This is the feature that lets you buy additional shares of a TF fund at Fidelity

for $5. Has anyone used it recently?

It used to be that you could schedule automatic investments of funds monthly or quarterly. But now, you must schedule automatic investments weekly, every two weeks, or monthly. I suppose that's helpful if one is making investments from periodic paychecks, but otherwise this seems excessive.

If there was an announcement about this change, I missed it.

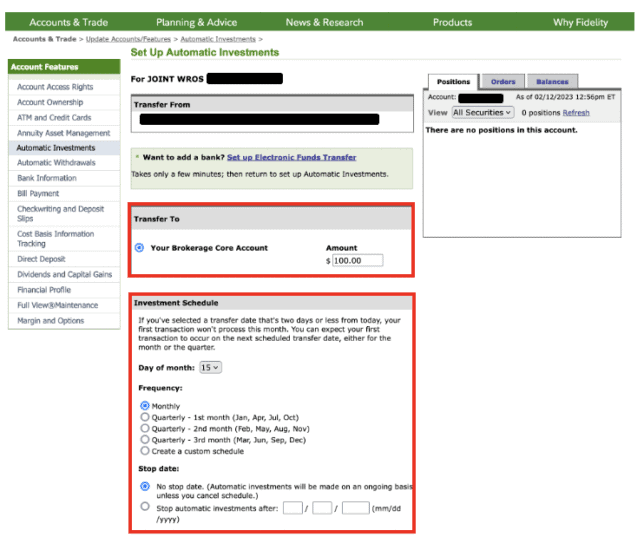

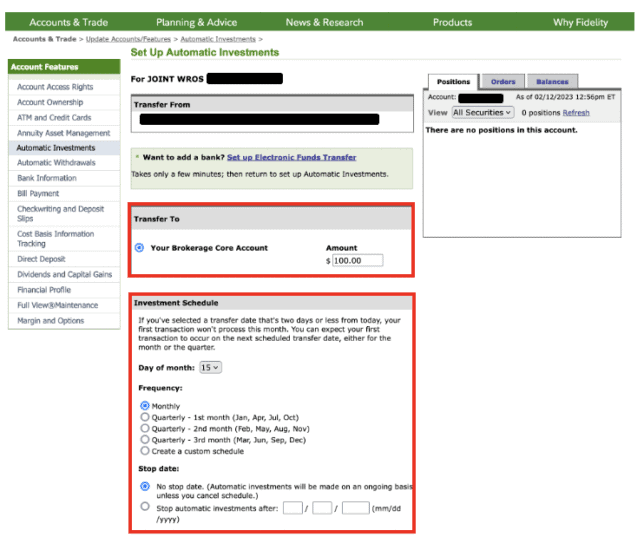

The interface used to look like this:

Fidelity has also added the ability to schedule automatic (weekly, biweekly, or monthly) ETF and stock investments. They are executed as market orders on the specified dates. I don't know the time of day that the orders are executed.

https://www.fidelity.com/trading/recurring-investments

Comments

Note: I’ve had some problems buying or selling larger quantities of shares (etf, CEF, stocks) after setting a “limit” price. Sometimes Fido goes ahead and partially fills the order. Not nice! I suspect there is a setting somewhere that I’m not seeing that would direct them not to process a limit order unless / until all shares requested can be purchased or sold within the limit price set … …

The second part of @Sven’s question: OEF buys or sells are processed at that day’s NAV based in the 4 PM close. So orders to buy or sell an OEF are displayed as “pending” or “open” until processed. You can actually cancel them up until 4 PM if you wish.

I have a question if anyone wants to chime in …

When Fido calculates the 60-day holding time for load-waived fund purchases, are weekends and holidays included in that 60 day period? I have a few shares remaining of a fund I mostly unloaded last week. When I pull up the “order history” and set it to 60-days it no longer displays any share purchases. By the calendar, it has been 61 days since the last purchase was made. Just double-checking before pulling the plug on those few remaining shares.

Most automatic investments are via DRIP plans. "True" DRIPs are set up with the companies themselves. In these plans, investors often receive shares from a company based on its closing price on the day of reinvestment, frequently at a discount. For example: https://ir.ofscreditcompany.com/shareholder-services/dividend-reinvestment-plan

However, for "synthetic" DRIPs, where the brokerage is reinvesting the divs, it's not clear what price the investor is paying for the additional shares. Likewise, when the brokerage is automatically purchasing shares (with investor cash, not divs) on scheduled dates, what price is paid for those shares?

What Fidelity does when reinvesting divs (I don't know about scheduled investments): https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/customer-service/brokerage-retirement-cust-agree-and-commission-sched.pdf

Related: what price does M* use for purchases in calculating total return including reinvested dividends? https://admainnew.morningstar.com/directhelp/Glossary/Performance/Total_Return.htm

Under "conditions" you can specify "all or none". You may have to use what Fidelity calls an "expanded trade ticket".

Limit-orders that get partial execution may get filled more during the day, or the next day, or next...

In the old days with commissions, there was a rule that all partial executions on a single day will be under the same commission, but a new commission would apply the next day. So, if there was, say, only a handful of residual shares left, one could cancel the order overnight. This factor is no longer relevant.

With "All or None", a risk is that you may miss the order trigger entirely.

Who said that a partial loaf in hand is better than a full loaf in the bush?

Fidelity wants maximum number of $49-50 commissions not $5 commissions.

Does Schwab offers similar fearure ?

Yup, missed it. I don't generally frequent reddit. From a Fidelity moderator, 10 months ago: https://www.reddit.com/r/fidelityinvestments/comments/17pglm6/its_here_weve_added_the_ability_to_automate_your/