Dear friends,

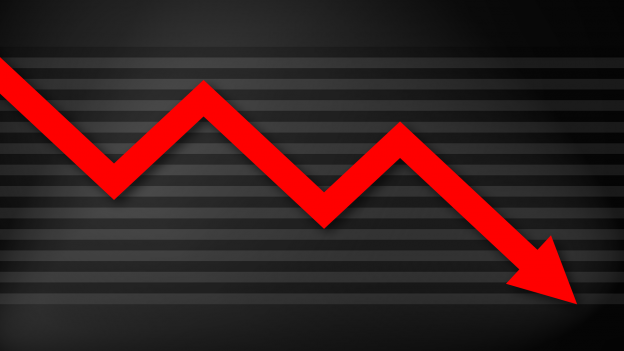

It’s been that kind of year. Who would have guessed that I’d miss the quiet sanity of 2021?

It has been a lot like that, hasn’t it?

Here’s a snapshot of 2022 so Continue reading →

Dear friends,

It’s been that kind of year. Who would have guessed that I’d miss the quiet sanity of 2021?

It has been a lot like that, hasn’t it?

Here’s a snapshot of 2022 so Continue reading →

My “Thoughts on Inflation Protection” essay, which appeared in MFO’s February 2022 issue, focused primarily on the role of different major asset classes in providing an inflation buffer for your portfolio. The article was focused in particular on the performance of funds and ETFs with substantial exposure to TIPS (Treasury Inflation-Protected Securities) and similar products. I highlighted the promise of short-duration TIPS funds.

In passing, I also noted the long-term potential role of domestic stocks and Equity REITS in protecting against inflation, while mentioning their two main drawbacks. One, they do not Continue reading →

We’ve just gone live with Interactive Charts on our premium site. The capability is a long time in coming and addresses an ongoing complaint (aaah … request) from David that the site should offer more than table-based screening tools, more specifically DataTables based. It does now.

The new charting tool provides Continue reading →

Risk is defined as “the possibility of loss or injury” by the Merriam-Webster Dictionary and volatility as “a tendency to change quickly and unpredictably.”

Risk refers to the possibility of loss, which is outcome focused. Volatility refers to a quick, unpredictable change, which isn’t centered on the outcome. To be a good investor, a person must be able to differentiate between these. Volatility acts as noise, while risk is worth paying attention to.

– The Difference Between Risk And Volatility, Investopedia, Judy Hulsey

I continue to expect a regime change from mid-cycle to late-cycle later this year and look for opportunities to reduce exposure to riskier assets from my current 55%. Fourth-quarter nominal gross domestic product is up 11.8% compared to a year ago with the consumer price index up 7.5% for a real (inflation-adjusted) gross domestic product of 5.6%. Inflation, valuations, geopolitical risks, and volatility are Continue reading →

“Stocks for the long-term!” goes the mantra. That chant has two meanings: (1) in the (very) long-term, no asset outperforms common stock. And (2) in any other term, stocks are too volatile to the trusted so if you’re going to buy them, be sure you’re doing it with a long time Continue reading →

As we head into March, it will soon be spring. A young man’s fancy lightly turns to love, while young and not so young investors’ thoughts turn more solemnly to taxes. This seems like an appropriate time to look at one corner of taxation – curiosities of ordinary income dividends distributed by funds.

I’ve been told that some people find taxes numbingly dull and perplexing. Who could imagine? Just to help you target your attention, Continue reading →

I’ve been told that some people find taxes numbingly dull and perplexing. Who could imagine? Just to help you target your attention, Continue reading →

On February 17, the Securities and Exchange Commission charged James Velissaris, the former Chief Investment Officer and founder of Infinity Q Capital Management, with overvaluing assets by more than $1 billion while pocketing tens of millions of dollars in fees.

The SEC’s complaint alleges that, from at least 2017 through February 2021, Velissaris engaged in Continue reading →