It looks like you're new here. If you want to get involved, click one of these buttons!

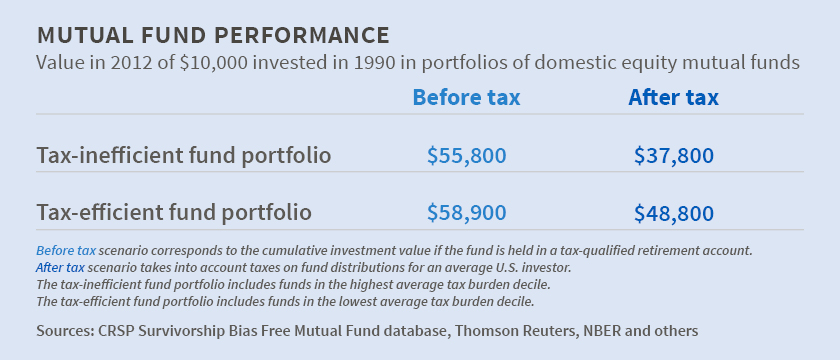

Source: NBER Digest | Aug 2015 | Jay Fitzgerald | http://www.nber.org/digest/aug15/w21060.htmlPursuing trading and investment strategies that could limit investment opportunities does not appear to lower average pre-tax returns.

In Tax-Efficient Asset Management: Evidence from Equity Mutual Funds (NBER Working Paper No. 21060), Clemens Sialm and Hanjiang Zhang investigate the performance of U.S. equity mutual funds that are "tax efficient" in the sense of following investment and trading strategies that minimize tax burdens on taxable investors.

The study finds that tax-efficient funds have tended to outperform other funds with respect to both before-tax and after-tax returns.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla

Comments