It looks like you're new here. If you want to get involved, click one of these buttons!

@Roy,The largest chunk by far of our investments have been in TRAIX/PRWCX for the past ~16-17 years, so the recent move to reduce some of those holdings was a bit difficult because of the emotional attachment as well as the FOMO on future equity gains. We are now roughly 50/50 equity/fixed income---still sufficient equity exposure for growth and nice dividend income from the MM/bond side. Our equity exposure had already been down the past 1 1/2 years as some money my wife inherited had been placed in fixed income rather than TRAIX/PRWCX.

Would be interested to know at what age many of you started reducing equity exposure as you neared retirement? I am 60 very soon.

The largest chunk by far of our investments have been in TRAIX/PRWCX for the past ~16-17 years, so the recent move to reduce some of those holdings was a bit difficult because of the emotional attachment as well as the FOMO on future equity gains. We are now roughly 50/50 equity/fixed income---still sufficient equity exposure for growth and nice dividend income from the MM/bond side. Our equity exposure had already been down the past 1 1/2 years as some money my wife inherited had been placed in fixed income rather than TRAIX/PRWCX.@Roy, think you are doing the right thing by reduce equity risk as you approach retirement. Five years out is not far away. Shifting more to balanced/allocation funds is another way to increase bond allocation. My high yield and bank loan funds have done well this year; YTD is about 5%. Likely these funds will have a solid year by year end. The rest of short term high quality bond funds are moving along well yielding 5%.

Watching if the market will broaden out more to smaller caps and cyclicals. If the recession strikes this year, bonds will serve as a ballast when stocks will fall.

Fine, right, recession, real-estate collapse, corporate credit blows out, rates go to zero, the 2008 of 2023. But then in March a couple of US banks failed, and many others came under a lot of stress, for exactly the opposite reason: Inflation was persistently high, interest rates went up, and those banks had to pay more on deposits even as their holdings of Treasury bonds lost value. Silicon Valley Bank was not subject to the Fed’s stress tests, as a mid-sized bank, but if it had been it would have done great! It did not do great in real life.The severely adverse scenario is characterized by a severe global recession accompanied by a period of heightened stress in both commercial and residential real estate markets, as well as in corporate debt markets. The U.S. unemployment rate rises nearly 6½ percentage points from the starting point of the scenario in the fourth quarter of 2022 to its peak of 10 percent in the third quarter of 2024. The sharp decline in economic activity is also accompanied by an increase in market volatility, widening corporate bond spreads, and a collapse in asset prices, including a 38 percent decline in house prices and a 40 percent decline in commercial real estate prices. …

The rising unemployment rate and the rapid decline in aggregate demand for goods and services significantly reduce inflationary pressures. …

Short-term interest rates, as measured by the 3-month Treasury rate, fall significantly to near zero by the third quarter of 2023 and remain there for the remainder of the scenario. Long-term interest rates, as measured by the 10-year Treasury yield, fall by nearly 3¼ percentage points by the second quarter of 2023, and then gradually rise in late 2023 to about 1½ percent by the end of the scenario.

Yes."Today's results confirm that the banking system remains strong and resilient," Vice Chair for Supervision Michael S. Barr said. "At the same time, this stress test is only one way to measure that strength. We should remain humble about how risks can arise and continue our work to ensure that banks are resilient to a range of economic scenarios, market shocks, and other stresses."

This scenario doesn’t count for bank capital requirements — “Consistent with the nature of an exploratory exercise, the exploratory market shock will not contribute to the capital requirements set by this year’s stress test” — but it is intellectually interesting. Broadly speaking the big banks did a little better in this scenario than in the severe-recession scenario.In February 2023, for the first time, the Federal Reserve published an additional, exploratory market shock component that applied only to U.S. G-SIBs. The purpose of the stress test is to understand a firm’s resilience to a range of severe but plausible events, and the exploratory component furthers that purpose by posing a different set of risks than is probed by this year’s global market shock component.

In contrast to this year’s global market shock component, which was characterized by a severe recession with fading inflation expectations, the exploratory market shock is characterized by a less severe recession with greater inflationary pressures induced by higher inflation expectations, increases in interest rates, an appreciation of the U.S. dollar, and increases in commodity prices.

It's funny how 2 people look at the same numbers https://fred.stlouisfed.org/series/LES1252881600Q and come up with different opinions.Real wages are still higher than they were in three out of the four years of the previous administration prior to the Covid outbreak, and it's false to say every month. They just started to rise this year:

https://fred.stlouisfed.org/series/LES1252881600Q

Meanwhile, the 3.7% unemployment rate is close to an all-time low:

https://fred.stlouisfed.org/series/UNRATE

I compared LSLTX(99+% in stocks) to SP500 and LCORX(60+% stocks) to PRWCX.According to LCORX's Fact Sheet, its investment objective is: "Capital appreciation and income while maintaining prudence in terms of managing exposure to risk. Investment guidelines are 30%-70% equity exposure and 30%-70% fixed income." What is the value in comparing it to a 100% equity fund like SPY after the longest equity bull market in history just ended? PRWCX is a fairer comparison as is VBIAX, and PRWCX has been a terrific fund.

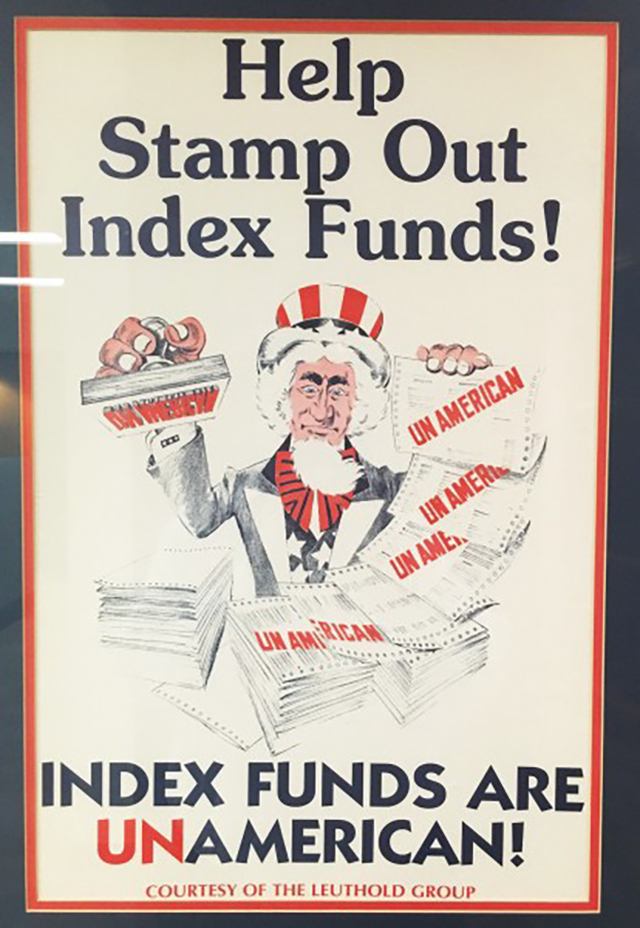

I suspect that poster might be a collector's item now. Bogle welcomed the challenge and found it amusing.In July 1971, the first index fund was created by McQuown and Fouse with a $6 million contribution from the Samsonite Luggage pension fund, which had been referred to Fouse by Bill Sharpe, who was already teaching at Stanford. It was Sharpe’s academic work in the 1960s that formed the theoretical underpinning of indexing and would later earn him the Nobel Prize. The small initial fund performed well, and institutional managers and their trustees took note.....

...But even in San Francisco, as in the country’s other financial centers, Fouse and McQuown’s findings were not a welcome development for brokers, portfolio managers, or anyone else who thrived on the industry’s high salaries and fees. As a result, the counterattack against indexing began to unfold. Fund managers denied that they had been gouging investors or that there was any conflict of interest in their profession. Workout gear appeared with the slogan “Beat the S&P 500,” and a Minneapolis-based firm, the Leuthold Group, distributed a large poster nationwide depicting the classic Uncle Sam character saying, “Index Funds Are UnAmerican,” implying that anyone who was not trying to beat the averages was nothing more than an unpatriotic wimp. (That poster still hangs on the office walls of many financial planners and fund managers.)

26 CFR § 1.263(a)-4Paragraph (f) of [26 CFR § 1.263(a)-4] provides a 12-month rule intended to simplify the application of the general principle to certain payments that create benefits of a brief duration. ...

(f) 12-month rule—(1) In general. Except as otherwise provided in this paragraph (f), a taxpayer is not required to capitalize under this section amounts paid to create (or to facilitate the creation of) any right or benefit for the taxpayer that does not extend beyond ... 12 months

https://www.irs.gov/pub/irs-prior/i1040sb--2022.pdfWhen you buy bonds between interest payment dates and pay accrued interest to the seller, this interest is taxable to the seller. If you received a form 1099 for interest as a purchaser of a bond with accrued interest, follow the rules earlier under Nominees to see how to report the accrued interest. But identify the amount to be subtracted as “Accrued Interest.”

That from his article on dealing with access to closed funds.An imperfect alternative is to find a substitute for a closed fund that either ... is run by the same manager. This March, T. Rowe filed for a prospectus for the Capital Appreciation Equity ETF, run by the same manager as the mutual fund ... the ETF will give investors a chance to access Giroux’s stock picks, but only those. In the mutual fund, Giroux also buys unusual bonds and bank loans. Moreover, the ETF ...will hold 100 stocks, while Giroux typically holds only 30 to 40.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla