UK pound question Have you considered holding pounds sterling in a US bank account?

TIAA (formerly Everbank) is the best known provider, but I believe Cathay Bank and perhaps others offer this type of account as well.

Of course you would pay to exchange dollars for pounds (and vice versa upon withdrawing), so this might not be good for short term trading. Like any savings account, you're limited to six withdrawals (except in person) in a single month. And the savings account

pays no interest, though TIAA's

GBP three-month CD pays 0.25%.In contrast, FXB isn't going to cost anything to buy or sell, aside from market spread of about 6 basis points and tracking error. But it does charge 0.40% annually in ER, and hasn't earned any interest in years. So its pound-denominated value is decreasing by 40 basis points per year. One hopes that with interest rates rising, it starts covering some of that cost with bank interest.

Despite being an ETF, it has similar risk to an ETN. That's because all deposits are held in a JP Morgan Chase account. I figure it's uninsured (thus just a general liability of JPMorgan Chase) because the fund's assets are way above any FDIC limit. Regardless of the reason,

the prospectus states that:

Neither the Shares nor the Deposit Accounts and the British Pounds Sterling deposited in them are deposits insured against loss by the FDIC, any other federal agency of the United States or the Financial Services Compensation Scheme of England

The prospectus also states that the interest rate it receives could drop below zero, so in theory the net expense ratio could exceed 0.40%. Though the

annual report shows that it has never earned less than 0% interest and has been paid as much as 0.3

5%/year (mid 2018 through end of 2019).

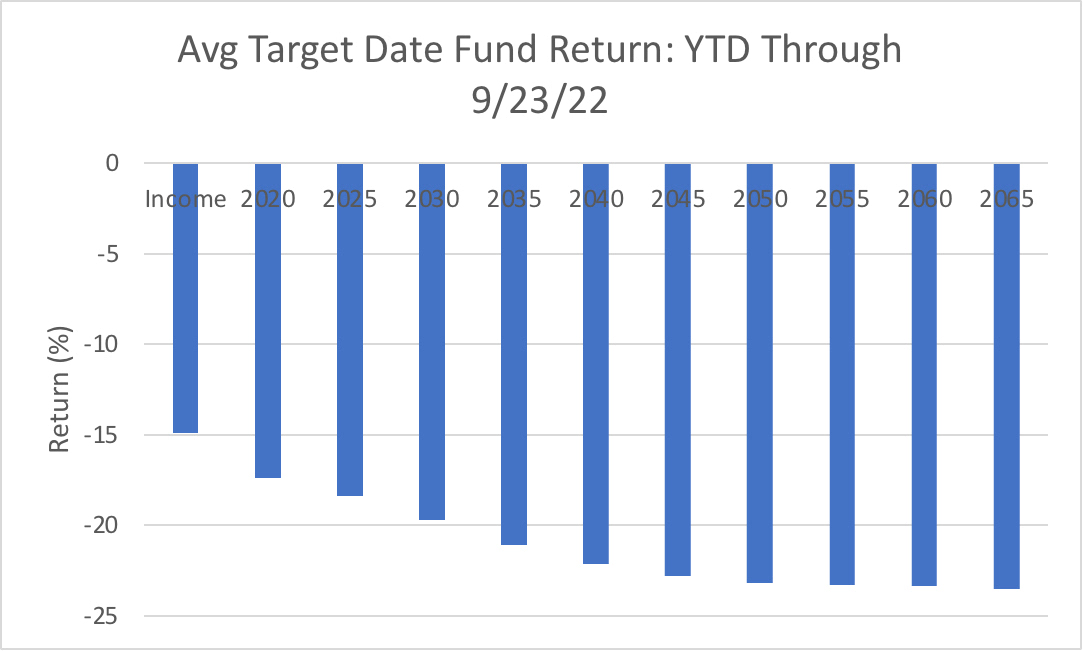

A look at some diversified benchmarks ytd M* Ptak posted this on TDFs at Twitter - TDFs 2030 and beyond are in a bear market.

Twitter LINK.

A look at some diversified benchmarks ytd FWIW, as of close Sept.23, misery loves company. Here is a look at some diversified TRP retirement funds as benchmarks - YTD losses.

TRRAX 44% equity -16.7%

TRRBX 50% equity -17.7%

TRRCX 68% equity -20.7%

TRRDX 87% equity -25.5%

Fan favorite balanced/allocation fund:

PRWCX -14.6%

What is a “Blood in the Streets” Moment? I'm using the S&P 500 as a bellwether for the broad U.S. market.

There have been twelve S&P 500 bear markets (peak to trough declines > 20%) since the end of WWII ¹.

The current year was taken out of consideration since it is a "work in progress."

The median peak to trough decline after WWII was 30.75%.

In the current environment, U.S. equities might appeal to me after the S&P 500 declines 35%.

¹ The S&P 500 was launched on March 4, 1957. Info prior to the launch date is hypothetical.

Bear markets were noted in 1946 (-26.6%) and 1948/1949 (-20.6%).

What is a “Blood in the Streets” Moment? holy crap and happy new year. baron rothschild did

not say that stuff? But (although it's cold and uncaring sounding,) it's smart! Maybe it's hyperbole, but it's smart. I'm reminded of Jeremiah buying the field at Anatoth--- even BEFORE the blood hit the streets and the exile began. That was more an expression of ultimate trust, rather than a choice expecting

monetary profit, though. The exile lasted about

50 years, so I was taught.

In a different direction, it always makes me smile to think of musician Dan Bern's caustic, sarcastic irony in naming his first, early-career band "The Int'l Jewish Banking Conspiracy."

https://archive.org/details/dan-bern-and-the-international-jewish-banking-conspiracy-2002-05-18-maxwells-sbd-t-flac16

Buy Sell Why: ad infinitum.

Buy Sell Why: ad infinitum. Good move for short-term cash.

In my opinion, the 26-week T-Bill is currently in the "sweet spot" of the yield curve.

Select rates from the Dept. of Treasury website for 09/23:

1 mo. - 2.67%

3 mo. - 3.24%

6 mo. - 3.85%

1 yr. - 4.15%

2 yr. - 4.20%

3 yr. - 4.21%

5 yr. - 3.96%

10 yr. - 3.69%

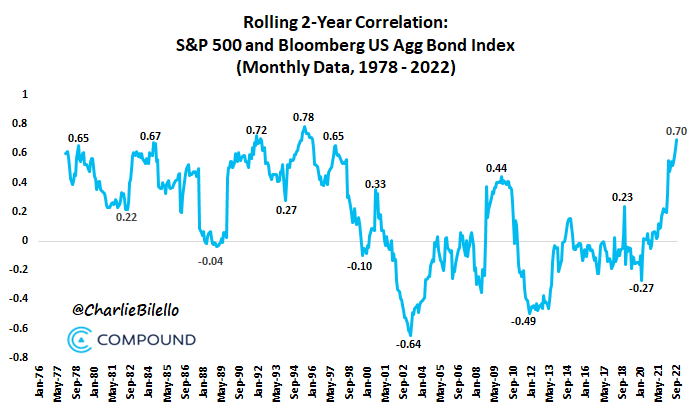

2022 YTD Damage So far this year, interest rates have been the driver of asset prices - a la the discount rate. (On the way up for the past 13 years we did not acknowledge this relationship and thought it is all our individual prowess.) BBB bonds at 5.7% and S&P 500 at 3,700 indicates both credit and equities are yet to price in all the rise in interest rates - risk assets still refusing to acknowledge the full weight of the interest rates. So, first we may have a mini restoration of historic correlations to fully reprice risk assets vs interest rates. If and when we start to feel the weight of negative economic conditions, then the historic relationships / correlations will return for us to see more clearly. More often than not, many of us are not wrong, we are probably just early - markets are not as efficient as we think. Part of my new practice has been to try to wait a few days / weeks so as to sync with the market.

What is a “Blood in the Streets” Moment? Guys...what happens if we have a dead decade ahead of us in the markets (Reference Druckenmiller's recent commentary)...who says the CBs/Fed will come to the rescue again with the brrrrrr money printer...I really don't think that is going to happen.

Why take the drawdown in an environment like this? I get it, really tough (impossible) to time the markets, ya might get lucky but likely not repeatable...I could see staying in during more "normal" times but this is some real wacko jacko markets we done got here, no?

I think we are due for a bounce within the next couple weeks, too many Puts have been bought....but....I think many are sanguine, hearing maybe down another 10-15% then markets should turn up as the fed again starts easing....and The Gundlach thinks we are going to overshoot to the downside next year...from the 9% (really more like 14-15%) to mayb even -3, -4%.....and if he is right, I don;t see any way how markets rally...

Hey, like they say, it;s your money. do what you need to do to feel sexy, don't listen to clowns on a chat board especially not me.

Best,

Baseball Fan