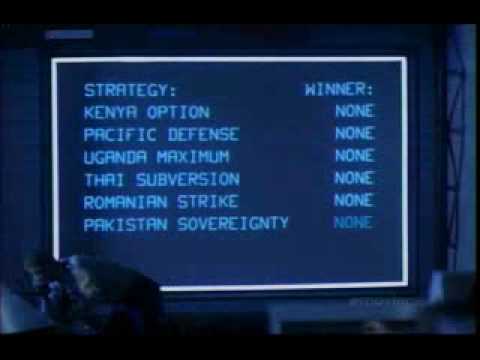

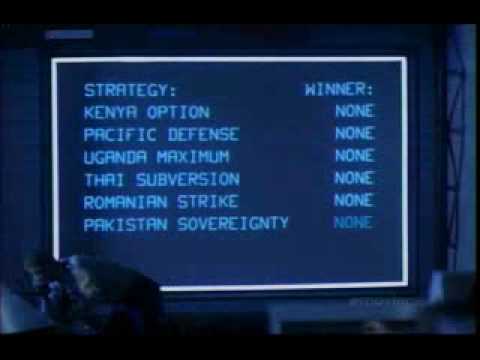

One doesn't need to watch the entire movie, "War Games", to hopefully understand my take and representation of the 4 minute sequence linked below. Tis another form of War Games that I imagine and consider while watching the video; where the military aspect is replaced by an economic aspect of War Games.

Perhaps you'll "see" what I see in terms of economic representations related to current tariff/trade threats and other..... Heck, even the super computer could be a representation of humans in powerful positions.

Lastly, are the gray and/or black swans nesting somewhere in the greater surrounding D.C. area???

Yes, this is posted in "funds category"; as appropriate, as this subject is affecting our investments.

Enjoy,

Catch

From the 1983 movie, War Games......4 minutes of your time.

Comments

The question that resonates with me ...

Is the "Trump Bump" going to turn into the "Trump Thump?" Or, pehaps worse into the "Trump Dump?"

I'm said to say, I hated to see Mrs. Yellen not get reappointed as the FOMC Chair; and, it also disappoints me to see Mr. Cohn resign. I'm thinking that these two people had great wisdom and a stabilizing effect and I am very said to see them go. Now, if McMaster leaves and Kelly follows ... Who's left? Tillerson & Ross

Remember, stock market votatility started during Mrs. Yellen's last week on the job and continues with the"Trump Follies" that now seem to follow. Yes, I'm sure there are good people that can replace them; but, their leaving creates uncertainty. And, the markets hate uncertainty.

I also agree that in the past our leaders and elected have given the store away in a number of foreign trade deals. But, do you upset the "Apple Cart" so to speak in revisiting these deals? After all, bruised apples have little value!

There are indeed a lot of things that need corrective action that politics messed up through the years.

Hopefully, these things can and will get worked out like rebuilding our steel industry without harming our neighboring trading partners, our long standing allies and even ourselves.

Skeet

Regards,

Ted

https://investing.com/indices/us-spx-500-futures

What's that saying? "Buy the Rumor...sell the News", but a lot of news these days is T"rumor"p. "Maybe short or sell the the T-"rumor"-p...forget the news".

what-does-buy-the-rumor-sell-the-news-mean

Thanks for the reminder. Much appreciated.

I have ample cash set aside for these rainy day blues.

I believe I can weather the storm. If it gets bad enough I might even do some buying.

Now would you rather bask in the sun? Or, set out a storm?

Skeet

This house, not unlike your's; "hearts" investing profits, but capital preservation is imperative.

As interest rates continued to creep up in late 2017, and viewing reactions over a period of months found real estate to continue very weak into early 2018......all of our real estate was sold. Also took the money and run from broad Europe holdings.

As the equity markets became more "insane" in January, sold away most of our technology and healthcare related.

In mid-January our portfolio was about 80% equity and is currently at 38.5%. The majority of this remains in tech. and healthcare related.

As bonds were still stuck in "suck land", what would have been a normal area for us to travel to with equity sells, all moved to plain cash.

So, we took the money and ran. Below is where we are parked at this moment.

EQUITY = 38.5%

BONDS = 21.4%

CASH = 40.3%

Sidenote: small caps continue to attempt to become better performers, so far this year.

Take care,

Catch

https://www.nytimes.com/2018/03/08/world/asia/us-trump-tpp-signed.html?rref=collection/sectioncollection/business&action=click&contentCollection=business&region=rank&module=package&version=highlights&contentPlacement=2&pgtype=sectionfront&mtrref=www.nytimes.com

https://www.nytimes.com/2018/03/10/opinion/trumps-negative-protection-racket-wonkish.html

Regards,

Ted

https://www.google.com/search?q=Risk+game+image&tbm=isch&tbo=u&source=univ&sa=X&ved=0ahUKEwjhu_Su1eLZAhWstlkKHfh-AzQQ7AkIQg&biw=1200&bih=551