I have mentioned this a few times. I own neither funds. I have/had been a big fan and long term holder of Artisan funds. Over the past few years, I've been a net seller. When a company goes public, it affects the culture. TRP might be the exception. It used to be when Artisan opened new fund, I would just buy with the expectation to hold forever. Not any more.

I have long lamented ARTZX not getting any love from investors. Forget that, not even from within Artisan. I wonder why the woman manager of ARTZX does not quit. Artisan decides to hire an high flying manager from Thornburg who mostly made his name in the good times and put him at helm of new fund ARTYX.

Net assets of ARTZX vs ARTYX : 62.4MM vs 2.4B

Expense Ratio of ARTZX vs ARTYX : 1.35 vs 1.4

WTF???

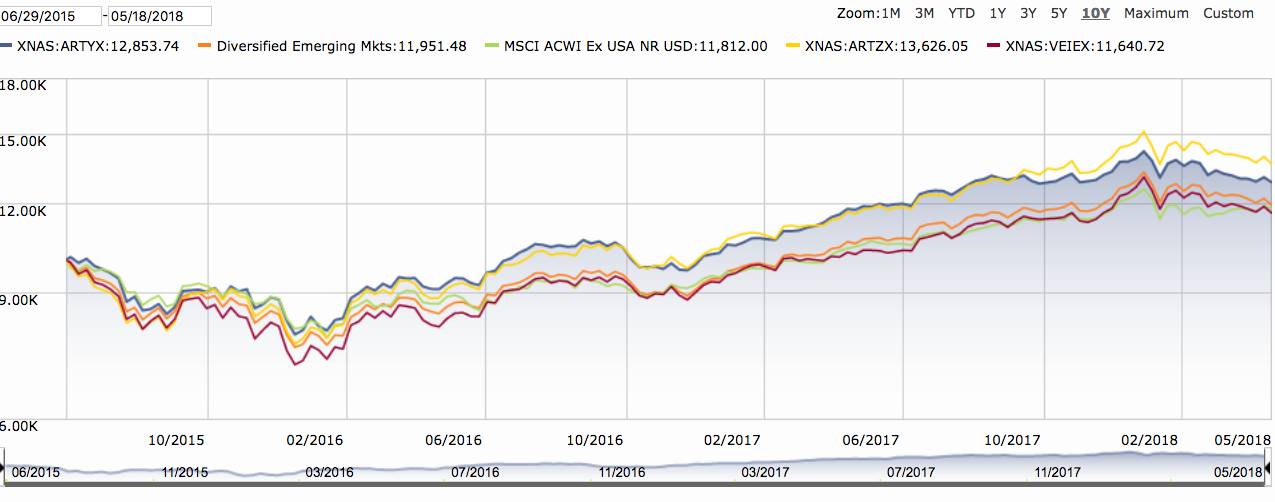

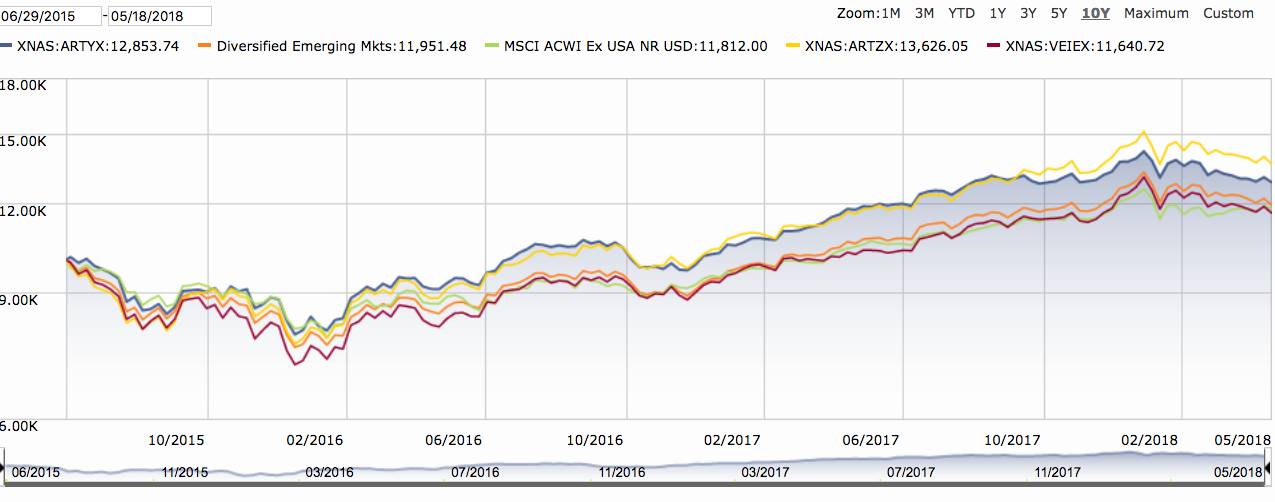

Chart of ARTZX, ARTYX, VEIEX, since date of inception of ARTYX.

I want ARTZX manager to sue Artisan for discrimination.

Comments

Normally small funds have higher ERs, but often the management company (not the manager him/herself) takes a hit by waiving fees to attract assets. ISTM that's a sign of support by the company for the fund.

ARTZX has waived some management fees. Absent those waivers, the total ER would have been 2.20% (and 2.25% (sic) for institutional shares). With that waiver, the total ER was 1.50%. Very recently (Feb 21, 2018), Artisan waived even more fees, reducing the ER to 1.35% (and 1.20% for institutional shares).

ARTZX has underpeformed its peers over its lifetime.. ARTYX has outperformed its peers over its lifetime. While APHEX (the institutional, older class of ARTZX) tracked its peer group very closely for its first five years (through May 2011), it greatly underperformed between June 2011 and June 2015 when ARTZX was created. THDAX was flying high during that period.

Certainly it shows discriminating taste to hire more successful managers to run new funds. Other than that, what discrimination are you referring to?

The point of showing the chart was ARTZX performance over ARTYZ lifetime has been better. And it has been consistently better. A $ invested in ARTZX would be worth more than same in ARTYX at its inception.

Does a relatively hot hand for a few months renders one fund superior to another? Does that mean that Negrete-Gruson was discriminated against only since last October? Or was the discrimination in the original hiring for ARTYX in June 2015?

We can research her demonstrated ability to navigate the "bad times" prior to Artisan selecting a manager for ARTYX:

From peak (5/31/08) to trough (2/28/09) APHEX lost 61.5%; its EM peers lost 58.7%

From peak (4/30/11) to trough (9/30/11) APHEX lost 30.9%, its EM peers lost 26.1%

We can look at how she performed during an extended flat market prior to June 2015 - using peak to peak dates:

From peak (4/29/11) to peak (9/5/14) APHEX lost 13.3%; its EM peers essentially flat, gaining 0.3%

Her annual performance record (for the institutional class shares, since those existed longer), prior to the hiring decision:

2008, 44th percentile

2009, 20th percentile - hot market "masking alleged ability of a fund manager" - peers returned 74%

2010, 49th percentile

2011, 96th percentile

2012, 65th percentile

2013, 72nd percentile

2014, 63rd percentile

I'm really at a loss to see why you want her to sue for discrimination.

Personally, I’d trust a woman over a man in just about any profession. As rule, they’re smarter and more responsible.

(Just my bias showing through).

04/30/11 to 09/30/11: THADX -25.3%, peers -26.1%, APHEX -30.9%

FWIW, the relative performances over the extended flat period, 4/29/11 to 9/5/14 are:

THADX 18.7%, peers 0.3%, APHEX -13.3%

Sorry I didn't detect your sarcasm.