My point with those funds (which do make an interesting list) is that value simply hasn't performed as well as blend, let alone growth. Lewis made this point as well in asking whether you were disappointed with the fund or with value in general.

KGIRX was not a fund I was familiar with. Something to note about it is that unlike most of the other better performing foreign LCV funds is that it has a large measure of EM.

Really large. 43%.I ran a few searches, and the closer one hews to low risk, foreign LCV, the more similar the performance becomes. For example, one screen was:

Category = foreign large value or foreign large blend

Large Cap Value >= 25%

Large Cap Growth < 10%

Bear market percentile < 50%

YTD return > 0

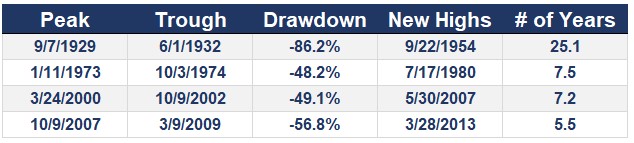

For me rapid spikes down or up don't matter. Unless one is planning on selling within a small window of time, ISTM that recovery time is more important than how deep a plunge is. Since the

2020 spike (decline) was between January 17 (when the market hadn't risen much YTD) to March 23, it seemed reasonable to look for funds to "break even" over the current year, hence YTD return > 0. (Between 1/17 and 3/23, many funds seemed to have drawdowns of 34% - 35%.)

Not too many funds pass this screen. (Variants include increasing the percentages of both LCG and LCV while keeping a significant difference between the two.) One of the few that did was PRCNX, which led me to believe you were looking for very similar funds.

Another fund that came out of that initial screen (LCV >= 25, LCG < 10) was GSAKX. This sits on the border of value and blend. It wanders along the dividing line; M* called it value in 2019-

2020, but blend in the prior three years. It's highly concentrated (34 stocks), and very Eurocentric @ 79% including UK. Its 1/17-3/23 drawdown was 34.5%, just slightly less than VEA's 35.1%.

Changing the screen slightly (LCV >= 35, LCG < 25) gives a few different funds. One is LZIOX. This is a more wide ranging fund from what is generally a value shop. It's generally been blend, though it had a year as a LCG fund and is now LCV. It has a more conventional 70 equities. It has performed respectably, though it too fell 34.6% between 1/17 and 3/23. Over the past three years it has done significantly better than TBGVX.

BRXAX is another fund from this screen. It's been LCV for the past four years, but this year its portfolio is blend and M* has placed in in the blend category. 149 stocks, including a bit more than 20% EM. Likewise, it fell 34.5% between 1/17 and 3/23.

None of these funds is going to set the world on fire. They're lower risk, reasonably performing, relative value funds. In contrast, TBGVX is a

"deep-ish value" fund.