It looks like you're new here. If you want to get involved, click one of these buttons!

It's not about knowing more, it's about backing up a "new" concept with real numbers. The best teacher is the market.FD - So you know more about investing than the professionals quoted in Barron’s?

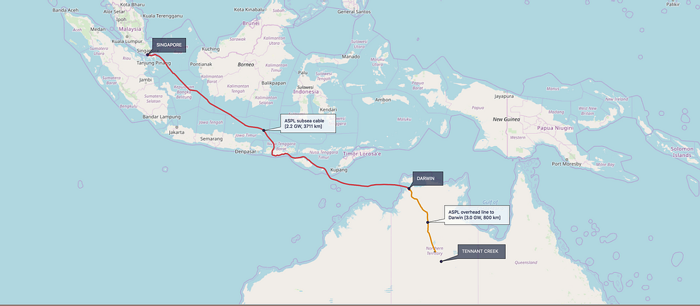

.....the Power Link doesn't just involve building the world's largest solar farm, which will be easily visible from space. The project also anticipates construction of what will be the world's longest submarine power cable, which will export electricity all the way from outback Australia to Singapore via a 4,500-kilometre (2,800 miles) high-voltage direct current (HVDC) network.

Again, the thread is not about me but after you couldn't come up with anything to debunk the original post you resort to make it personal. I never said that what I do is the only game in town, it works extremely well for our portfolio. I actually posted many times that the average Joe should buy several funds (indexes+managed) and hardly trade.It's all good, FD. PIMIX is still good for long term holders. I'm meeting my goals. That is what is important to me. Keep convincing yourself that getting 5% per year with low SD is the only game in town. I guess there's a reason people live in Georgia :o}

(Even Orman concedes that in this low interest rate environment she puts some money into stocks, though most is still in munis.)Do you enjoy spending money? Oh, yes. My greatest pleasure is still flying private. I spend between $300,000 to $500,000, depending on my year, on flying private.

What do you do with the rest of your money? Save it and build it in municipal bonds. I buy zero-coupon municipal bonds, and all the bonds I buy are triple-A-rated and insured so that even if the city goes under, I get my money.

https://www.theatlantic.com/politics/archive/2014/08/why-arent-reformicons-pushing-a-guaranteed-basic-income/375600/The idea isn’t new. As [David] Frum notes, Friederich Hayek endorsed it. In 1962, the libertarian economist Milton Friedman advocated a minimum guaranteed income via a “negative income tax.” In 1967, Martin Luther King Jr. said, “The solution to poverty is to abolish it directly by a now widely discussed measure: the guaranteed income.” Richard Nixon unsuccessfully tried to pass a version of Friedman’s plan a few years later, and his Democratic opponent in the 1972 presidential election, George McGovern, also suggested a guaranteed annual income.

NYT Article:As companies furloughed millions of workers and stock prices plunged through late March, Treasury Secretary Steven Mnuchin offered a glimmer of hope: The government was about to step in with a $4 trillion bazooka.

The scope of that promise hinged on the Federal Reserve.

how-coronavirus-could-usher-in-a-new-age-of-automationAdvances in robotics and artificial intelligence will lead to a net increase in jobs over the next five years but the coronavirus pandemic will result in “double-disruption” for workers, according to the World Economic Forum (WEF).

That will require a significant level of “reskilling” and “upskilling” from employers to ensure staff are sufficiently equipped for the future of work. According to the WEF, half of all employees will need some level of retraining in the next five years.

True the equity/bond asset allocations are a bit different. Still, the equity profiles are similar:The equity profiles are quite similar, .....Important to note significant differences between the two funds in equity holdings: VWINX 36% with HBLYX holding 44%.

https://dodgeandcox.com/pdf/shareholder_reports/dc_income_semi_annual_report.pdfIn the first six months of 2020, we established new positions in over a dozen corporate issuers at what we believe were exceptionally attractive valuations. These purchases, along with many additions to existing corporate issuers, increased the Fund’s Corporate sector weighting by 11 percentage points to 45%.

To fund these purchases, we sold certain Agency MBS and U.S. Treasuries, which now make up 31% and 8% of the Fund, respectively. We lengthened the Fund’s duration modestly through the aforementioned corporate bond purchases, though we remain defensively positioned with respect to interest rate risk.

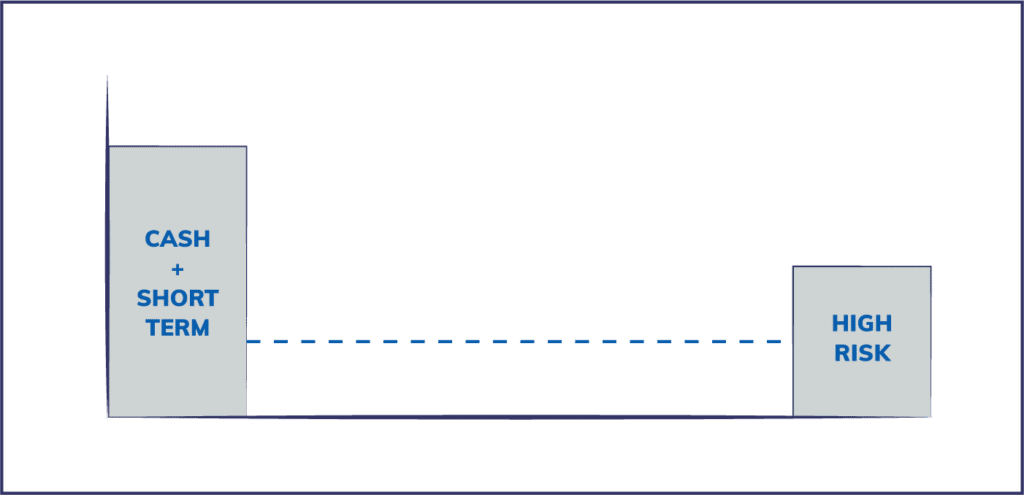

Are riskier-hedges-are-displacing-u-s-debtMany investors have no choice but to stick with Treasuries because of fund mandates, or they do so since they’re unconvinced it’s worth taking a chance on something else. Yet others are exploring riskier assets -- from options to currencies -- to supplement or fill the role of portfolio protection that U.S. government debt played for decades, a trend that highlights the dangers that the Fed’s rates policy can create.

and,

Options Hedge

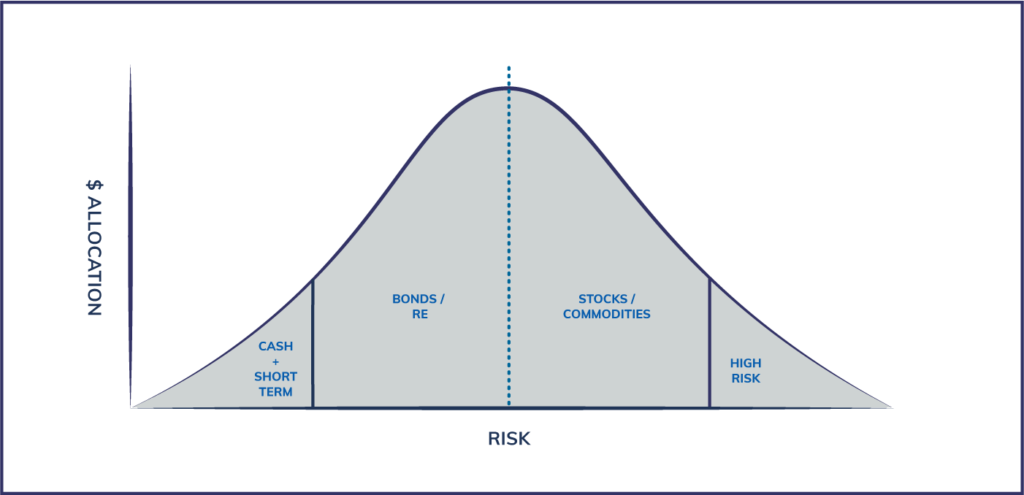

Swan is a longtime skeptic of Modern Portfolio Theory, which was made famous by economist Harry Markowitz in the 1950s and is the thinking upon which the 60/40 mix is based. Two decades ago, Swan created a strategy of using long-term put options plus buy-and-hold positions in the S&P 500 to limit huge losses during economic downturns.

That approach has since been expanded to include positions in exchange-traded funds indexed to small cap stocks, and developed and emerging markets. It relies on constant allocations of 90% to equities and 10% to put options purchased on the underlying ETF portfolio.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla