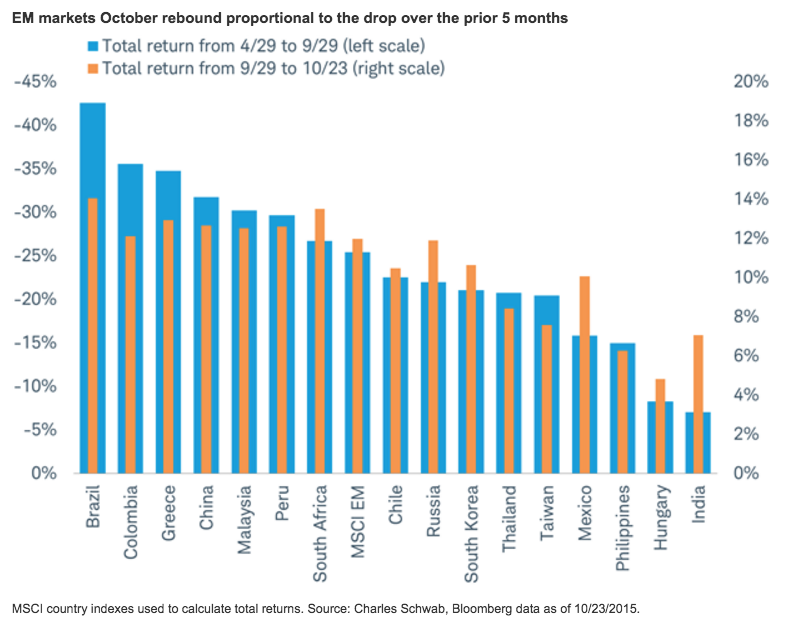

"No one is going to tap you on the shoulder to give you the head’s up when they do bottom and markets move very fast. A bottom may not be obvious until they’ve made a 50% move off of multi-year lows. It is true that these countries are mostly in awful condition and that they face major risks. With the current valuation discount between developed market equities and emerging market equities, you are being compensated for this reality. Maybe not compensated enough or maybe compensated more than enough, only time will tell."

Click

Here for Johsua Brown's post.

Comments

Investment Management

Tales from the Emerging World Commentary

|October 6, 2015

In China, the working-age population growth

rate was still hovering at just under 2 percent as recently as

2003, but then started dropping steadily until it turned

negative this year.

Population decline is now high on the list of reasons to doubt

that China can sustain rapid GDP growth. Many of these

reasons have been widely discussed, including the negative

impact of a credit binge that has quickly run up China’s debts

to around 300 percent of GDP,

and an investment binge that

has left development ghost towns all over China. But the fallout

from the depopulation bomb is at least as damaging to growth.

http://www.morganstanley.com/msamg/msimintl/docs/en_US/IN/Insights/tales_emerging_world/2015/tew_20151006_new_population_bomb_hits_china.pdf

Related

China Drops One-Child Cap After Three Decades to Lift Growth

Bloomberg News

October 29, 2015 — 5:34 AM CDT Updated on October 29, 2015 — 6:01 AM CDT

The party’s decision-making Central Committee approved plans to allow all couples in China to have two children, the official Xinhua News Agency said Thursday at the end of a four-day party gathering in Beijing. The move, which had been expected, comes after a previous effort to relax the policy fell well short of the goal of boosting births by 2 million a year.

"It shows the party wants to take action as soon as possible, and shows there is no time to delay for China to modify its population policy," said Wang Yukai, a governance professor at the Beijing-based Chinese Academy of Governance. "They couldn’t wait for the legislation to pass next year. The leaders want the new policy now."

http://www.bloomberg.com/news/articles/2015-10-29/china-abandons-three-decade-old-one-child-policy-to-lift-growth

Can a market for bigger/safer cars,larger apartments,better educational opportunities and a demand for cleaner air keep the Chinese growth rate in the 7% range ?

ox.ac.uk/news/2014-12-12-why-reform-china%E2%80%99s-one-child-policy-has-had-little-effect-boosting-fertility-levels