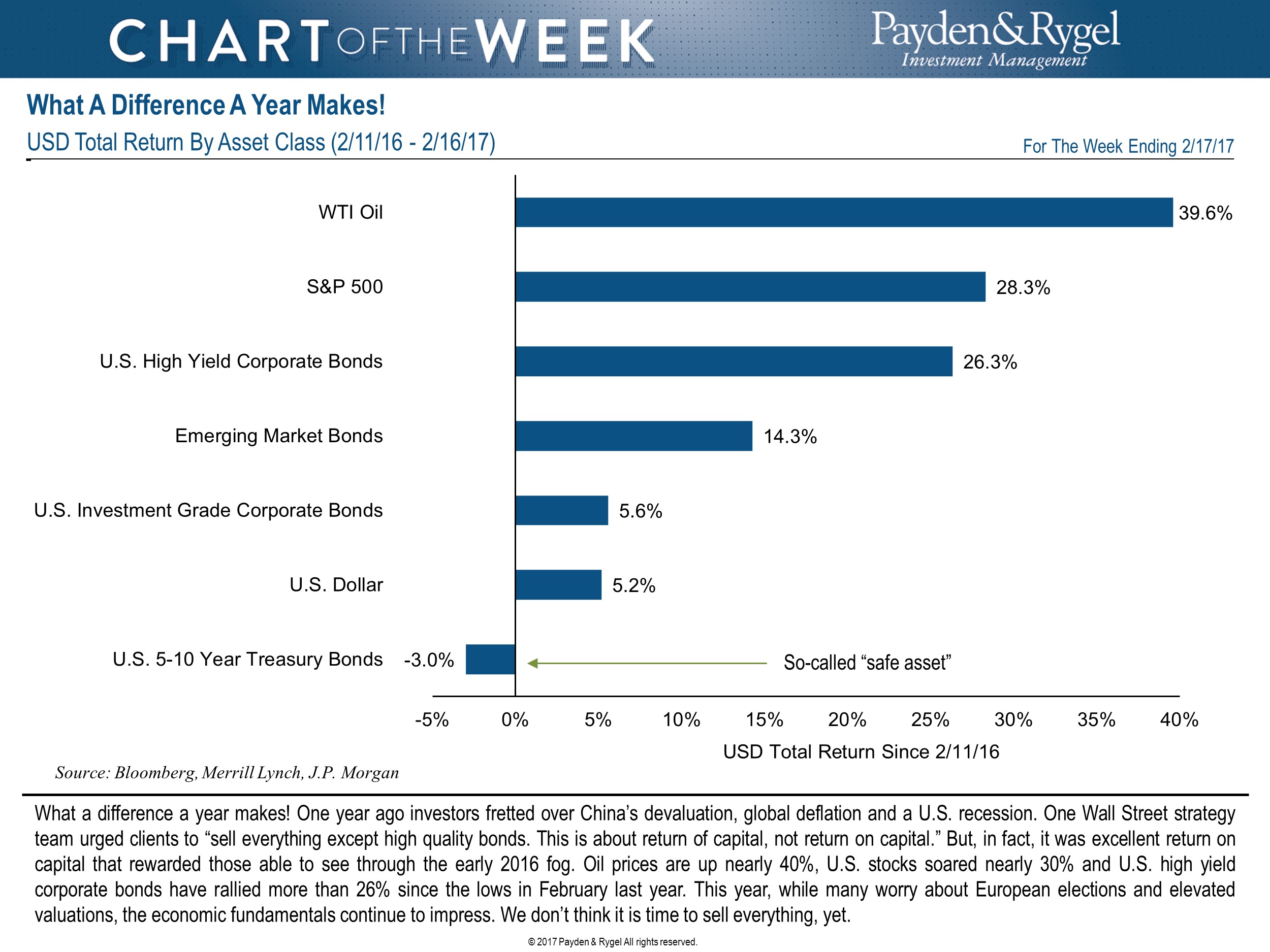

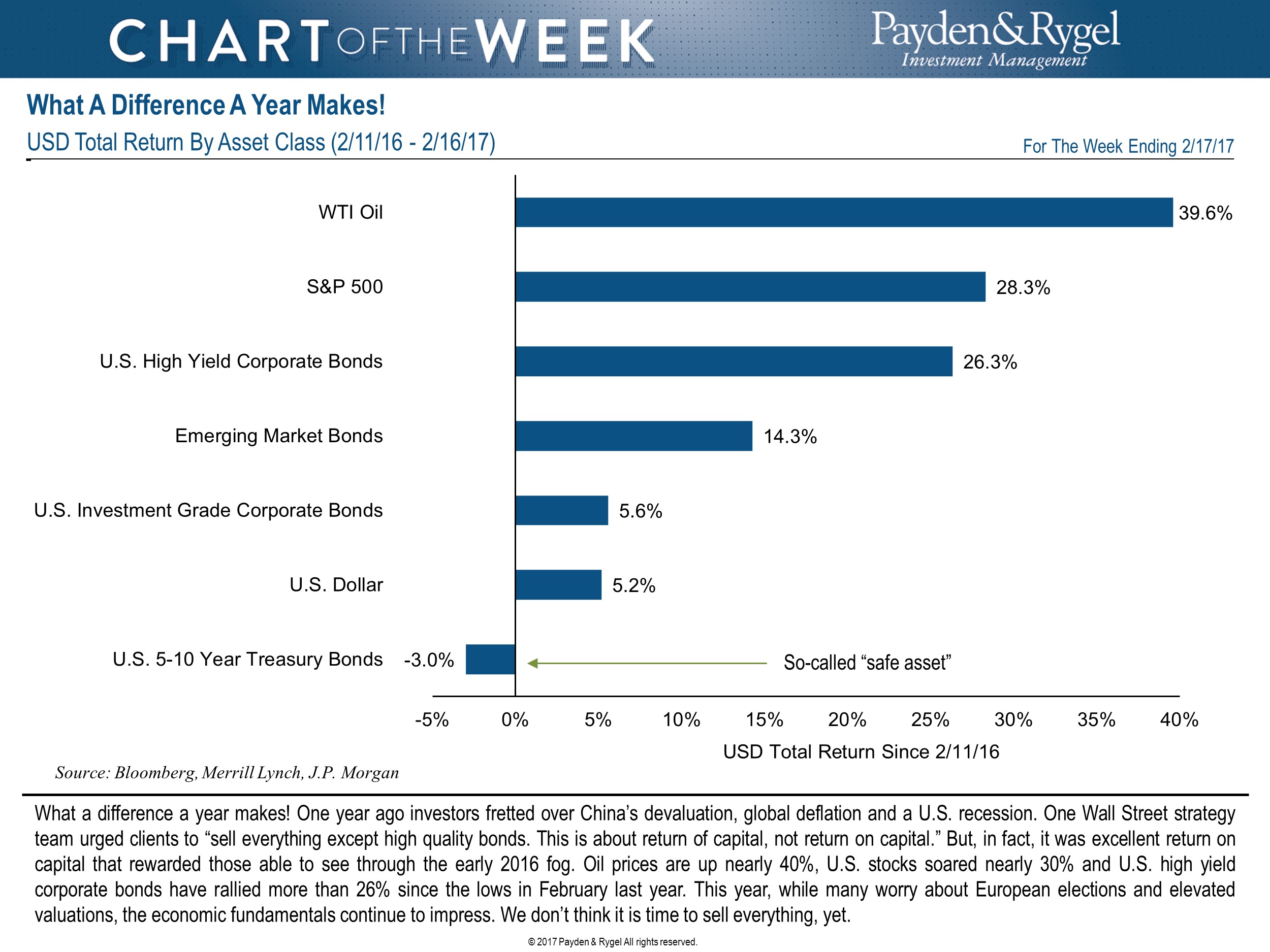

What A Difference A Year Makes!Economic Overview:From PAYDEN & RYGEL © 2017 Payden & Rygel All rights reserved.

What a difference a year makes! One year ago investors fretted over China’s devaluation, global deflation and a U.S. recession. One Wall Street strategy team urged clients to “sell everything except high quality bonds. This is about return of capital, not return on capital.” But, in fact, it was excellent return on capital that rewarded those able to see through the early 2016 fog. Oil prices are up nearly 40%, U.S. stocks soared nearly 30% and U.S. high yield corporate bonds have rallied more than 26% since the lows in February last year. This year, while many worry about European elections and elevated valuations, the economic fundamentals continue to impress. We don’t think it is time to sell everything, yet.

Treasuries

Treasuries A little over two hikes are priced in for 2017, and only two hikes are priced for 2018. European concerns and Trumponomics remain the focus with risk off the theme for the latter part of the week. Markets are still waiting with bated breath for Trump’s “phenomenal” tax plan and whether or not it will include a border adjustment tax (BAT). Next week we have 2,5, and seven-year Treasury auctions with sizes unchanged.

Equities: The U.S. Equity Market surged to new record highs this week on increased investor optimism surrounding the Trump administration’s tax reform, improving economic data, and strong corporate earnings results.

Securitized Products: On Deck Capital, arranger of small-business loans over the internet, tumbled after fourth-quarter losses widened and loss provisions rose more than anticipated. Not to be deterred, LendingClub said it plans to fund its loans via ABS. The Arcadia Receivables Credit Trust 2017-1 with LendingClub collateral is being marketed with Jefferies as the lead.

HighYield...only 14% of the market needs to be refinanced before 2020, so refinancing risk will remain low over the medium term.

Municipals: Municipals bonds are at the cheapest levels relative to taxable bonds since at least December, with ratios to taxable Treasury bonds making munis look more attractive. The 10-year and 30-year ratios are currently at 100% and 105%, respectively.

https://www.payden.com/weekly/wir021717.pdf