It looks like you're new here. If you want to get involved, click one of these buttons!

@Crash - Only $5 cash? Been there myself a few times …Agreed!

And after a partial rejigger in January, I find myself at 57 stocks 37 bonds and 5 cash. Close enough, I guess. PRNEX is more trouble than it's worth. Gonna exit and redeploy the money in that one. Too volatile, and performance has been yucky.

Still maintaining a hard wall between retirement accounts and taxable stuff. Taxable is up to 14% of portf. total now. Retirement $$$ is all in funds in TRP, except for BRUFX. Taxable (so far) is all in single stocks.

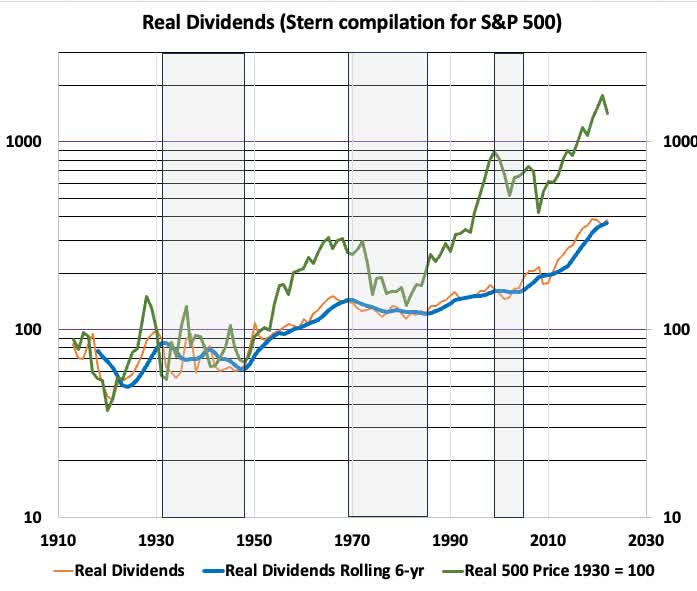

The areas shaded gray show periods when the real value of the dividends from the S&P 500 decreased. Notice that they did not decrease much and decreased far less than the real index value. During those periods, a retirement strategy based on those dividends would have been far more successful than one based on total returns.

To clarify: I was referring to *pensions* that employees only pay into but have no control over how it's invested - those are the places witih the fat allocation to expensive hedge funds/PE black boxes. My state (MD) 403(b) also has the brokerage window where I could dump 0-99% of my 403 now into whatever fund I wanted to offered at TIAA or Fido ... but I'm happy with the one LCV fund I'm in now at TIAA, so I haven't used that.

Many government retirement plans offer up to 25% in self directed mutual funds at outside firm such as Fidelity. CA state retirement plans are a mess with agenda that have nothing to do with best risk adjusted return. My wife worked several years for state - I need to move over to something like Fidelity balanced.

Many government retirement plans offer up to 25% in self directed mutual funds at outside firm such as Fidelity. CA state retirement plans are a mess with agenda that have nothing to do with best risk adjusted return. My wife worked several years for state - I need to move over to something like Fidelity balanced.@Tarwheel again I agree completely.

It's also why when I joined my state university system I avoided the pension plan and went for the self-directed 403(b). Many state pensions have huge positions in various (and costly) hedge/PE investments that I want no part of ... plus I don't trust the investing savvy of the political appointees overseeing the pension's investment, many of whom live and die by whatever the Wall Street favorite 'thinking' is at the time regarding allocations.

As I said at the time, if I'm going to lose or make money, I want to be the one responsible for it.

ETA: Somewhat off-topic but IIRC the Nevada State Pension is entirely in Vanguard funds. A WSJ article a few years ago talked about how 'boring' the Pension Chief's job was. :)

Let's not conflate trading with the number of funds an investor holds."Simple" question: what do you think will generate better results for Joe average investor during his lifetime...holding up to 5 funds and hardly trading, or using 10+ holdings with more trading?

[snip]

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla