"...if you owned only the FANG stocks or only the Nifty Nine and that was your entire portfolio, it is undeniable that you crushed it this year. Unfortunately, you also took a major risk – one that would not likely benefit you should you attempt to repeat this exploit in future years."

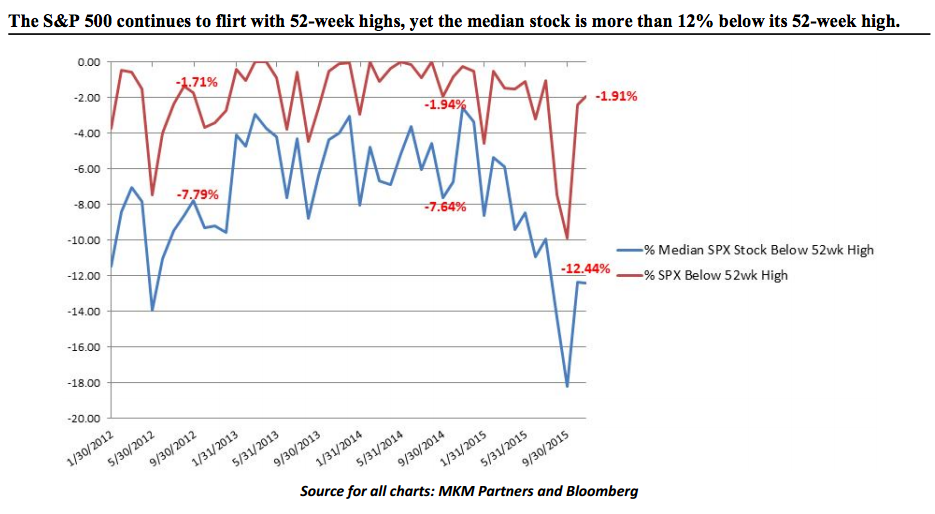

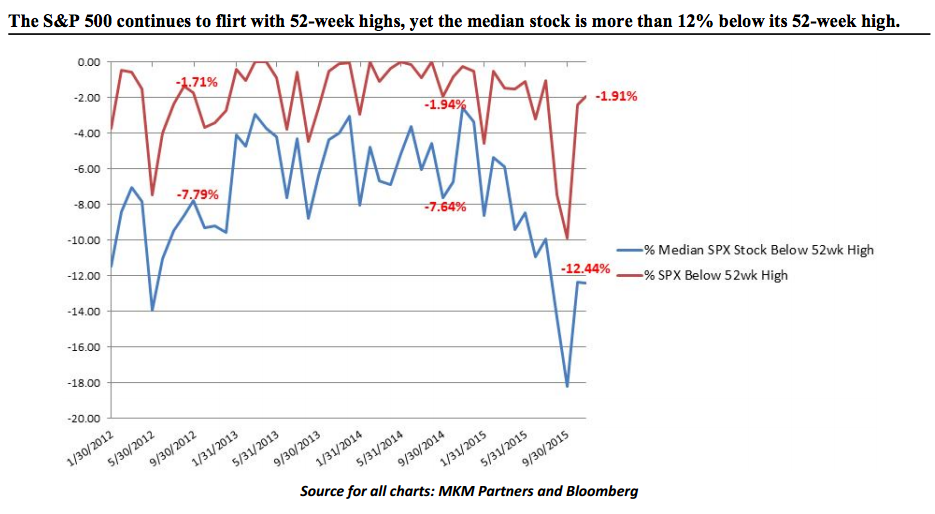

"My friend Jon Krinsky’s new technical analysis note at MKM Partners paints the picture of this year’s bumper crop of losing stocks perfectly in a single chart:"

"Says Jon:.... just 53% of components are above their 200 DMA....In the last 20 years, the only other times we have seen less than 55% of components above their 200 DMA while the SPX was within 2% of a 52-week high have been ’98-’00, October 2007, and July/August of this year."

See:

Joshua Brown

Comments

I'm not usually one to be alarmed or nervous when trends or statistics of that nature are pointed out, but that last sentence frankly made me sit up and take notice.

press