It looks like you're new here. If you want to get involved, click one of these buttons!

https://fidelity.com/learning-center/trading-investing/markets-sectors/stock-market-drops-2020Key takeaways

The big questions are when will the growth rate of new COVID-19 cases peak and will the fiscal and monetary policy response be enough?

The significant drop in the stock market has been made significantly worse by the oil price war between Saudi Arabia and Russia, as well as forced deleveraging and a soaring dollar.

Earnings estimates for the next few quarters tumbled last week, and will likely fall further in the coming weeks.

While further US stock market declines are quite possible or even likely, my technical work suggests that the momentum of this decline may diminish in the weeks ahead.

https://washingtonpost.com/business/2020/03/21/economy-change-lifestyle-coronavirus/“It’s amazing how slowly habits change, where people get stuck in the ruts of doing things, and then you have a shock like this that can change everything,” said Erik Brynjolfsson, director of the MIT Initiative on the Digital Economy. “It forces people to overcome the switching costs, figure out something new and say, ‘Hey, this is way better.’ ”

“This is an inflection point, and we’re going to look back and realize this is where it all changed,” Jared Spataro, a Microsoft executive, said in an online news briefing. “We’re never going to go back to working the way that we did.”

On the other hand.....

Carnegie Mellon economics professor Lee Branstetter said his first attempts at teaching students online convinced him that although there is some opportunity for efficiencies, the old-fashioned classroom experience offers much more. He expects other forays into living and working online will convince many to return to routine human contact once they can.

“What I’m appreciating is just how much we lose when we go online,” Branstetter said.

Once the crisis is over, he added, “People are going to be so sick and tired of takeout.”

A crisis in credit markets deepened on Sunday as a cluster of funds that own mortgage bonds sought to sell billions in assets to meet investor redemptions, sparking pleas for government intervention.

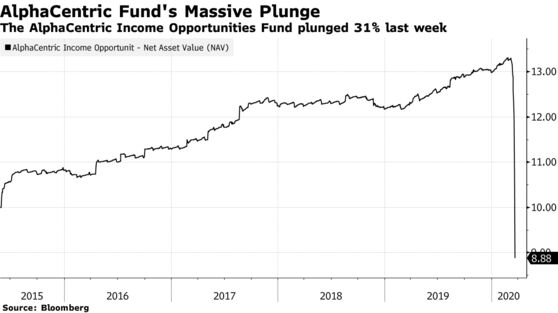

The sales included at least $1.25 billion of securities being listed by the AlphaCentric Income Opportunities Fund on Sunday, according to people with knowledge of the sales. It sought buyers for a swath of bonds backed primarily by private-label mortgages as it sought to raise cash, said the people, who asked not to be identified discussing the private offerings. The fund plunged 17% on Friday, bringing its total decline for the week to 31%.

“The coronavirus has resulted in severe market dislocations and liquidity issues for most segments of the bond market,” AlphaCentric’s Jerry Szilagyi said in an emailed statement on Sunday. “The Fund is not immune to these dislocations” and “like many other funds, is moving expeditiously to address the unprecedented market conditions.”

The best way to obtain favorable prices is to offer a wider range of securities for bid, Szilagyi said. He declined to discuss the amount of securities the fund put up for sale.

By Loeffler's own admission, her holdings are not in a blind trust. She is routinely told what she owns (independent of whether it is in a trust).Mark - This article https://www.nytimes.com/2020/03/20/us/politics/kelly-loeffler-richard-burr-insider-trading.html?searchResultPosition=1 refers to Sen. Feinstein's office stating that her investments are in a blind trust. (There's a link.) Not sure about a link from Sen. Loeffler. Both senators are married to wealthy investors.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla