporate) funds in "ordinary income years"

A couple of techniques to bundle cap gains

- Accelerate recognition of gains (sell and repurchase if desired) in "cap gains years"

- Sell "around" annual distributions - avoid distributions of ordinary income (if any) and repurchase after record date (recognizes additional cap gains)

Depending on how much space you have in your 0% cap gains bracket, creating more cap gains may or may not work out for you. In any case, the added cap gains are state-taxable, so that should be kept in mind as well.

On the flip side, Roth conversions may be partially or fully state tax-exempt, depending on the state. That's motivation to convert some money even if it eats into the 0% cap gains bracket.

Note that the numbers presented in the graph are incorrect.

Cap gains: $47,025 (top of 0% bracket) + $14,600 (std ded.) = $61,625, not $63,475

Ordinary inc: $47,150 (top of 12% bracket) + $14,600 (std ded.) = $61,750, not $63,475

Note also that the cap gains bracket does not line up exactly with the ordinary income bracket (as given by the IRS). Close, but different.

It looks like the author may have been adding in the 2023 extra deduction ($1,850) for being over age 65 (or blind). That would make the cap gains figure come out to $63,475.

Barron's, Vanguard Throws in the Towel on Its Managed Payout Fund, Feb 28, 2020Payout funds got their start during the 2007-2008 financial crisis when Vanguard and Fidelity both launched the products. The idea was appealing: Convert a retirement savings pool into a reliable income stream and offer investors peace of mind that they’d get a monthly paycheck, regardless of the market’s ups and downs.

...

Vanguard initially had three payout funds but merged them into one fund in January 2014. Fidelity developed a series of Income Replacement funds, paired with an optional monthly payout feature, but Fidelity rebranded the funds in 2017 as “Managed Retirement Income” with more of a high-income focus rather than managed payouts.

One hurdle: Managed payout funds have long had trouble hitting their income targets without dipping into capital—simply giving investors part of their money back. Annuities work similarly, though they have an insurance component that can keep the income flowing if the portfolio runs out of money.

What annuities do is pool risk. Some people die early, others later. Instead of each individual self insuring (collectively overinsuring), individuals pool their risk through an insurance company. This provides larger income streams safely.[U]sing a relatively simple model we estimate consumption could increase by approximately 80% for retirees if assets were converted to lifetime income streams, where the improvement rates are significantly higher for joint households

The Mechanics and Regulation of Variable Payout Annuities (50 pages. TL;DR)Variable payout annuities provide protection against longevity risk and allow for some participation in the higher (but more volatile) returns of corporate equities and other real assets. They also avoid the annuitization risk because their benefit payments vary with investment performance and are not fully determined by the prevailing conditions at the time of retirement. But VPAs are exposed to investment and inflation risks ...

For 2024, individuals with taxable income below $47,025 ($94,050 for married couples) pay 0% tax for long-term capital gains (LTCG). In years when you’re under the threshold you could effectively lock in tax-free long-term gains. The idea would be to realize just enough LTCG to stay within the 0% tax bracket. You also have to tack on the standard deduction which is $15,000 for individuals or $30,000 for a married couple. That means don’t have to pay federal income taxes on your long-term capital gains until your income exceeds a little more than $63,000 (single) or $126,000 (married couple). So you could realize more than $63,000 ($126,000) in capital gains and dividends without paying any federal income tax.

Unfortunately, that "above the line" deduction was temporary, it was only allowed in 2020 and 2021. There is a movement to restore it and make it permanent.I believe one can claim $300 on standard form. I"m probably wrong as I haven't done my Taxes in the last 7 or 8 years. I realize $300 isn't going to help much, but to some people every little bit saved is a plus.

Abstract: The shift to defined contribution savings plans means that more retirees must fund spending

from savings. Prior studies find that there appears to be a behavioral resistance to spending down

savings after retirement in a manner that is consistent with life cycle models. We explore how lifetime

income, wage income, capital income, qualified savings, and nonqualified savings are used to fund

retirement spending. We find that retirees spend far more from lifetime income than other categories of

wealth. Approximately 80% of lifetime income is consumed, on average, versus only approximately half or

other available savings and income sources. Overall, the analysis suggests that converting savings into

lifetime income could increase retirement consumption significantly, especially for married households.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla