It looks like you're new here. If you want to get involved, click one of these buttons!

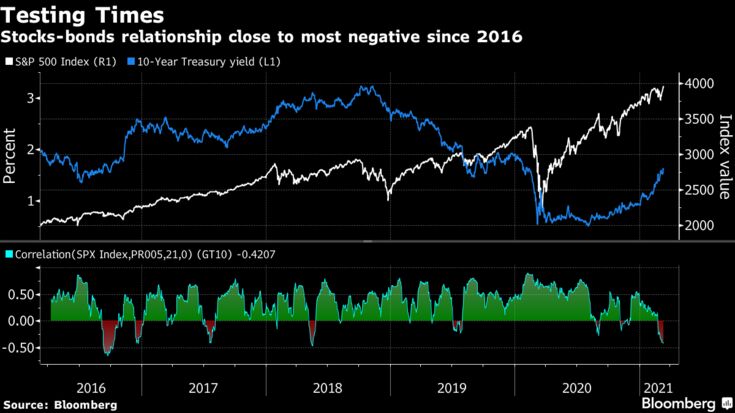

The strategy -- an investing stalwart since it arose from Harry Markowitz’s Modern Portfolio Theory about a half-century ago -- was already under pressure from the historic decline in bond yields. But the sharp move in the opposite direction is a more immediate threat, as recent market volatility has triggered tandem declines in stocks and bonds.

That jeopardizes the relationship at the heart of 60/40, which relies on the smaller, fixed-income allocation cushioning losses when riskier assets slump. The prospect of a faster economic recovery due to vaccines and heavy government stimulus has hit bonds hard, driving yields up at a speed that’s roiled equity markets. The method now faces one of its most severe tests since 2016, when U.S. President Donald Trump’s election raised expectations that lower taxes and lighter regulation would turbo-charge growth.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments

https://theirrelevantinvestor.com/2021/03/15/aint-so-bad-2/

As @bee illustrates above, declines for high-quality bond funds (except long-term funds) are tame compared to stock funds.

Shiller p/e is nearing 36, highest since runup / plunge ~ Jan 2000 (forget 2009).