AlphaCentric Prime Meridian Income Fund raises initial minimum investment https://www.sec.gov/Archives/edgar/data/1697196/000158064220004585/acpmi497.htm497 1 acpmi497.htm 497

AlphaCentric Prime Meridian Income Fund

(the “Fund”)

December 22,

2020The information in this Supplement amends certain information contained in the Fund’s current Prospectus and Statement of Additional information (“SAI”), each dated April 24,

2020.

______________________________________________________________________________

The Fund’s Board of Trustees approved increases in the minimum purchase requirements for regular accounts from $2,500 to $10,000 and for retirement plan accounts from $1,000 to $10,000.

All references to the minimum investment amounts contained in the Fund’s Prospectus and SAI are hereby revised accordingly.

* * *

You should read this Supplement in conjunction with the Fund’s Prospectus and SAI, which provide information that you should know about the Fund before investing. These documents are available upon request and without charge by calling the Fund toll-free at 1-888-910-0412, or by writing to the Fund at c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202.

Please retain this Supplement for future reference.

T. Rowe Price Global Real Estate Fund manager change M* shows a manager change at the New Year, 2018-2019. Not long ago!

"The fund is notable for what it doesn't own. The focus here is on traditional real estate, so the fund typically doesn't hold data center and infrastructure REITs, such as cell tower companies. The fund has historically tended to be light on healthcare REITs, owing to the long-term length of leases and specialized uses that potentially limit resale value. However, Jones has added to the portfolio's healthcare holdings, so that as of March 31, 2020, it was only slightly underweight in that area relative to the Wilshire US Real Estate Securities Index." I have owned TRREX, but not for long. I note the DISTRIBUTIONS have indeed been juicy.

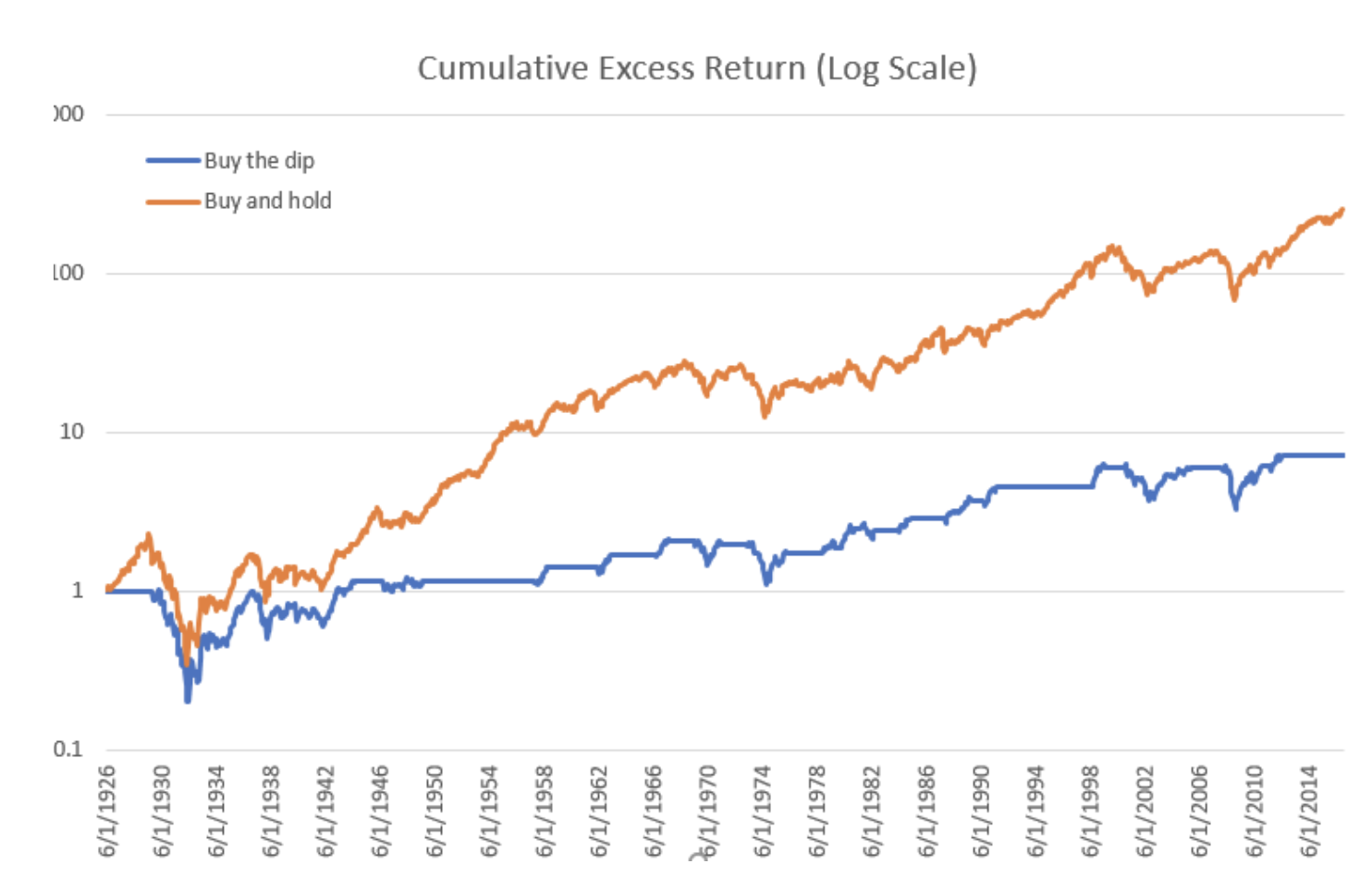

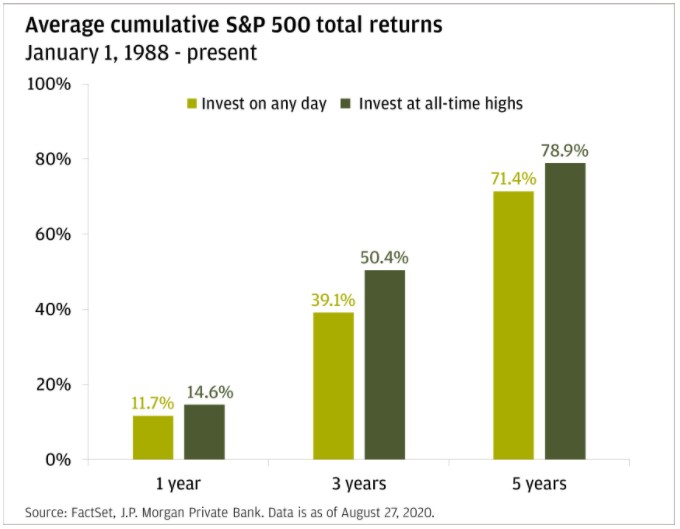

The counterintuitive truth about stock market valuations

FAIRX - blast from the past Fell for both CGMFX and FAIRX. Did okay on CGMFX; got out of FAIRX too late to have realized net gains beyond what a decent bond fund would have given me over the same period.

Kick myself a bit on FAIRX because I knew I wasn't comfortable with the way Bruce was getting waaaay too overexposed, as well as some of his bizarre personnel decisions. He was spending a bit too much time drinking his own bathwater, and I ultimately got too nervous and XFER'd out.

Now, as a rule, I never let such "moonshot" active funds be more than 7.5% of my total portfolio.

T. Rowe Price International Discovery Fund manager change Found more information on Ben Griffins at M* (including mis-spelling on his name)

Ben Griffins

03/01/2020 —

Ben Griffins is a vice president of T. Rowe Price Group, Inc. and T. Rowe Price International Ltd and an investment analyst in the Equity Research Team of T. Rowe Price International Ltd, covering European small-cap stocks. Ben has been with the firm since 2006. Prior to joining T. Rowe Price, he was an investment manager with Baillie Gifford. Ben earned a diploma in investment analysis from Stirling University and an M.Eng. in engineering science from Oxford University. He also has earned his Chartered Financial Analyst designation.

Certification Chartered Financial Analyst

Education

M.S. University of Oxford,

Other Assets Managed

financials.morningstar.com/fund/management.html?t=PRIDX®ion=usa&culture=en-US

T. Rowe Price International Discovery Fund manager change Does anyone has more background information on Ben Griffins? He is listed as co-manager who joined Justin Thomson since March 2020. I would expect this transition plan has been in place for some time - 9 months is a bit short. Perhaps Ben Griffins has experience co-managing other international funds.

T. Rowe Price Global Real Estate Fund manager change https://www.sec.gov/Archives/edgar/data/1440930/000174177320003676/c497.htm497 1 c497.htm

T. Rowe Price Global Real Estate Fund

Supplement to Prospectus Dated May 1,

2020In section 1, the portfolio manager table under “Management” is supplemented as follows:

Effective April 1, 2021, Jai Kapadia will become portfolio manager and Chair of the fund’s Investment Advisory Committee and Nina Jones will transition from her role as portfolio manager and Chair of the fund’s Investment Advisory Committee. Mr. Kapadia joined T. Rowe Price in 2011.

In section 2, the disclosure under “Portfolio Management” is supplemented as follows:

Effective April 1, 2021, Jai Kapadia will become portfolio manager and Chair of the fund’s Investment Advisory Committee and Nina Jones will transition from her role as portfolio manager and Chair of the fund’s Investment Advisory Committee. Mr. Kapadia joined T. Rowe Price in 2011 and his investment experience dates from 2004. During the past five years, Mr. Kapadia served as a member of the fund’s Investment Advisory Committee responsible for selecting the fund’s investments in the Asia-Pacific region (beginning 2019) and previously, as an analyst and associate director of research in the Equity Research Group of T. Rowe Price in Hong Kong, covering Asian conglomerates, real estate and Indian pharmaceuticals.

The date of this supplement is December 21,

2020.

F173-041 12/21/20

T. Rowe Price International Discovery Fund manager change https://www.sec.gov/Archives/edgar/data/313212/000174177320003678/c497.htm497 1 c497.htm

T. Rowe Price International Discovery Fund

Supplement to Prospectus Dated December 15,

2020In section 1, the portfolio manager table under “Management” is supplemented as follows:

Effective January 1, 2021, Mr. Thomson will step down as a portfolio manager and Cochair of the fund’s Investment Advisory Committee. Mr. Griffiths will remain as portfolio manager and Chair of the fund’s Investment Advisory Committee.

In section 2, the disclosure under “Portfolio Management” is supplemented as follows:

Effective January 1, 2021, Mr. Thomson will step down as a portfolio manager and Cochair of the fund’s Investment Advisory Committee. Mr. Griffiths will remain as portfolio manager and Chair of the fund’s Investment Advisory Committee.

The date of this supplement is December 21,

2020.

F38-041 12/21/20

The counterintuitive truth about stock market valuations John Hussman's market forecasts were consistently very wrong over the past decade.

Investors should just ignore his prognostications.

Link

FAIRX - blast from the past I haven't heard much about Ken Heebner in years.

He was a real "cowboy" investment manager back in the day.

The trailing returns for the CGM Focus Fund occupy the bottom percentile (100) in the Large Blend category for the 1,3,5,10, and 15 year periods ending 12-18-2020.

The fund's standard deviation is also considerably higher than that of its category peers.

Bill Miller: This is one of the 5 greatest buying opportunities of my life By March of 2009, Miller's flagship had drawn down about 80 percent. He only drew down half that 11 years later. How does he get the new capital to take advantage?

That is a sure way to fund his yacht while his investors stay poor. Glad I never invest with Bill Miller. He still paddles his investment view on WealthTrack.