It looks like you're new here. If you want to get involved, click one of these buttons!

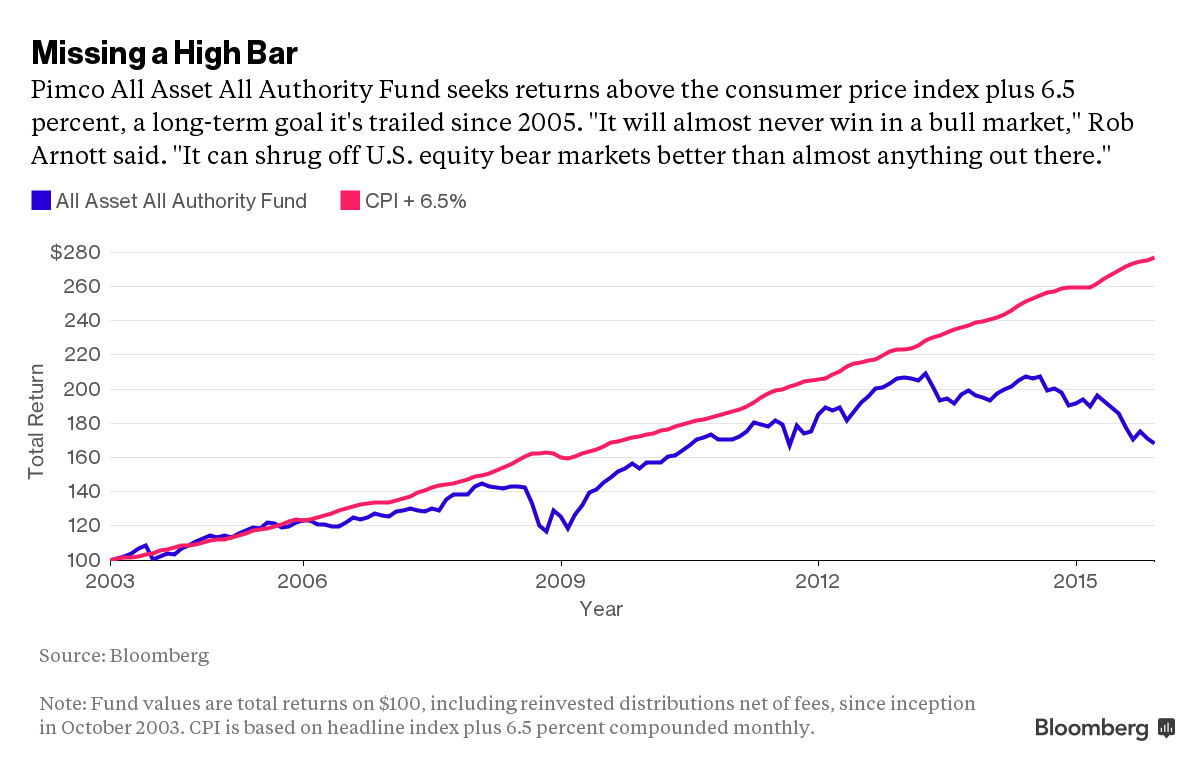

"Investors last year pulled a combined $15.8 billion from two mutual funds run by 61-year-old Rob Arnott -- Pimco All Asset and All Asset All Authority-- as their returns trailed most peers for the third straight year. They had Pimco’s most redemptions in 2015 except for Gross’s old fund, the Pimco Total Return Bond Fund, with $54.6 billion in withdrawals."

http://www.bloomberg.com/news/articles/2016-02-05/bill-gross-investors-aren-t-the-only-ones-pulling-pimco-money"Redemptions from All Asset All Authority surpass even Pimco Total Return in percentage terms when looking at their peaks. All Asset All Authority assets are down 76 percent from their 2013 high, to $8.6 billion, compared with Total Return’s 70 percent drop from its all-time high the same year."

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments

I bailed in 2012 (I think) and never looked back. Sounded good on paper, but keeping a 20% equity short position on in the face of Fed intervention and a raging, if not artificially-produced bull market, was inexcusable. Sure, you could by his PAAIX instead that didn't have the short position, but still. The very nature of PAUIX coupled with his dogmatic operation of it, led to this situation. Good riddance!

Arnott's QOTD is pure comedy gold: "“Now that these strategies are a bargain, we’re seeing outflows. It’s human nature.” No, it's your sub-par multi-year performance that lost people money who now can't buy into these 'bargains' and/or are simply fed up with you.

In my baseball analogy earlier, a hitter that waits for a specific ball to send it out of the park as opposed to one who takes every ball as it comes and manufactures a hit. The team can lose while the former is waiting.

Still, I will pass on buying them back.