It looks like you're new here. If you want to get involved, click one of these buttons!

Nothing to do with insecurity, trying to be accurate. FXAIX didn't perform better because it didn't have a lower ER all these years. The main difference between me and others is that I supply numbers and not just narrative ;-)Your contrib is so valuable, but are you really so insecure you have to impugn ('obsess') anyone who offers even mild corrections or challenges ?

Anyway, let me add that FXAIX does not outperform either Vanguard SP500 product if you go back to their spring 1988 origin, only more recently.

See 15 years of risk/reward(link).I think you got the mandate wrong there. D&C is not required to beat the S&P 500. They are acting to select value stocks which they deem safer and worthy of their clients money. It's obvious to me that many investors do, judging by the AUM. For many of them it's not just all about who has the biggest pile of money at the end of the day. Not everyone can make trades after the fact.

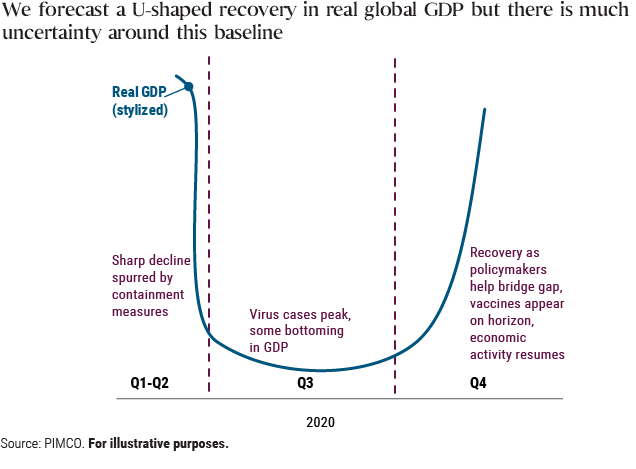

We are seeing the first-ever recession by government decree – a necessary, temporary, partial shutdown of the economy aimed at preventing an even larger humanitarian crisis. What is also different this time is the unprecedented speed and size of the monetary and fiscal response, as policymakers and monetary authorities try to prevent a recession turning into a lasting depression.

We believe this crisis is likely to leave three long-term scars:

Globalization may be dialed back

More private and public debt

Shift in household saving behavior

We believe a caution-first approach is warranted in an effort to protect against permanent capital impairment.

how-pandemic-proof-globalizationAs airports, factories, and shops slow down or shut down, the novel coronavirus pandemic is testing the international supply chains that define the current era of globalization. And the multi-factory and often multi-country manufacturing processes used by companies around the world are proving more fragile than anticipated. If the virus and the economic wreckage it is causing aren’t contained soon, blueberries and avocados won’t be the only things missing from market shelves across the still chilly Midwest and Northeast United States. Cars, clothes, electronics, and basic medicines will run short as far-off factories disconnect.

'Nuff said in my opinion. ARIVX didn't work. Hopefully he puts that money to work wisely. But isn't everything value now? Maybe more value a month from now?He previously ran cash-heavy portfolios with an Aston River Road fund ARIVX and at Intrepid Capital.

https://seekingalpha.com/article/4336021-bad-blood"Where to from here?" is a question no one can currently answer.

The oil story isn't merely a sideshow to the pandemic. The price war (narrowly construed) is tangential, but the potential for the collapse in prices (which fell the most in history during the first quarter) to make an already bad economic situation worse, is real indeed.

....This speaks to the irony of the Fed's multi-pronged corporate bond buying program announced late last month alongside a raft of additional measures. We are in no position to allow misallocated capital to be "purged."....In short, all of this has to be propped up, bailed out and otherwise inoculated. If it's not, the domino effect would be catastrophic, and although the cavalier among you may be inclined to bravely parrot the "let it all burn" line, I doubt you really want that.

Although there are, of course, limits to how much spending can be authorized without offsets, those limits are dictated by inflation. Quite obviously, inflation isn't something we need concern ourselves with in an environment characterized by the single largest demand shock of the past century.

In short, the mighty US services sector just disappeared in the space of four weeks. It's gone. That doesn't mean it's not coming back, but for the duration of the lockdown, it basically doesn't exist.

... there is absolutely no way to know what earnings are going to look like for the second and third quarters. I cannot remember (or find anyone who can remember) a time when there's been less visibility into the outlook for all corporate profits, not just one or two troubled sectors.....Show me someone who thinks they can price equities in this environment and I'll show you a liar. It's just that simple.

The Fed isn’t going to cancel all of the various liquidity facilities and asset purchase programs put into place over the past four weeks if the spread of the virus slows. That bid (which is now unlimited in scope) will be in the market for the foreseeable future, and now it includes spread products.

My main point, for years now, that many put D&C on a pedestal because their team management style, LT investing history, lower rates which I know all about but the numbers don't back it up and then I hear the excuses.VTV is not SP500 value, right? That would be VOOV.

3/4 as many stocks.

And if you write and edit fund prospectuses, you recognize that the D&C language nuance / emphasis are subtly more different from than similar to the TRP language.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla