Index of Consumer Expectations 89.5 1Mo +5.0% 1Yr+8.2%University of Michigan said its consumer sentiment led to the highest level of the Sentiment Index since January 2004....a record 18 percent of respondents "spontaneously mentioned the expected favorable impact of Trump's policies on the economy." Consumers anticipated that a stronger economy would create more jobs, with the share expecting higher income rising to a one-year high.Needless to say, the overall gain in confidence was based on anticipated policy changes, with

specific details as yet unknown. Such favorable expectations could help jump-start growth before the actual enactment of policy changes...To be sure, nearly as many consumers referred unfavorably to anticipated changes in economic policies

http://www.sca.isr.umich.eduReal Estate Weekly: Record High Home Prices And Consumer Confidence, REIT Rally PausesBottom Line from Hoya Capital Real Estate

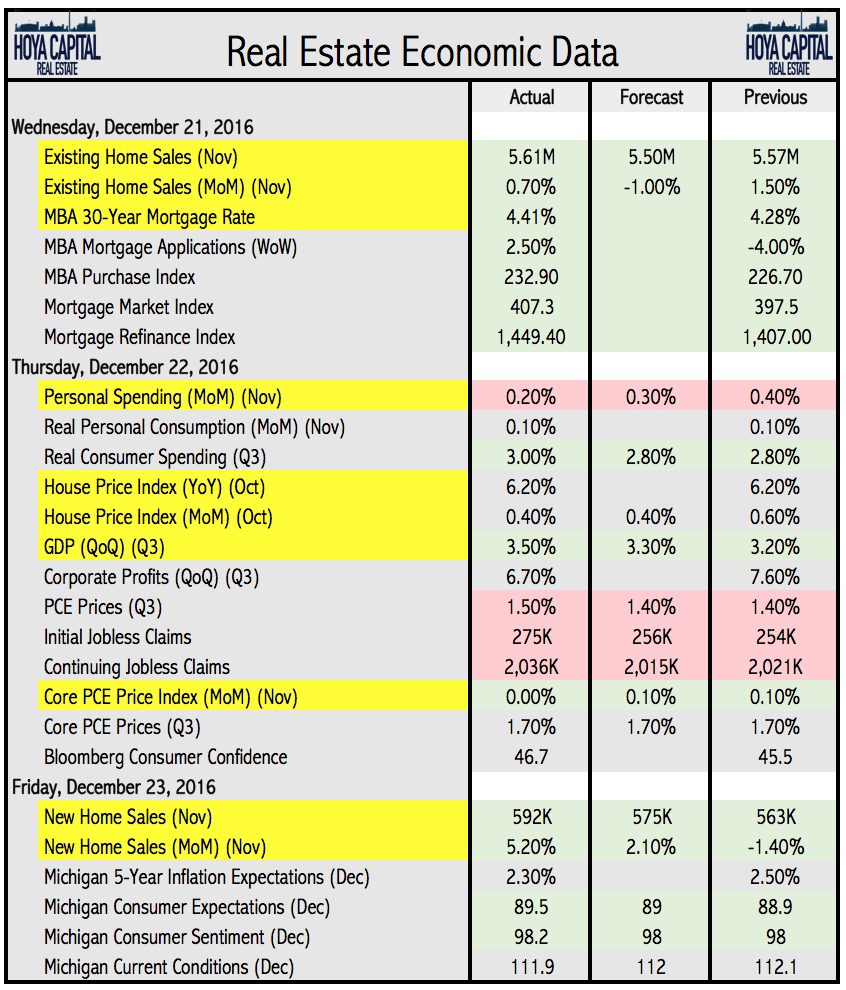

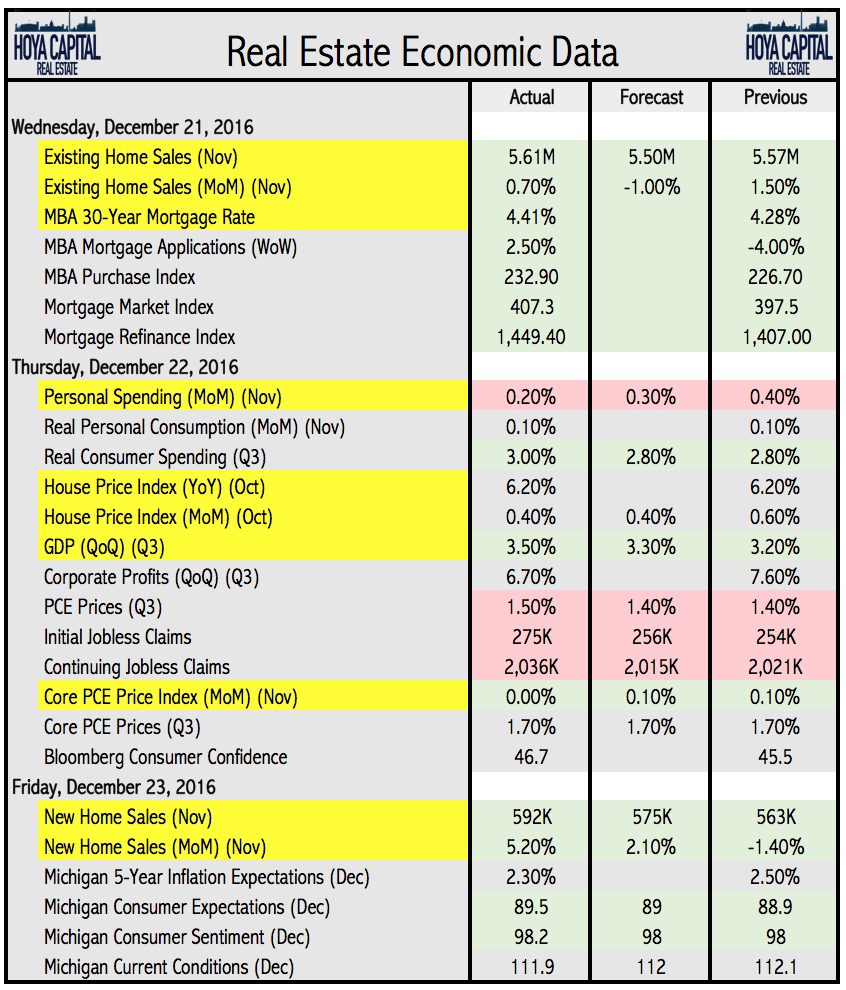

The real estate economic data released this week was very solid, but we have not yet seen the full effects of higher mortgage rates. We expect home price gains to moderate slightly in 2017.

There is still

significant policy uncertainty heading into the new administration. A significant overhaul of the tax code could potentially alter the economics of home ownership, but at this time, we expect any changes in this regard to be minimal.

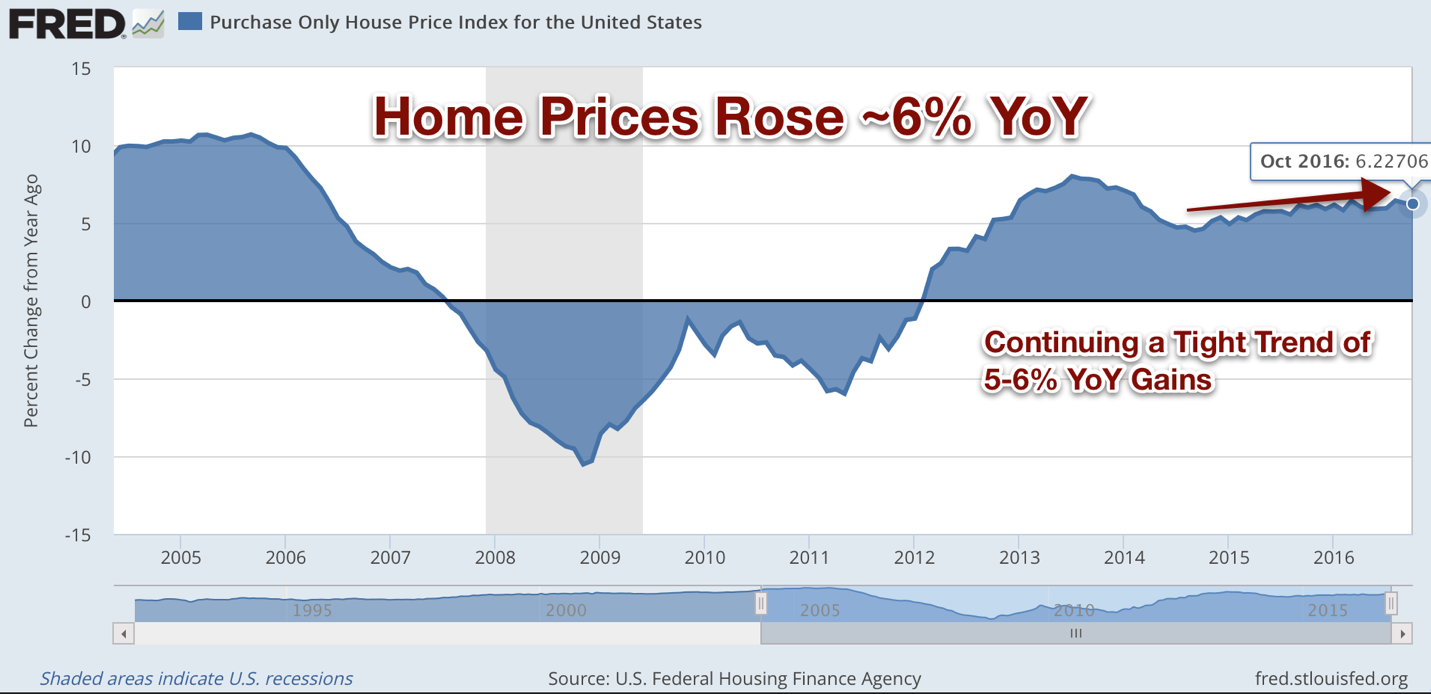

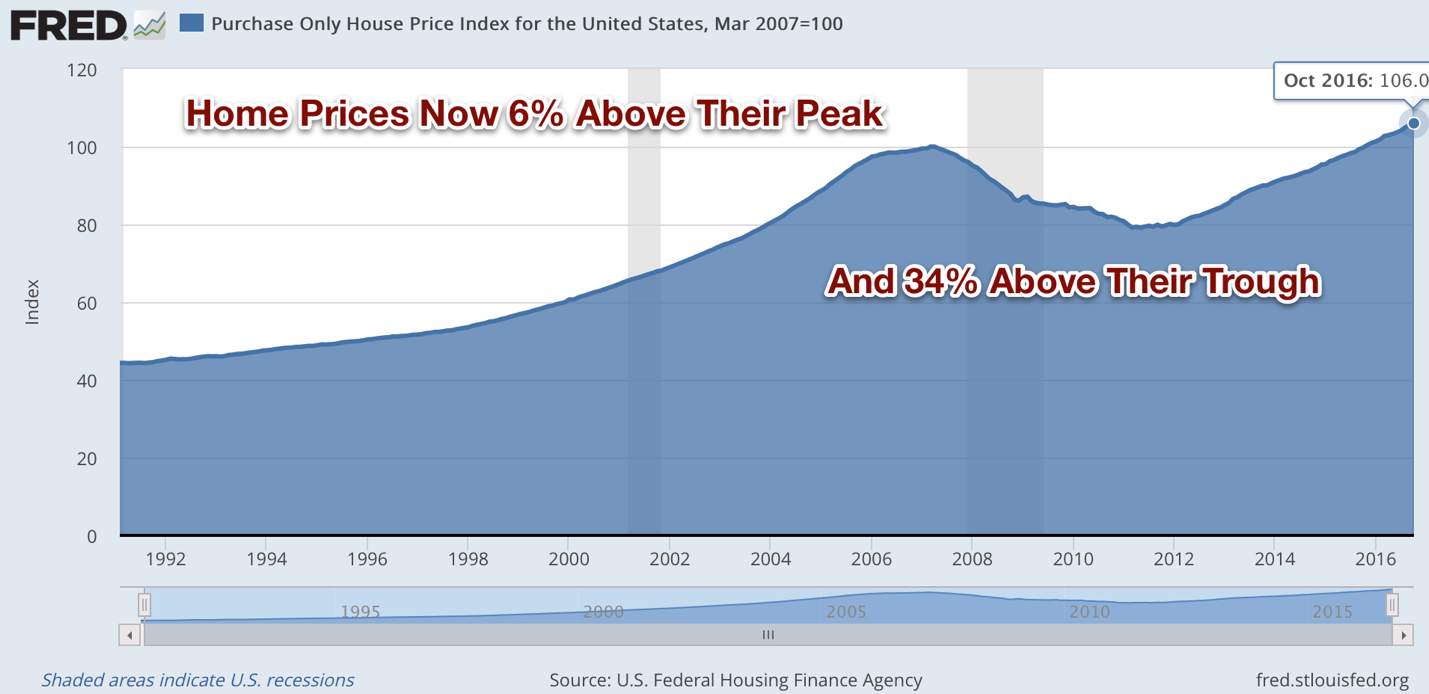

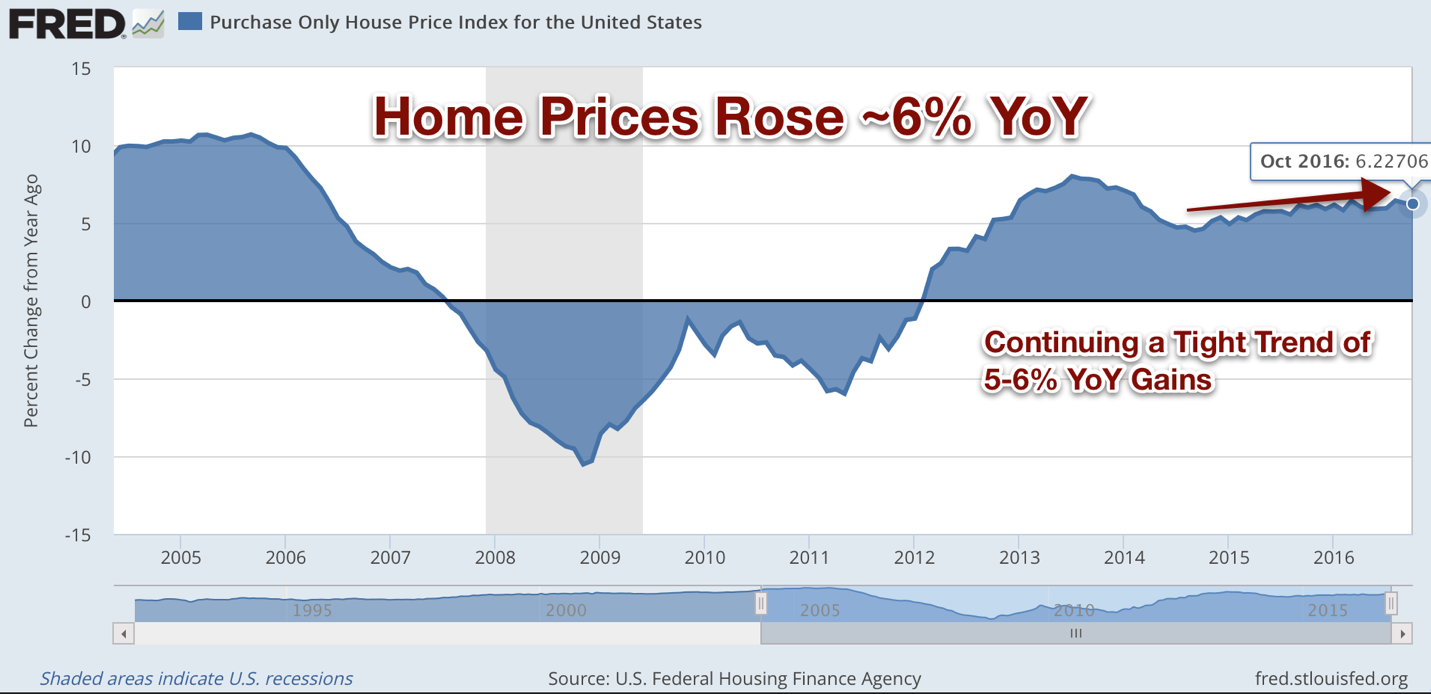

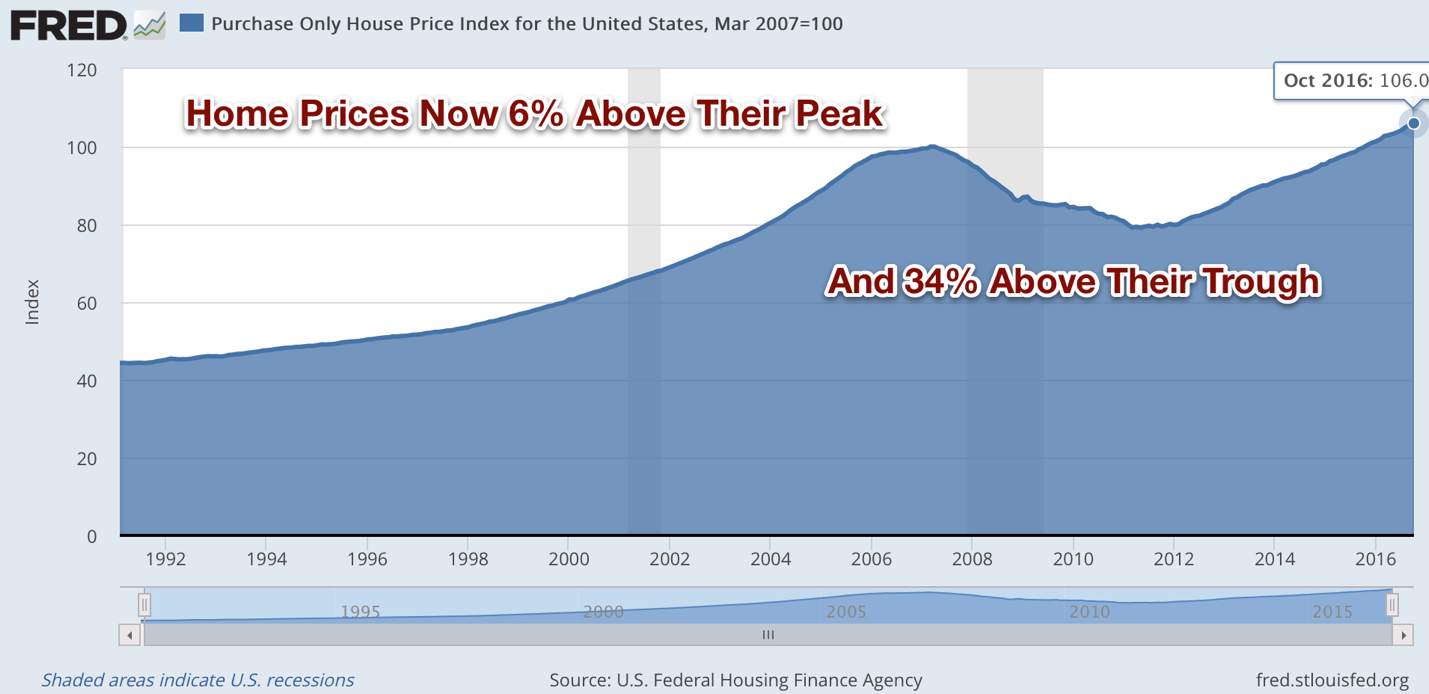

A healthy US housing market, the largest asset class in the world, is critical for economic stability and growth.Home Prices RiseThe FHFA released their home price data showing a 6.2% YoY rise in home prices, in line with expectations. It's important to point out that home prices are reported on a nominal basis, before subtracting inflation

/>

http://seekingalpha.com/article/4032479-real-estate-weekly-record-high-home-prices-consumer-confidence-reit-rally-pauses

Comments

Have a good one!

The towns Crash mentioned don't seem to have high property tax rates. I used a calculator here to estimate the rates. Note that it asks for assessed value, which can lower than actual value, so the effective rates could be lower than what I'm showing below. (I used 300K value to get tax amount, and converted to percentage.)

Kimberley: 0.859%

Grand Forks: 0.976%

Windermere: This town's so small that it barely registers on google. 1259 people in 2006, according to Wikipedia. No tax data.

To put these BC rates in perspective, I looked for US rates.

I can't swear to the accuracy of the site below, but the figures it's giving sound about right: US effective tax rate (i.e. rate on actual value) of 1.19%, with New Jersey's being the highest at 2.29%. It says that Michigan is not far behind (7th) at 1.83%.

https://smartasset.com/taxes/new-jersey-property-tax-calculator

Interview with a Bond Guy often cited by Gundlach

Bond expert: Markets will be tough to stomach in 'great unknown' 2017

Gail MarksJarvis

Chicago Tribune

James Bianco, 54, is known for his outspoken voice and independent views on the economy and markets — especially the bond market. His research, written at the firm he began in 1998 in Chicago, is followed by professional investors throughout the world — from hedge fund to endowment fund managers.

With people losing money in typically safe U.S. Treasury bonds and hoping to hold onto their unusually large 14 percent gains in the Dow Jones Industrial Average this year, individuals are on edge. They want to know if it's time to be careful of stocks, and whether bonds will continue to inflict losses.

James Bianco, president of Bianco Research, is telling professionals who invest money for clients to expect a nerve-wracking early 2017. He thinks both stocks and bonds will be tough to stomach amid significant volatility next year as "we go into the great unknown," he said.

There is an expectation that with Trump as president, wages will go up, that there will be more hiring and a better economy. People expect infrastructure spending, lower taxes and less regulation, but the devil is in the details.

I don't know how Trump can deliver unskilled jobs in an economy of robotics. The future of manufacturing will go to Purdue college graduates programming robots. If the hope is to get a good-paying eight-hours-a-day job in a factory, you might get it for a while before it goes to Mexico. But even the $3-an-hour jobs in Mexico will only be temporary until they are replaced by robot

At this point we don't know who Trump is or how it will turn out. There is a risk for stock investors if Trump doesn't deliver. As long as we think he's moving toward the goal, it will be OK. But the moment he seems to be stalling the rally could be in trouble.

http://www.chicagotribune.com/business/ct-bianco-research-james-bianco-exec-qa-1225-biz-20161223-story.html