It looks like you're new here. If you want to get involved, click one of these buttons!

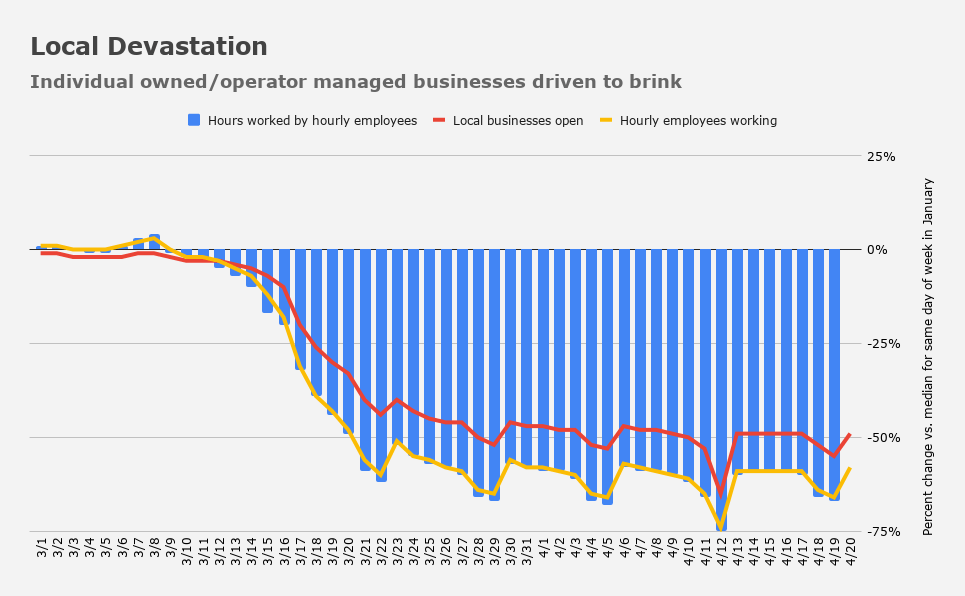

The manufacturing sector hasn't completely rolled over yet, but the services sector simply ceased to exist starting late last month.....The message is clear: Main Street isn't just hurting, it is disappearing in a very literal sense. As Atlanta Fed boss Raphael Bostic warned earlier this month, "May is going to loom large, in terms of the transition of concern from this being a liquidity issue… to this perhaps translating and transferring into a solvency issue, and whether companies can exist at all."

.(...from Homebase, a scheduling and time tracking tool used by more than 100,000 local businesses covering 1 million hourly employees.)

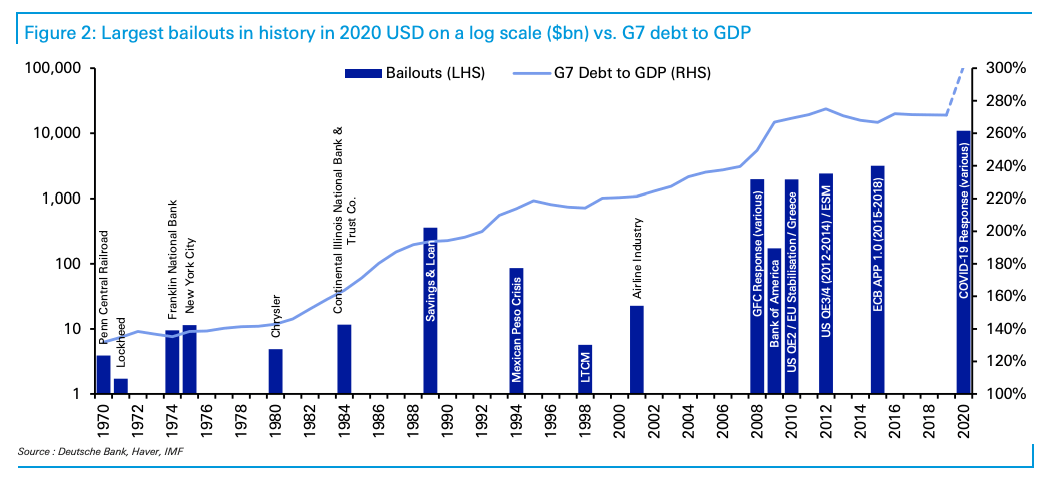

Deutsche Bank rolled up the fiscal and monetary support programs announced and implemented in the US and Europe into a single "bailout" figure. The sheer size of the COVID-19 response necessitated a log scale (on the left axis) in order to help "better identify the earlier bailouts and get a rough feel visually for the numbers," as the bank put it. ....."Obviously we won’t know how much will be used until much further down the road," the bank cautioned, in the course of presenting the numbers and accompanying visuals.

https://seekingalpha.com/article/4340027-dystopia-now

....policymakers have been deliberately suppressing volatility, compressing risk premia, tamping down credit spreads and keeping the market wide-open for borrowers for the better part of a decade....

Deutsche Bank's George Saravelos.....At the extreme, central banks could become permanent command economy agents administering equity and credit prices, aggressively subduing financial shocks. With unlimited capacity to print money, central banks have unlimited capacity to intervene in asset markets too. Put simply, a central bank that pegs bond, credit and equity markets is highly likely to stabilize portfolio flows as well.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments

You didn't have to add the dystopian stuff davfor. It's easy enough to imagine.

Thanks for the post.

QQQ signaled a buy based on the MACD at the end of March. QQQ passed the 200 days MA in the second week of April, then passed the 50 days MA, then test the 50 days MA again and now is up and running with a clear buy.

The SP500 is still struggling, The MACD signaled a buy at the end of March, the price passed the 50 days MA twice but still is not above the 200 days MA.

It's not a secret that unemployment will hit at least 15-20% and the economy right now is in bad shape but the stock market is looking 6-12 months ahead. The assumption is that most states will open their businesses in the next 1-3 months and the economy will get better. It would still take 1-2 years to get to normal. The fiscal and monetary policies were a success so far. If the Coronavirus will come back it's going to be ugly.

The SP500 and QQQ are capitalization-weighted indexes. This means that the biggest companies matter much more than the smaller ones. There are many companies in bad shape but several of the top ones are doing just fine and why the indexes are doing better. QQQ is mostly high tech where you see it even more.

The healthcare(XLV) sector is doing great too and the (chart) looks better than QQQ or XLK.

Is the above a guarantee? of course not. I'm skeptical like many of you but the charts are based on actual prices that traders were willing to pay.