It looks like you're new here. If you want to get involved, click one of these buttons!

How I Invest My MoneyThe world of investing normally sees experts telling us the “right” way to manage our money. How often do these experts pull back the curtain and tell us how they invest their own money? Never. How I Invest My Money changes that. In this unprecedented collection, 25 financial experts share how they navigate markets with their own capital. In this honest rendering of how they invest, save, spend, give, and borrow, this group of portfolio managers, financial advisors, venture capitalists and other experts detail the “how” and the “why” of their investments.

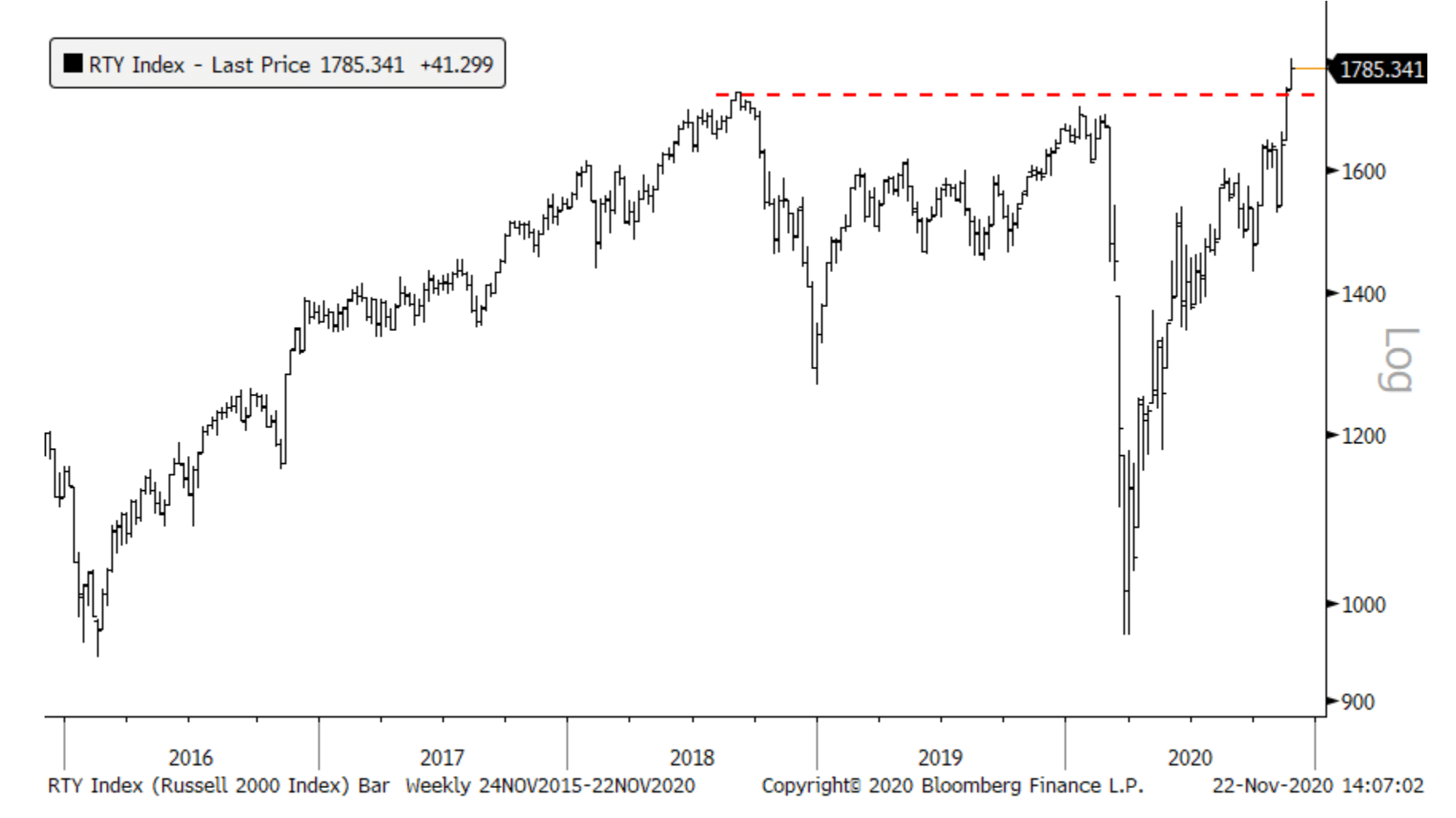

Small and midcap stocks will keep rocketing higher for 5 big reasonsSmidcap stocks are on fire. The Russell 2000 RUT, +0.55% is up over 19% this month compared to 10% for the S&P 500 index SPX, +0.24%.

Will it continue? This group has been beaten and battered for so long that many people simply doubt the move. But this is a big mistake. I don’t know about the next few days ahead, but smidcaps will continue to do well over the next year for the following five reasons.

U.S. Money-Market Investors Face Multiple Grim Trends in 2021Investors in the U.S. money market are facing a grim year ahead. That’s the vision laid out by JPMorgan Chase & Co. strategists, who predict that the supply of investable assets will shrink by about $300 billion while the amount of cash chasing them has nearly doubled to $3 trillion. A key factor on the supply side is that the quantity of Treasury bills is poised to shrink as the U.S. government replaces with longer-term debt much of the short-term borrowing it undertook in 2020 to pay for fiscal stimulus.

what-happens-to-small-caps-after-a-huge-monthly-gain/The Russell 2000 Index of small cap stocks is currently on pace for its best month ever. As of Tuesday afternoon, it’s now up more than 20% for the month of November. I looked at every double-digit return month for the Russell 2000 going back to 1979 and then calculated the total returns for the ensuing 1, 3 and 5 year periods to see how they performed after those wonderful months:

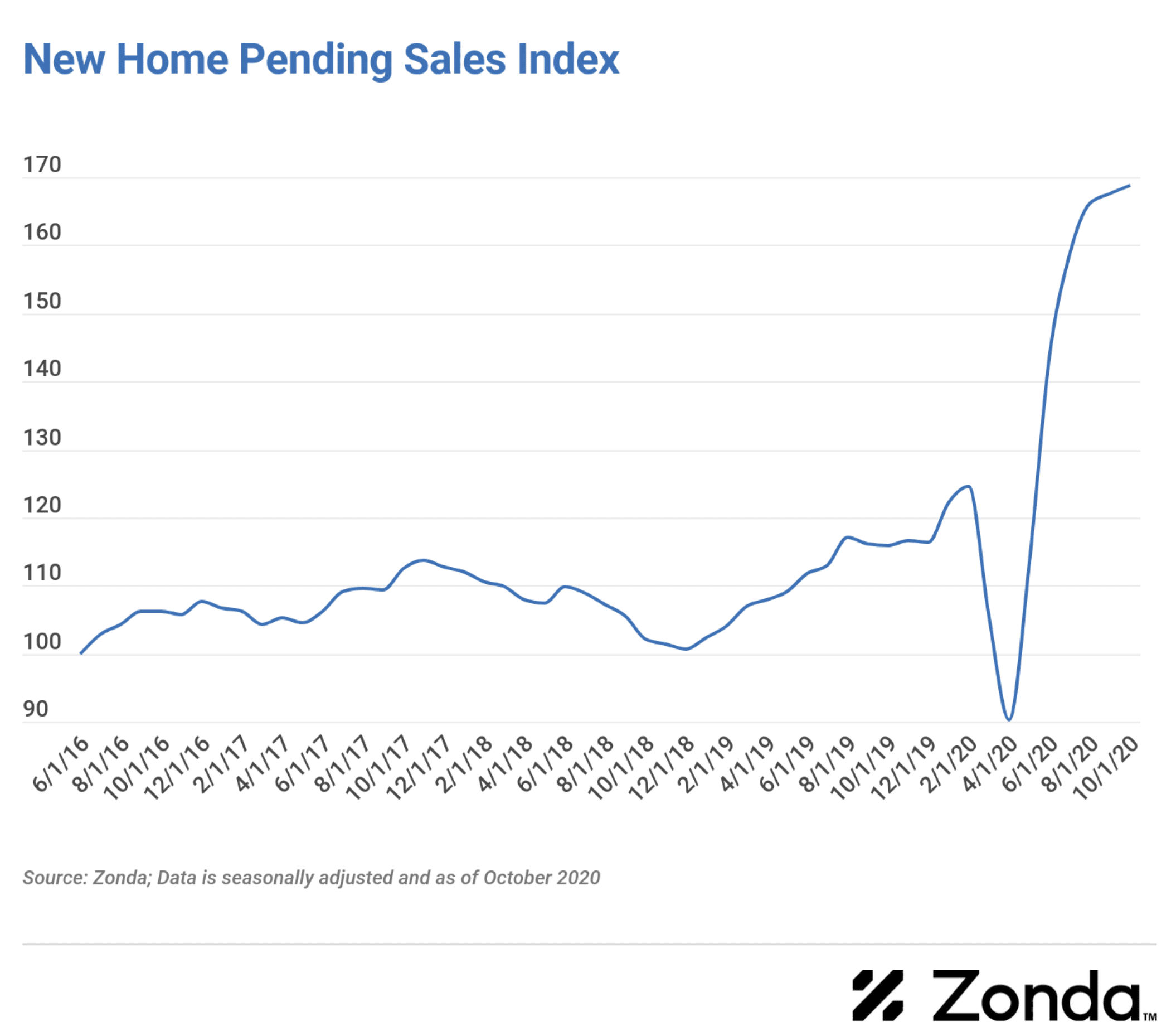

why-housing-could-be-one-of-the-best-performing-asset-classes-of-the-2020sThere is a real possibility real estate could be one of the dominant assets of the 2020s. Here are some reasons why:

Millennials. Young people are settling down later in life because they are going to school for longer, had to deal with a housing bust, and graduated in and around the Great Financial Crisis. But millennials were going to begin doing adult things eventually.

That means buying houses, even if it comes later in life than it did for their parents. Millennials are now the biggest demographic in the country and will dominate the most common ages in the country for years to come:

small-caps-break-out-of-two-year-consolidationAccording to Jon Krinsky at Baycrest, 83% of the Russell 3k names got back above their 200-day moving averages last week, a record going back seven years to 2013. It wasn’t bearish then and it’s not likely to be bearish now.

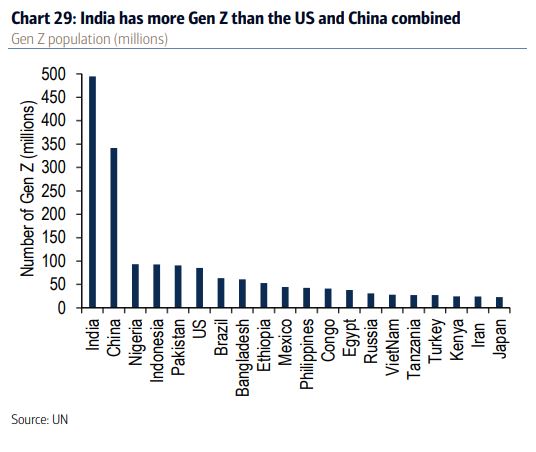

move-over-millennialsIt’s time to shift our attention to the next generation, Gen Z. These are the 2.5 billion people born between 1996 and 2016.

Gen Z is the single largest age cohort, representing 32% of the global population (2.5 Billion), Nine in 10 of these young people live in emerging markets……half a billion of them are in India, more than the combined population of Gen Zers in China and the United States.

Thematic Investing - OK Zoomer: Gen Z PrimerDemographics have big implications for everyone. It shapes societies. It transforms political systems. It makes economies run.

Check out the whole report if you want to learn more about where we’re going.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla