It looks like you're new here. If you want to get involved, click one of these buttons!

There's no perfect recipe for anything in this world, including investing. I don't own any bond funds calling themselves "high yield" any longer. I looked at those three. It seems to me that for "HY" products, those dividends are rather sub-par. ...Right now, my PTIAX offers the best of my three funds' distributions, and it is closer to breaking-even in 2020 than my PRSNX or RPSIX. Yields on these funds range from 3.69 to 3.88 to 4.68.In high yield I've been satisfied with VWEHX TGHNX and MWHYX .

For years, commentators of a conspiratorial lean have half-jokingly suggested that humanity is living in a simulation, à la The Matrix. When it comes to economic activity and markets, that is no longer an absurd suggestion.

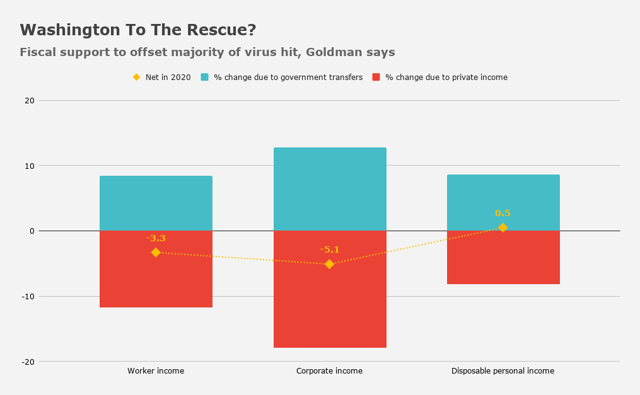

...around three-quarters of those laid-off workers "receive benefits that exceed their former wage," Goldman says.

Goldman's projections actually call for a small increase in disposable personal income.

But there is a problem related to living in a simulation:Again, we are living in a simulation.

Another thread of the article discussess Modern Monetary Theory and ties it into current Fed and Treasury activities. Here is a sample:The Treasury can make up for people’s lost wages, but people need the things wages buy. So replacing lost wages and revenues will not be enough for long: the economy has to produce goods and services.

Here is the link to the article:The US can always buy whatever there is to buy that's denominated in US dollars. It has no need to borrow dollars from anyone else because it is the issuer of those dollars. The US can spend too much, which risks stoking inflation, but the US does not, will not, and has never, needed to borrow dollars. Suggesting otherwise is to traffic in patent nonsense.

Why do governments sell bonds whenever they run deficits?...By selling bonds, they maintain the illusion of being financially constrained.

https://nytimes.com/2020/05/10/health/coronavirus-plague-pandemic-history.htmlWhen will the Covid-19 pandemic end? And how?

According to historians, pandemics typically have two types of endings: the medical, which occurs when the incidence and death rates plummet, and the social, when the epidemic of fear about the disease wanes.

“When people ask, ‘When will this end?,’ they are asking about the social ending,” said Dr. Jeremy Greene, a historian of medicine at Johns Hopkins.

Looking at VWINX's most recent Drawdown (-8.5%):VWINX is a fine one stop fund for income and some capital gains. It is paying only a little more than a core bond fund but subject to more equity risk. IT lost 8% in the recent crash.

Certainly moving money around in IRAs is more difficult. In a post I made on another board I acknowledged that. Here, it just didn't occur to me that the question concerned IRAs. You're right that they're more problematic.I would rather not have to set up another account, especially a retirement account to buy Marcus CDs. While FDIC guarantees work ( I lost two CDS during the 1980s housing crisis) it does take some time to get your money back so there is some opportunity cost.

1.5% after taxes will not beat inflation, unless you think there is a massive deflation coming. There are a number of 1 year A+ bonds paying up to 2.5% from companies that are highly unlikely to go bankrupt in the next year ie, Kimberly Clark, Home Depot, Wells Fargo. If a good analyst knows what they are doing I think they can avoid bankrupcies and make more than that with longer duration bonds.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla