It looks like you're new here. If you want to get involved, click one of these buttons!

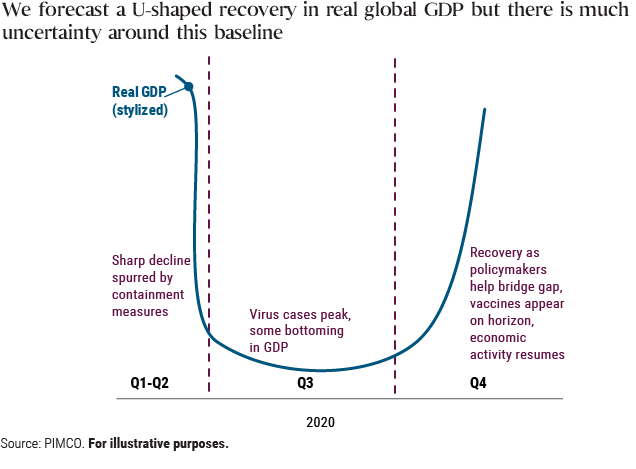

We are seeing the first-ever recession by government decree – a necessary, temporary, partial shutdown of the economy aimed at preventing an even larger humanitarian crisis. What is also different this time is the unprecedented speed and size of the monetary and fiscal response, as policymakers and monetary authorities try to prevent a recession turning into a lasting depression.

We believe this crisis is likely to leave three long-term scars:

Globalization may be dialed back

More private and public debt

Shift in household saving behavior

We believe a caution-first approach is warranted in an effort to protect against permanent capital impairment.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments