It looks like you're new here. If you want to get involved, click one of these buttons!

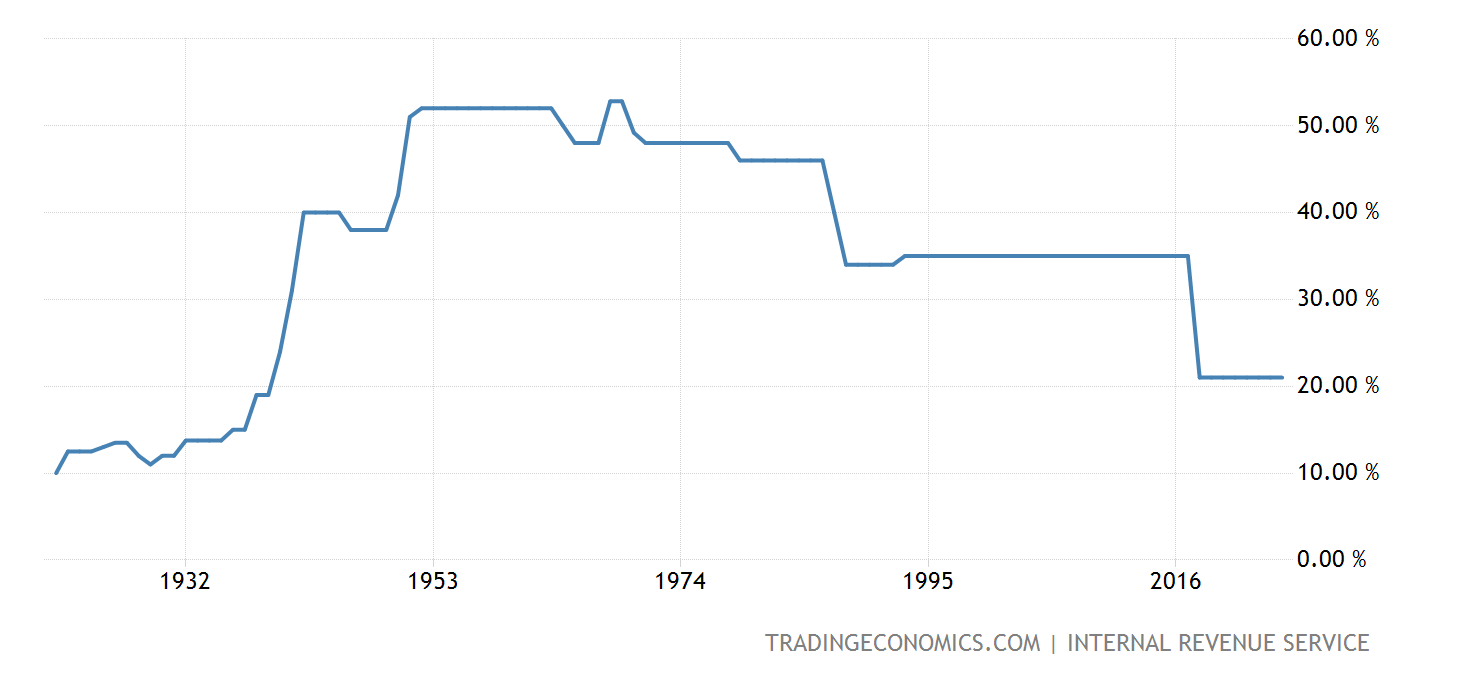

Governments worldwide are desperate to raise extra revenue to rebuild their pandemic-ravaged economies and corporate taxation is becoming an obvious target after decades of decline.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments

Is the SSTF Real?