It looks like you're new here. If you want to get involved, click one of these buttons!

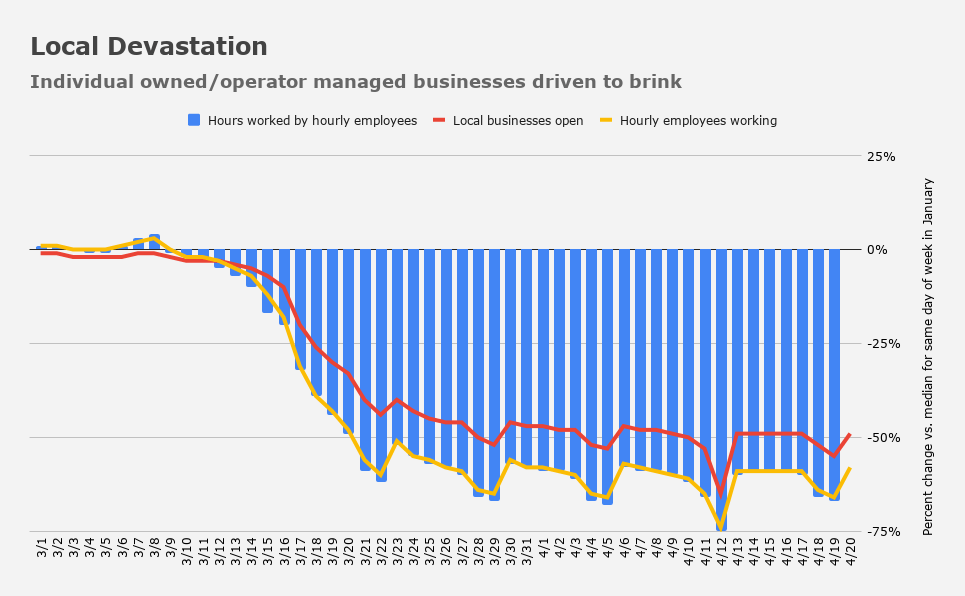

The manufacturing sector hasn't completely rolled over yet, but the services sector simply ceased to exist starting late last month.....The message is clear: Main Street isn't just hurting, it is disappearing in a very literal sense. As Atlanta Fed boss Raphael Bostic warned earlier this month, "May is going to loom large, in terms of the transition of concern from this being a liquidity issue… to this perhaps translating and transferring into a solvency issue, and whether companies can exist at all."

.(...from Homebase, a scheduling and time tracking tool used by more than 100,000 local businesses covering 1 million hourly employees.)

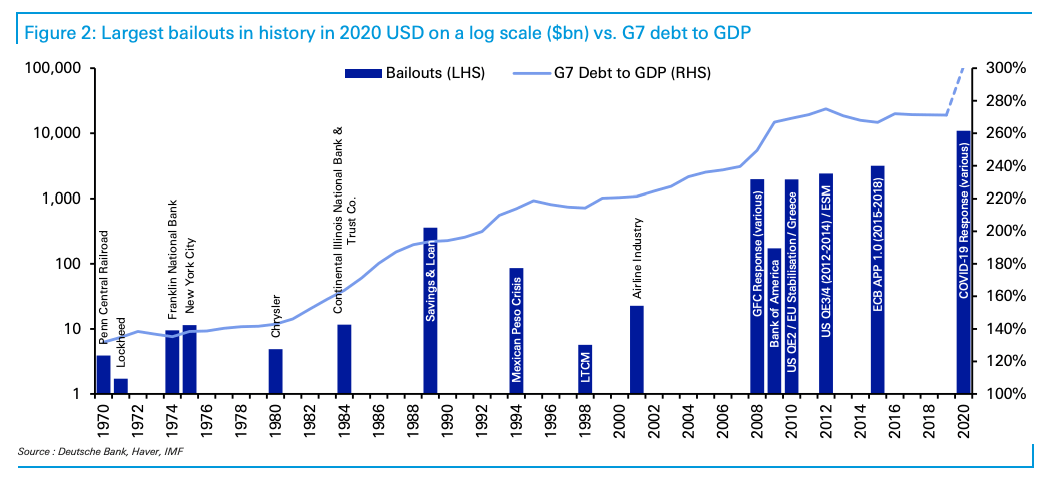

Deutsche Bank rolled up the fiscal and monetary support programs announced and implemented in the US and Europe into a single "bailout" figure. The sheer size of the COVID-19 response necessitated a log scale (on the left axis) in order to help "better identify the earlier bailouts and get a rough feel visually for the numbers," as the bank put it. ....."Obviously we won’t know how much will be used until much further down the road," the bank cautioned, in the course of presenting the numbers and accompanying visuals.

https://seekingalpha.com/article/4340027-dystopia-now

....policymakers have been deliberately suppressing volatility, compressing risk premia, tamping down credit spreads and keeping the market wide-open for borrowers for the better part of a decade....

Deutsche Bank's George Saravelos.....At the extreme, central banks could become permanent command economy agents administering equity and credit prices, aggressively subduing financial shocks. With unlimited capacity to print money, central banks have unlimited capacity to intervene in asset markets too. Put simply, a central bank that pegs bond, credit and equity markets is highly likely to stabilize portfolio flows as well.

The Trinity Study:First, I wanted to see how this was working with recent stock market returns. The original study was only covering years up to 1995. I wanted to have more recent data. I wanted to make sure that the results were holding with more recent stock market behavior. So this simulation will cover returns until the end of 2019!

Secondly, the original study was only covering up to thirty years of retirement. I wanted to be sure that the portfolio can sustain withdrawals for much more extended periods. For people retiring early, I think that 50 years is not unreasonable.

You don't have to invest in a high yield bond fund for your mission."And we should not have to invest in JUNK in order to get a decent income stream, each month..."

https://www.marottaonmoney.com/if-you-act-fast-you-can-undo-your-2020-rmd-thanks-to-the-cares-act/Furthermore, although qualified charitable distributions (QCDs) can be used to satisfy your RMD, I believe that you cannot make a rollover contribution using those funds. To be a qualified charitable distribution, the assets need to be paid directly to the charity. However, in order to begin a rollover contribution, the funds must be paid directly to you so they are under your control. Thus, even though I cannot find an explicit ruling on the matter, I believe any QCD already taken in 2020 will also be final.

blog.yardeni.com/2020/04/fed-trying-to-contain-zombie-apocalypse.htmlCreating the Zombie Apocalypse. Fed Chair Jerome Powell is doing an admirable job of playing the action hero in “2012 Zombie Apocalypse,” a 2011 film about a fictional virus, VM2, that causes a global pandemic. He is doing whatever it takes to stop the zombies from killing us by ruining our economy and way of life.

A couple of tweaks.YOU have 60 days to return it from date of distribution, I believe I read. Although that may be from CARES implementation.

(Already taken out your 2020 RMD but wish you hadn’t? You might be able to roll over distributions you’ve already taken for 2020, says Slott. If you've already received a distribution from your own IRA or one inherited from a spouse for 2020, you can roll it back into your IRA within 60 days of receipt. ]

(Nerd Note: The lone exception for beneficiaries would be for a spouse who chose to remain a beneficiary of the deceased spouse’s retirement account. In such an instance, they may be eligible to put the RMD back into their own retirement account, as a spousal rollover, using one of the methods described above.)

https://bizjournals.com/baltimore/news/2020/04/21/bill-miller-this-is-one-of-the-5-greatest-buying.html?ana=yahoo&yptr=yahooMiller said only four other times have stocks have been as attractive: In 1973-1974 when the Vietnam War was going on and Richard Nixon had resigned as president; in 1982 after Mexico defaulted on its debt; in 1987 following Black Monday; and in 2008-09 during the last financial crisis. "If you missed the other four great buying opportunities, the fifth one is now front and center," wrote Miller, who is now the chief investment officer and founder of Miller Value Partners in Baltimore.

Justin Thomson, a chief investment officer for T. Rowe Price Group Inc. (NASDAQ: TROW) who oversees international equities, also offered some guidance to help investors thrive.....he sees a buying opportunity...."I should emphasize that truly great companies are rare," Thomson wrote in a white paper. "Opportunities to buy great companies at great prices are even rarer. We are currently at one of those moments."

My main point is that you can't make your assumption on others. If an investor meets their goals then it's that simple. I know a guy that sold his company for millions of dollars years ago and wants low volatility and invested over 90% in Munis and it worked great for him over 20 years. Another one retired with a pension + his SS covers his expenses and all his money is in stocks. Another guy uses only CEFs and trade them with good results. They all met their needs, there is no right or wrong answer, the problem is trying to put someone in a box that you don't like."...I can say that if you are not a buy and hold forever (Bogle style) then you are not an investor...."

I come here to learn. Reading many of the interchanges between others here and FD1000, it's clear that he/she has an unreasonable need to win all the time. Reminds me of conversations with my nephew. Reminds me of the Orange Abortion in the White House.

....... When I was a younger man and doing comunity organizing, our leader reminded us very early about a Cardinal Rule: if you control the terminology and definitions and can get the ones on the other side of the issue to start believing and using your definitions and terminology, then you've all but WON the issue.

********************************************

I'm not interested in embroidery nor competition in here. You've got info worth sharing? Share it, by all means.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla