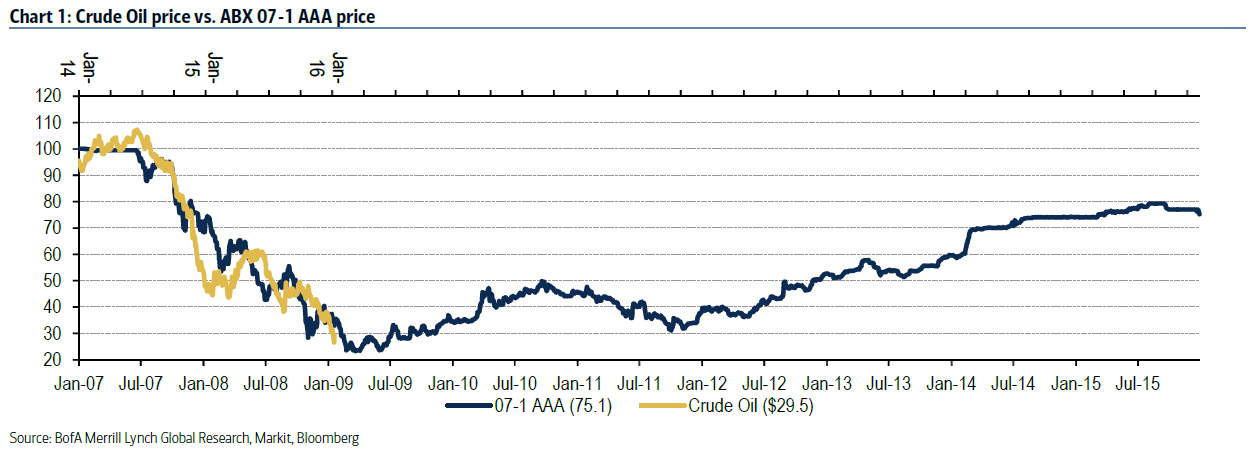

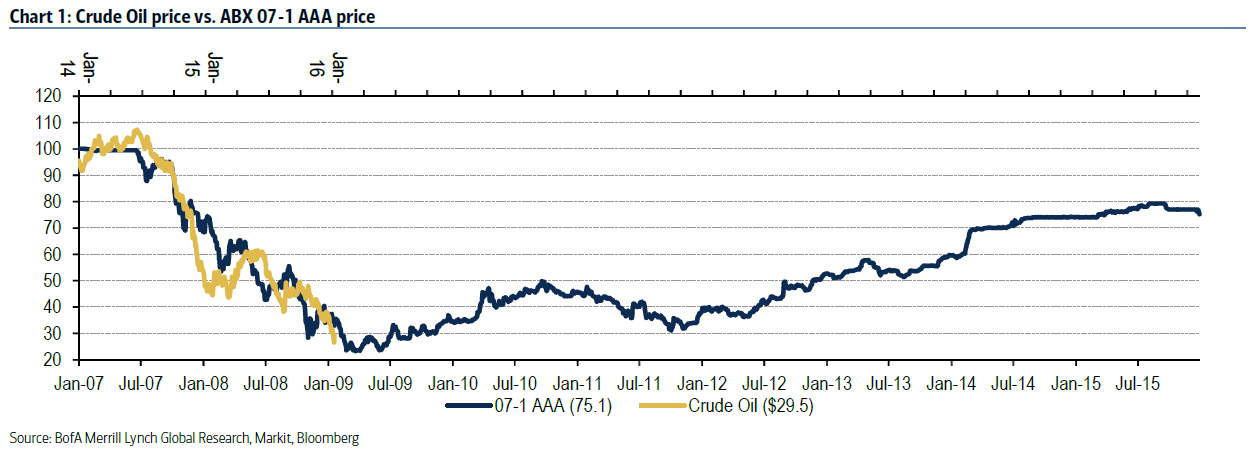

"The price of crude has been tracking an infamous subprime mortgage index....

Lower prices beget accelerated selling, as asset owners need to raise cash. It could be margin calls or it could be producer selling needs, it doesn’t really matter: the selling becomes inevitable and turns into forced selling.....The point here is not that oil is necessarily the new subprime crisis per se but that the recent action in the price of crude resembles nothing if not the bursting of a bubble and the sudden realization that the asset has been overvalued for too long."

See:

http://www.bloomberg.com/news/articles/2016-01-25/so-yes-the-oil-crash-looks-a-lot-like-subprime

Comments

http://www.marketwatch.com/story/default-risk-in-energy-debt-seen-as-highest-since-great-recession-2016-01-20