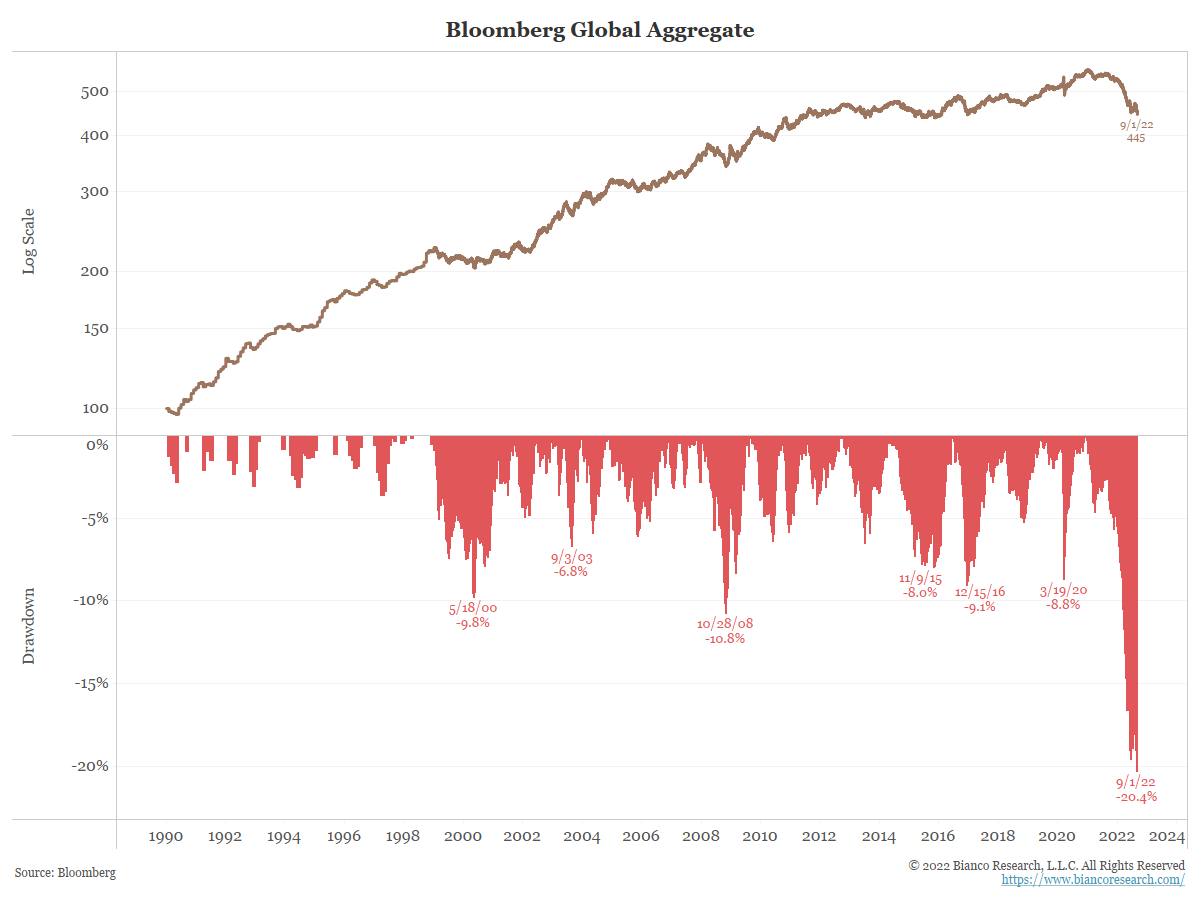

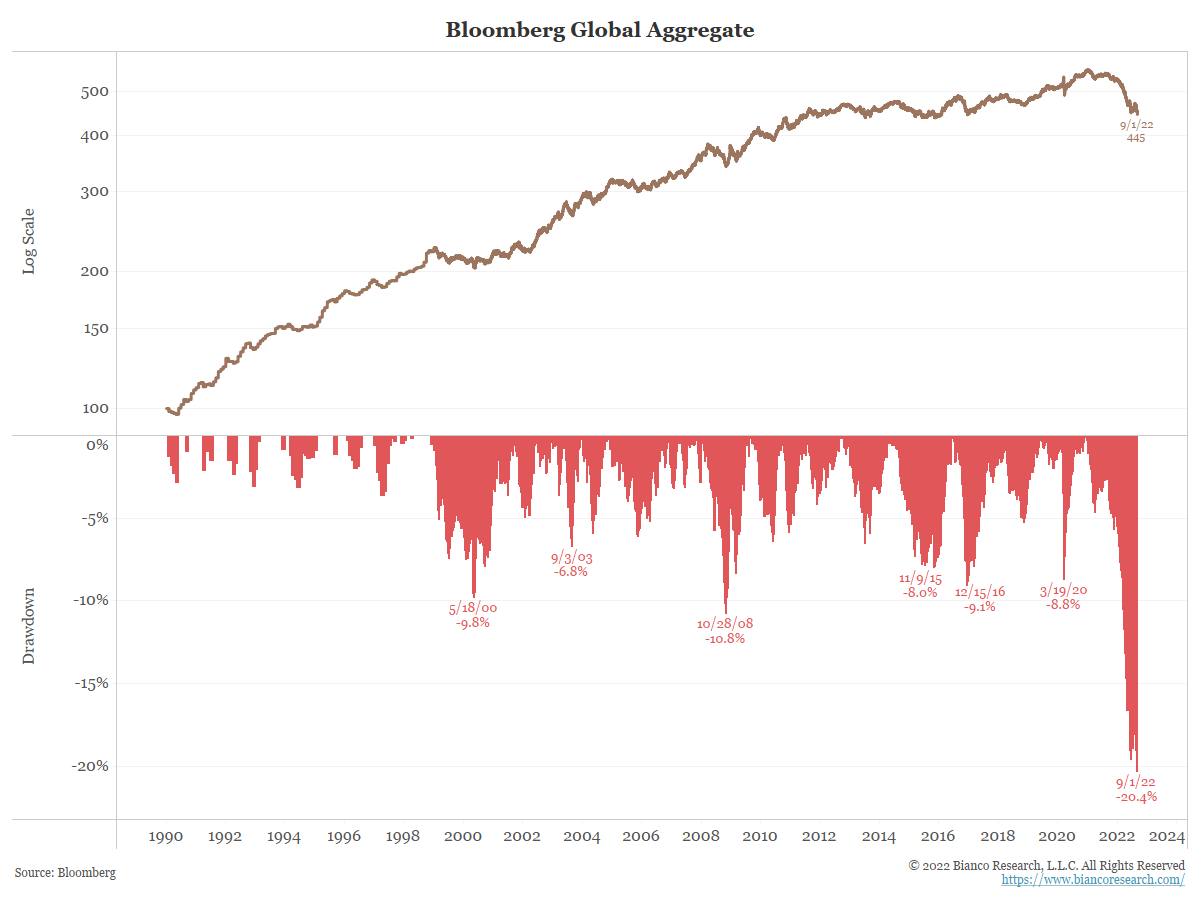

Global Bond Bear

The drawdown for the global bond index was recently at -20.4% for the first time in its history (1990- ). Based on the interest rate history over 5,000 years, this may be the first time ever for the global bond market. The US bond index (1976- ) had a record drawdown of -14.3% in mid-June, recent (only) -12.7%.

Twitter LINKNone of this would make you feel better. But if you hold bonds in any form, including within allocation/balanced funds, you know that it has been painful. Of course, some category of bonds (HYs, EMs) and some types of bond funds (CEFs) have had even worse drawdowns.

Twitter Chart1, Global Bond Index

https://pbs.twimg.com/media/FbpXRzBWAAE4PEb?format=png&name=mediumTwitter Chart2, US Bond Index

https://pbs.twimg.com/media/FbpX43rWIAEYBSa?format=png&name=mediumTwitter Chart3, 5,000 Yr Rate History

https://pbs.twimg.com/media/FbpYQ5dWYAUjXh9?format=jpg&name=medium

Comments

premx. em. down -19.95

fnmix em. down -17.31

agepx frontier mkt. bonds. down -14.46

yup. i own tuhyx, not the others.