It looks like you're new here. If you want to get involved, click one of these buttons!

For 2024, individuals with taxable income below $47,025 ($94,050 for married couples) pay 0% tax for long-term capital gains (LTCG). In years when you’re under the threshold you could effectively lock in tax-free long-term gains. The idea would be to realize just enough LTCG to stay within the 0% tax bracket. You also have to tack on the standard deduction which is $15,000 for individuals or $30,000 for a married couple. That means don’t have to pay federal income taxes on your long-term capital gains until your income exceeds a little more than $63,000 (single) or $126,000 (married couple). So you could realize more than $63,000 ($126,000) in capital gains and dividends without paying any federal income tax.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments

A few techniques to bundle ordinary income

- Do Roth conversions in "ordinary income years".

- Buy short term (1 year or less) CDs/T-bills in "cap gains years" that mature in "ordinary income years"

- Invest in muni (MM, bond) funds in "cap gains years", and taxable (Treasury, corporate) funds in "ordinary income years"

A couple of techniques to bundle cap gains

- Accelerate recognition of gains (sell and repurchase if desired) in "cap gains years"

- Sell "around" annual distributions - avoid distributions of ordinary income (if any) and repurchase after record date (recognizes additional cap gains)

Depending on how much space you have in your 0% cap gains bracket, creating more cap gains may or may not work out for you. In any case, the added cap gains are state-taxable, so that should be kept in mind as well.

On the flip side, Roth conversions may be partially or fully state tax-exempt, depending on the state. That's motivation to convert some money even if it eats into the 0% cap gains bracket.

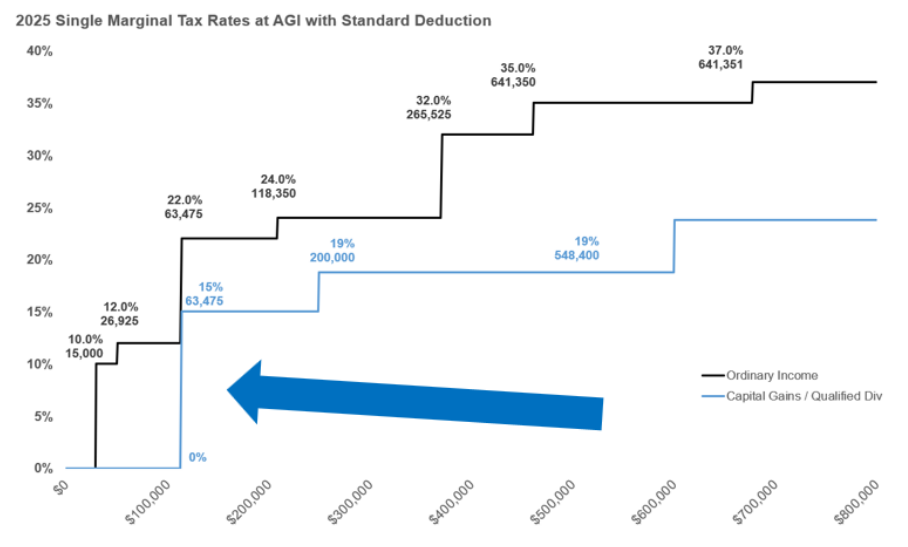

Note that the numbers presented in the graph are incorrect.

Cap gains: $47,025 (top of 0% bracket) + $14,600 (std ded.) = $61,625, not $63,475

Ordinary inc: $47,150 (top of 12% bracket) + $14,600 (std ded.) = $61,750, not $63,475

Note also that the cap gains bracket does not line up exactly with the ordinary income bracket (as given by the IRS). Close, but different.

It looks like the author may have been adding in the 2023 extra deduction ($1,850) for being over age 65 (or blind). That would make the cap gains figure come out to $63,475.

RMDs are taking as early as possible to potentially provide a LT capital gain (from the RMD WD date + 1 year) AKA "Capital Gains Years". Conversely, In years where these RMDs suffered a loss, one would sell (by Dec 31st of that year) to harvest a tax loss which would help offset future gains in "Capital Gains Years".

Not to beat a dead horse, but as a retired bean counter I've posted many times that tax planning is, or should be, a lifelong process.

When we started our professional careers in 1980 we adopted our "Avoid, Delay, Minimize" tax plan and have executed it with relentless precision. We prefer to pay our income taxes on our own schedule.

Result? We have not paid a dime in FIT/SIT since the year after our retirements in 2012, and will likely continue to choose to pay ZERO until RMDs are required at Age 73, a tax-free period of 16 years.

Some cool features of the strategy are ZERO taxes on otherwise taxable Cap Gains, SS and pensions, and (effectively) annual tax-free withdrawals from IRAs up to the taxable threshold. We choose to take the cash in lieu of Roth conversions to fund our smallish, annual income gap.

There are three phases to an investor's life: Accumulation, Maintenance and Disbursement. Our lifelong tax strategy and retirement investment strategy have allowed our portfolio to continue to grow significantly annually and we remain in the Accumulation phase.

Please indulges us with your "pay no tax" strategies.

With your RMDs being 16 years away and retirement starting in 2012 or at age 45, I am all ears.

Congratulations.

RMDs are taking as early as possible to potentially provide a LT capital gain (from the RMD WD date + 1 year) AKA "Capital Gains Years". Conversely, In years where these RMDs suffered a loss, one would sell (by Dec 31st of that year) to harvest a tax loss which would help offset future gains in "Capital Gains Years".

I don't believe TLH is legal in IRA. Maybe I'm missing the boat?

I no longer take RMDs early after I got burned in 2020.

We plan on making QCDs when we're finally subject to RMDs. So had we been subject to RMDs by 2020, we would not have been very upset at having taken a distribution that wasn't required. The money would have gone to some good causes (at least we think so).

We make partial Roth conversions annually. Since those are generally best done early in the year, and since they cannot be done prior to taking RMDs, we plan on taking RMDs (for QCDs) early each year.

In 2009, RMDs were also waived. But this was announced at the end of 2008. So there was no confusion about what to do with 2009 RMDs already taken. Only two waivers in 50 years (RMDs started in 1974 with ERISA), and only one of those without advance warning. Those are pretty good odds of it not happening again in our lifetimes.

Let me correct your dates. Sorry if my post was confusing on that!:

Retired in 2012 at Age 56

RMDs will start in 2029 at Age 73 (unless gov't pushes back further)

Paid ZERO FIT 2013-2024 (12 years)

Plan to (and very likely will) pay ZERO FIT/SIT 2025-2028 (4 years)

Total ZERO FIT/SIT period (16 years)

Strategy was pretty simple (but takes a while to explain!):

Starting with first professional employments in 1980, got as much $ as humanly possible into tax-deferred accounts. We were DINKS, Double Income, No Kids.

ONLY worked for companies that had defined benefit pension plans as a bene. Collectively had four professional jobs and four defined benefit pension plans between the two of us between 1980-2012. Annually maxed out 401k's and 403b's and all other investable monies went to Roth IRAs.

Rolled all possible Pension monies to IRAs upon termination of service to control when we receive income. Final employers provided lovely parting gifts of Retiree Health Insurance, Retiree Dental Insurance and a RHSA (Retiree Health Savings Account). Retired with just enough $ outside the umbrella (in taxable a/c's) to bridge income gap in years until early SS began for both at Age 62 in 2018.

Started taking (effectively) tax-free IRA w/d's in 2013 to fully defray annual income gaps and/or maximize tax savings. Currently, SS and remaining pensions (that could not be rolled) cover all but a couple grand of annual living expenses.

98% of liquid net worth is still in IRAs and only 2% is in taxable accounts. We have generated negligible taxable income other than early SS starting in 2018 and remaining Pensions that weren't rolled starting in 2013. We have ALWAYS since 2013 kept total taxable income UNDER the taxable MFJ threshold.

And to answer question by @derf:

No formal employment since both retired in 2012. We do however have some friends and relatives throw at us a little cash, dinners, event tix and the like for our otherwise gratuitous mgmt of their ports. I have also done some yard work for some neighbors to keep busy and active for a ridiculously smallish hourly fee. Currently down to just one neighbor as I've tired somewhat of all that.

Have a good day, Derf

I wanted to share this article regarding the use of direct indexing investing (author uses a Fidelity product) for the purpose of tax loss harvesting to manage losses and unrealized gains to manage LT capital gains taxes.

articles/direct-indexing-allan-roth

Option 1: Donate to charity or a donor-advised fund (DAFs have more flexibility)

Option 2: Hold until death (Step-up, but you must die first)

Option 3: Hold until retirement (hoping for lower tax bracket that may not be)

Option 4: In the future, you may be able to convert this SMA to a new lower cost etf (351-Exchange ETFs)

The Barron's piece you linked to requires a subscription to read (I read Barron's online through my library). However, here's another article that Allan Roth wrote that for ETF.com (via Yahoo), supporting what I might have also said:

- For limited purposes (such as tax loss harvesting, minor portfolio customizations) direct indexing may provide benefits that exceed their higher cost

- For general index investing, net long term benefits are slim to none

On the first point, direct indexing is oriented toward mechanical tax loss harvesting. Customization is limited (you can exclude a small number of stocks from your "index"). Of note is that Fidelity offers most of its direct indexing strategies only in taxable accounts (i.e. aside from the tax loss harvesting, these vehicles are not competitive).

https://digital.fidelity.com/prgw/digital/msw/overview/a

Adding more flexibility comes at much higher min asset levels and with higher fees. These more flexible (active) accounts are not targeted at investors in the 0% cap gains bracket.

More generally, Allan Roth wrote: https://finance.yahoo.com/news/allan-roth-direct-indexing-better-160000280.html

I'm not one easily spooked by lengthy statements (especially when computers deal with most of this gibberish), but even I have my limits!

Here's M*'s take, which is similar (i.e. minor positive sentiment)

https://mp.morningstar.com/en-us/articles/blt5e360f590235f987/direct-indexing-vs-etfs-myth-busting