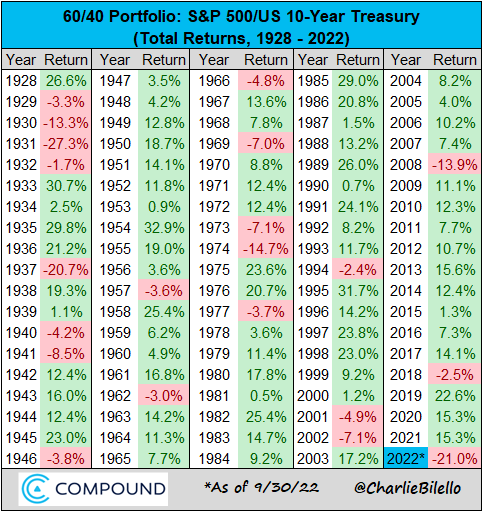

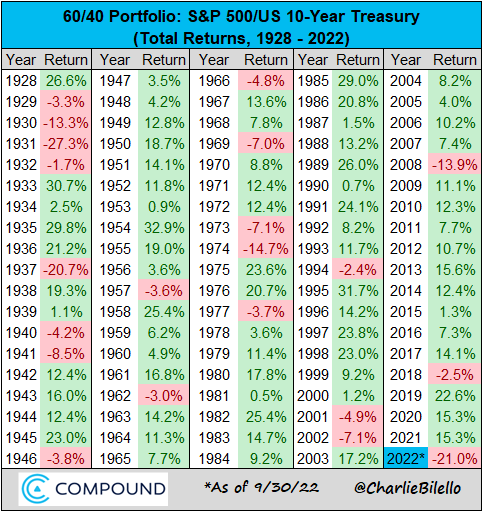

In 2022, both stocks and bonds had bear markets simultaneously. This caused heavy losses in allocation/balanced portfolios as well as risk-parity portfolios. Bonds failed to moderate declines due to stocks and, instead, contributed significantly to portfolio losses. Reasons were many - rapid Fed tightening, strong dollar, high inflation, post-pandemic fragile economies, recession fears, Russia-Ukraine war, supply-chain disruptions, chaos in oil/gas markets, etc. Purpose here is to record how bad things were by 2022/Q3.

Allocation/balanced portfolios were the 2nd worst with -21% 2022YTD (the record was -27.3% for full 1931). Other bad (full) years with double-digit % declines were 1930 (-13.3%), 1974 (-14.7%) and 2008 (-13.9%). Table below is from

Twitter LINK1Risk-parity portfolio performance was among the worst in history. These portfolios try to equalize volatilities of stock and bond portions and then use leverage.

Twitter LINK2There is growing appreciation for multi-asset funds that include stocks-bonds-alternatives. Prominent examples of these are FMSDX, VPGDX. These have to be battle-tested in future, but by 2022/Q3, their performance was FMSDX -16.80%, VPGDX -16.12% and that compared well with traditional moderate-allocation index fund VBINX -20.85% (active moderate-allocation funds were around this).

It was bad, but far from the worst year for SP500.

Twitter LINK3Image with 60-40 Table

https://pbs.twimg.com/media/FeJ8OKuXwAMqguu?format=png&name=small

Comments

I was hoping somebody would comment on why VIX fell on Friday when market fell quite a bit. Is that one of the set ups for today’s bounce. Any thoughts?

https://stockcharts.com/h-sc/ui?s=$VIX&p=D&b=5&g=0&id=p55512620048

Why different? In relative terms, bonds are more depressed than stocks. Bond losses are historic, while stock losses are far-far from the worst (but painful, yes). So, bond volatility is very high as seen in bond volatility MOVE. But daily changes are hard to explain. MOVE was very high on Wednesday and Thursday on the UK bond/gilt crisis.

https://finance.yahoo.com/quote/^MOVE?p=^MOVE&.tsrc=fin-srch

Bounce today is also hard to explain. Things looked quite negative on Friday and over the weekend when the media was going crazy with rumors about the collapse of Swiss CS (as for coincidences, its Chairman is named Lehmann), and possible bond and/or stock crash, but what do we get? A bounce! US stock futures this evening are also up. This may be a dollar-relief bounce. Have the clouds cleared? No.

https://www.cmegroup.com/

https://stockcharts.com/h-sc/ui?s=$USD&p=D&b=5&g=0&id=p51598651421

I did not buy anything today, though based on weekend research I wanted to buy some stuff. I got tempted but thought may be everybody else too came back from the weekend with a buy list and jumped in from the get go. The market was already racing by 5he time I woke up.

https://twitter.com/charliebilello/status/1577770081152602127