It looks like you're new here. If you want to get involved, click one of these buttons!

A good explanation. Thank you!

(Snip)

2024 will determine whether I stick with PSTL. David Sherman warned about share dilution in the REIT sector, and that DID happen in '23. Very attractive dividend, though, and lots of room for growth.

9% undervalued. (Morningstar.)

1-year return: +6.74%.

Price/Cash Flow 10.37%

Yield: 6.52%. Payout ratio: 728.85% is NUTS. What gives with that?

@Crash, payout ratio uses “dividends” divided by GAAP earnings.

The best measure of “earnings” (or distributable cash flow) for REITs (due to accounting rules like depreciation etc. which don’t affect cash flow) is funds from operation/adjusted funds from operation (FFO/AFFO)….a quick Google search found PSTL’s AFFO is $1.01, with a distribution of 95 cents. That’s a mid 90’s% payout ratio, which doesn’t allow much retained capital for growth (meaning debt or equity issuance will be required for growth).

Sorry if you know all of this! :)

Happy New Year

@Crash, payout ratio uses “dividends” divided by GAAP earnings.

(Snip)

2024 will determine whether I stick with PSTL. David Sherman warned about share dilution in the REIT sector, and that DID happen in '23. Very attractive dividend, though, and lots of room for growth.

9% undervalued. (Morningstar.)

1-year return: +6.74%.

Price/Cash Flow 10.37%

Yield: 6.52%. Payout ratio: 728.85% is NUTS. What gives with that?

I don’t think it’s about “making more” or how many is the “best number”. Might be if someone trades too much as @MikeM says. I just think it’s a lot easier to hold a few large equally weighted positions. (Obviously stocks would need to be in smaller amounts). I got tired of the hassle and associated tracking / record keeping / trading a large inventory requires. As for specific funds, I have opportunities today I never dreamed of while largely parked at TRP. So it hasn’t been hard at all settling on a few I think I understand well and am willing to sink 10% into.Ahh, the age-old difference in opinion on how many positions are ideal in a portfolio. Many go for the perceived (index like?) comfort of volume and others can be decisive and have less holdings. Personally, I do think having many or "toe hold" positions can lead to more in-and-out decisions and therefore reduced return. I, admittedly and begrudgingly, tend to go both ways. I feel very comfortable with a few balanced funds making up the bulk of my portfolio. On the other hand, do I need 3 SC funds and 3 LC's? No. But I can be undeceived at times. If I can exist with ~15 funds, I'm feeling pretty good about myself.

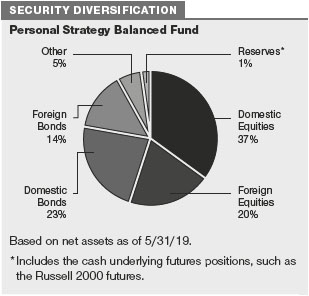

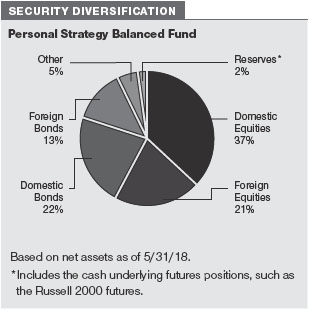

On October 1, 2016, we introduced three new underlying investment strategies to the Personal Strategy Funds. ... The changes include a new allocation to alternatives through a hedge fund-of-funds, as well as initiating an investment in the T. Rowe Price Dynamic Global Bond Fund and an equity index option strategy.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla