Selling or buying the dip ?! Below is some hasty / lazy work for me to show myself my actual practice since covid onset and I sold off nearly everything after return to breakeven summer '20 (as I was sure covid would be this bfd hit to all markets).

- All dip buying and selling were done by feel, not by percentage or any defensible criterion other than 'ooh, ooh, it just went down pretty sharply', ... just because it eventually hit me over the head that p/e be damned, this market was just too strong and kept returning to strength, for all the reasons already mentioned by others.

- I am too chicken to figure out if buy-hold woulda been better, but I suspect so, given said unstoppable market strength.

What the below activity did was make me feel better about my fairly quick / short 'defensive' darts in and out of the traffic.

buys and sells of VON_, AOR, and/or CAPE, plus a TRP mfund

(gains; no losses; all Roth, so no tax consequence)

bot 6/11/20 and sold the next day, >1%

bot 10/28/20 and sold 11/13/20, 10%

bot 2/25/21 and sold 4/9/21, 7%

bot 4/22/21 and sold 5/6/21, >3%

bot 5/12/21 and sold 5/14/21, <3%

bot 6/18/21 & 7/6/21 and sold 9/22/21, <3%

bot 7/2/21 and sold 9/2/21, <1%

bot 7/19/21 and sold 8/3/21, >2%

bot 8/4/21 and sold 8/11-2/21, 1%

bot 8/18/21 and sold 9/1/21, 5%

bot 9/20/21 and sold 9/23/21, 3%

I am again now almost completely out of equities.

And of course the kick-myself revenge makeup motive going on here was to try and recoup the hundreds of thou lost by my summer 2020 selloff decisions, after the big covid dip. If I had stayed the equities course (duh) we would have enough extra now to half-forgive kids' debts to us, lavish on grandchildren education funding, replace a car and roof and such, and give way more seriously to a few charities and colleges.

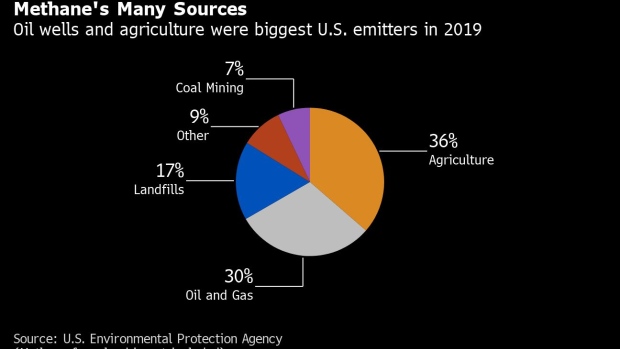

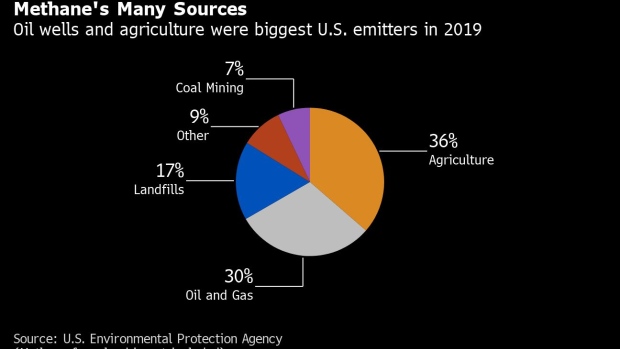

Biden Nearing Methane Crackdown Dreaded (and Dodged) by Industry It's looking like the oil and gas industry may soon be faced with significant additional expenses but that agriculture may continue to get a pass for now....

Crackdown

Crackdown

Selling or buying the dip ?! sold all vong and cape

will buy back in later

Senate bill could spell end to ETF tax advantage @davfor - If I understand what you are trying to say then I disagree with your statement above "Passage of this bill would force taxable account investors to buy and hold onto individual stocks to continue to receive some of the advantages available through tax-deferred retirement accounts. That would uncomfortably alter the investing lands

cape for many taxable account ETF investors."

Those taxable account ETF investors can sell shares of their ETF's and receive cash on which they'd pay their fair share of taxes 'rather' than receiving (from the article) "A proposal has been drafted to change the law eliminating exchange traded funds’ chief tax advantage in the US by levying taxes on in-kind redemptions."

The average Joe ends up paying the taxes either way because few, if any, are "authorized participants" while those who are already exceedingly rich can game the system.

"Only “authorized participants” – a form of institutional investor – may redeem shares directly from an ETF. These investors are also able to contribute securities to a fund in exchange for newly issued ETF shares. Retail investors, on the other hand, can only buy and sell ETF shares through a broker."

From this article:

What is an in-Kind Redemption

Senate bill could spell end to ETF tax advantage Passage of this bill would force taxable account investors to buy and hold onto individual stocks to continue to receive some of the advantages available through tax-deferred retirement accounts. That would uncomfortably alter the investing landscape for many taxable account ETF investors.