It looks like you're new here. If you want to get involved, click one of these buttons!

Example 4: James and Dolly Madison anticipate that they will each receive $18,000 of Social Security income and $19,500 of qualified-plan income during retirement, for a combined total income of $75,000 each year.

With their retirement income mix, the Madisons would have an estimated $0 state tax bill in 24 states! Notably, this list includes Illinois, New Jersey, and New York, states commonly thought of as high-tax states.

wow, man. yours are brass. i just could not do it that way.Sold oil equities today. These direct investments are now 0.5% of portfolio value.

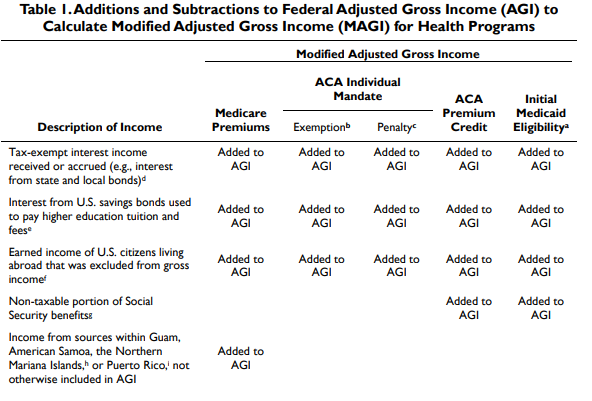

Part B Premium 2022 Coverage (2020 Income) 2023 Coverage (2021 Income)https://thefinancebuff.com/medicare-irmaa-income-brackets.html

Standard Single: <= $91,000 Single: <= $97,000

Married Filing Jointly: <= $182,000 Married Filing Jointly: <= $194,000

Married Filing Separately <= $91,000 Married Filing Separately <= $97,000

Standard * 1.4 Single: <= $114,000 Single: <= $123,000

Married Filing Jointly: <= $228,000 Married Filing Jointly: <= $246,000

Standard * 2.0 Single: <= $142,000 Single: <= $153,000

Married Filing Jointly: <= $284,000 Married Filing Jointly: <= $306,000

Standard * 2.6 Single: <= $170,000 Single: <= $183,000

Married Filing Jointly: <= $340,000 Married Filing Jointly: <= $366,000

Standard * 3.2 Single: < $500,000 Single: < $500,000

Married Filing Jointly: < $750,000 Married Filing Jointly: < $750,000

Married Filing Separately < $409,000 Married Filing Separately < $403,000

Standard * 3.4 Single: >= $500,000 Single: >= $500,000

Married Filing Jointly: >= $750,000 Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000 Married Filing Separately >= $403,000

https://www.regulations.gov/document/SEC-2016-2027-0001see also Adoption of (1) Rule18f-1 Under the Investment Company Act of 1940 to Permit Registered Open-End Investment Companies Which Have the Right to Redeem In Kind to Elect to Make Only Cash Redemptions and (2) Form-N-18F-1, Investment Company Act Release No. 6561 (June 14, 1971) [36 FR 11919 (June 23, 1971)] (“Rule 18f-1 and Form N-18F-1 Adopting Release”) (stating that the definition of “redeemable security” in section 2(a)(32) of the Investment Company Act “has traditionally been interpreted as giving the issuer the option of redeeming its securities in cash or in kind.”).

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla