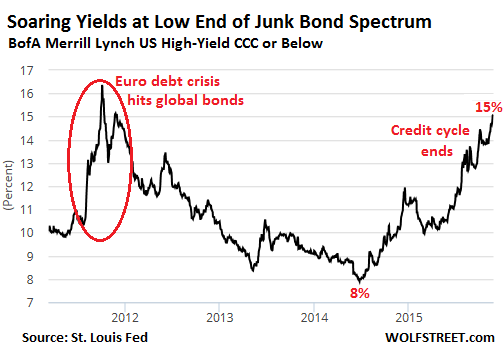

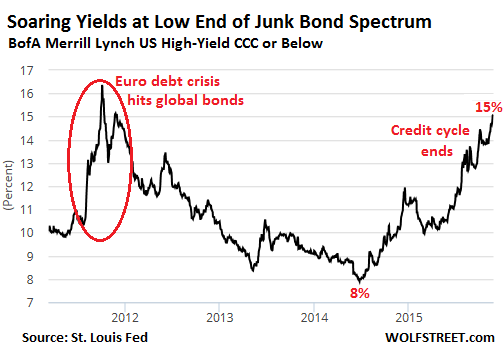

"...the flight to quality, as it’s called, has begun. The least risky junk bonds (rated BB) have merely edged down as their average effective yield has edged up from around 4.3% in mid-2014 to 5.85% now, according to the BofA Merrill Lynch US High Yield index. But the bottom has fallen out of the riskiest end: junk bonds rated CCC or below have swooned, and their yields have soared from around 8% on average in mid-2014 to over 15% now:

And the Fed hasn’t even begun to raise rates yet.

Corporate deal makers and Wall Street aren’t blind. They see that the credit cycle is ending, that lower-rated companies are having trouble issuing bonds at survivable rates. They see rising defaults. They see a few mega-caps propping up the S&P 500 index, while numerous former darlings have been abandoned. And so they’re furiously making hay as the storm is moving in."

See:

http://wolfstreet.com/2015/11/25/ma-frenzy-spikes-as-bottom-falls-out-of-riskiest-end/