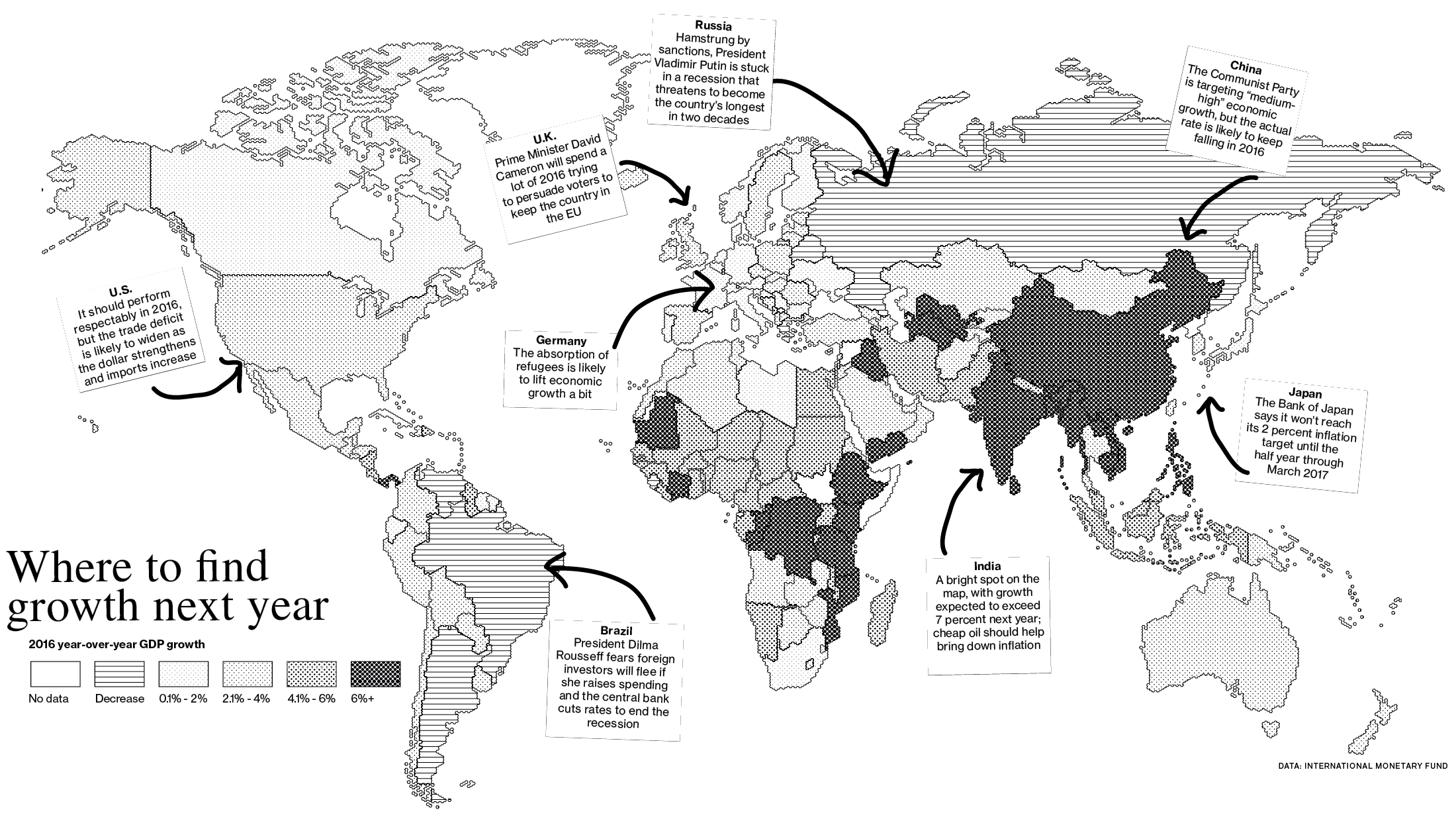

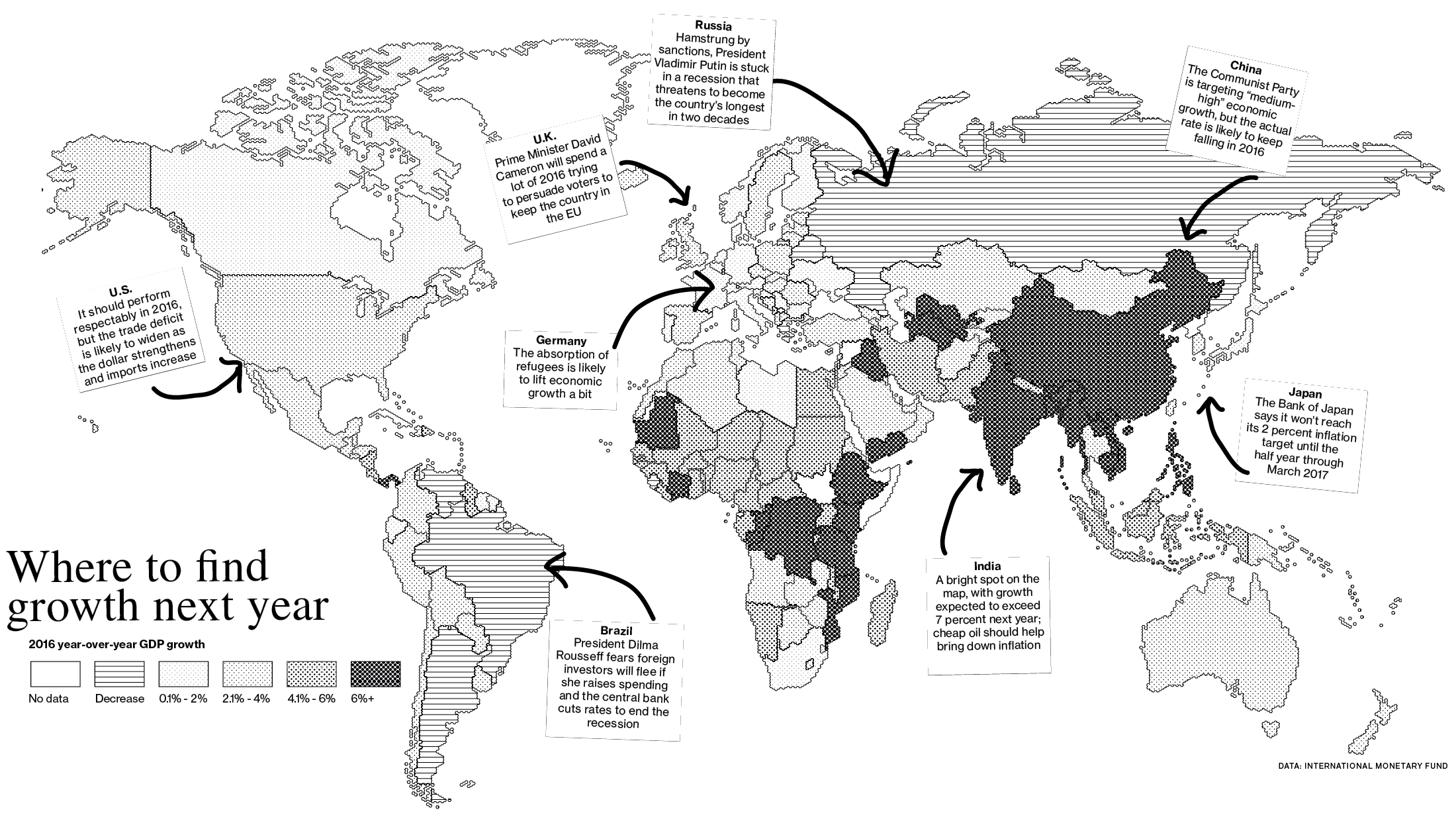

"Here’s the mainstream outlook in a nutshell: China will continue to decelerate. The U.S. will continue to outperform its rich-nation peers. With global demand soft, the price of money (interest rates) and the prices of oil and other commodities are likely to remain low. Central bankers Janet Yellen, Mario Draghi, and Haruhiko Kuroda will be in the spotlight as the Federal Reserve attempts to nudge rates higher and the European Central Bank and Bank of Japan look for ways to stimulate growth."

"The upside of America’s slow growth is that the economy is way short of inflationary overheating, so there’s no need for the Fed to jack up rates rapidly and potentially kill the expansion." ... “We’re still in recovery mode. We’re not even in expansion mode.”"

See:

2016