Dear friends,

Stand back!

Be ready!

Augustana just launched another flight of cheerful, broadly-educated graduates in your direction. Don’t worry too much: it’s the 158th time we’ve done it. Continue reading →

Dear friends,

Stand back!

Be ready!

Augustana just launched another flight of cheerful, broadly-educated graduates in your direction. Don’t worry too much: it’s the 158th time we’ve done it. Continue reading →

The surest way to corrupt a youth is to instruct him to hold in higher esteem those who think alike than those who think differently.

Nietzsche

Some years back my colleague Clyde McGregor and I used to have philosophical discussions about the market positioning of our fund, the Oakmark Equity and Income Fund (OAKBX), vis-à-vis our competitors. And while some of our focus was on fees, most of the Continue reading →

The fund seeks “maximum total return” through a combination of capital appreciation and income. The fund invests in undervalued securities, mostly mid- to large-cap dividend paying stocks. The manager has the option of investing in REITs, master limited partnerships, royalty trusts, preferred shares, convertibles, bonds and cash. The manager invests in companies “that he understands well.” The manager also generates income by selling covered calls on some of his stocks. As of February 28, 2018, the fund held 21 different investments, which Continue reading →

With a summertime nod to William Butler Yeats, “Sailing to Byzantium,” and not so much to the movie that cribbed a line from him.

I

That is no country for old men. The young

In one another’s arms, birds in the trees,

—Those dying generations—at their song,

The salmon-falls, the mackerel-crowded seas,

Fish, flesh, or fowl, commend all summer long

Whatever is begotten, born, and dies.

Caught in that sensual music all neglect

Monuments of unageing intellect. Continue reading →

At the time of publication, this fund was named Index Funds S&P 500® Equal Weight.

The fund equally weights all of the stocks in the S&P 500 index and rebalances its portfolio quarterly.

The Index Group, headquartered in Colorado Springs, Colorado. While they are legally permitted to Continue reading →

You may not know it. You may not want to admit it. But you’d certainly be running one.

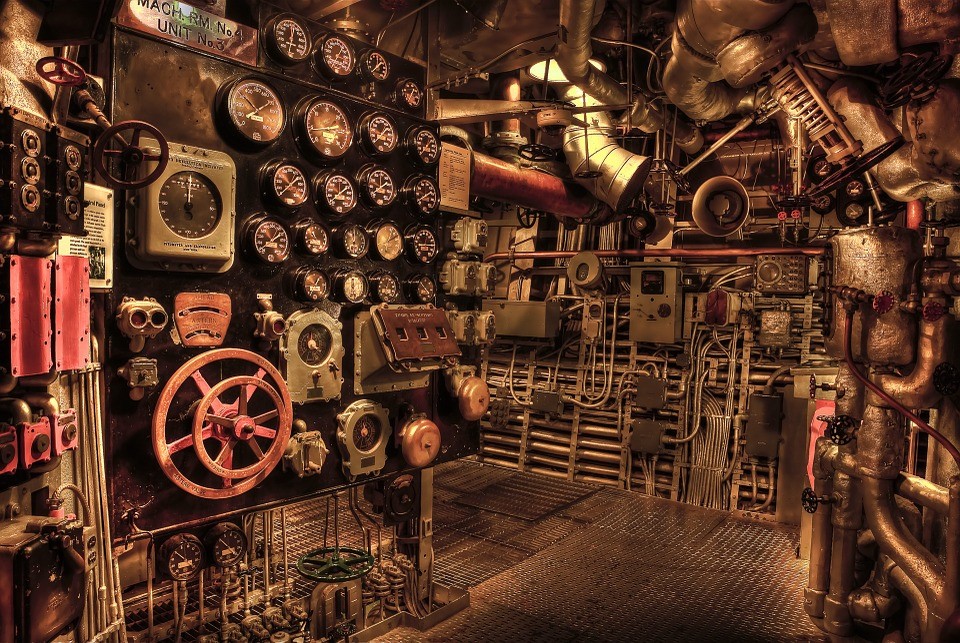

How do I know? Because managed futures funds operate exactly the way you do. Managed futures funds are momentum investors; they choose some number of asset classes (US stocks, currencies, EM bonds, commodities, whatever) to include in their portfolios. They then invest in the asset classes that show the greatest upward momentum, avoid assets that are drifting, and short those that are falling. You could also imagine a control panel with eight toggle switches, one for each asset class, and three positions for each switch (positive, neutral, negative). Managers look at relative strength data and might flip Continue reading →

The Mutual Fund Observer is the product of a virtual team and, when our colleagues from England and Trinidad were working with us, a virtual global team. Chip and I reside in Iowa, Ed and Sam in Illinois, Charles in California, Bob C in Ohio and Dennis in Montana. One of the great attractions of the Morningstar conference is that it gives us a chance to work side-by-side on interviews and stories, and to share quick and personal reactions to the ideas and personalities we encounter.

As ever, we’ll try to offer some quick responses in the form of end-of-day posts to Continue reading →

Quaker Funds, based in Berwyn PA, are a small family at tactical allocation funds. As they imagine a transition which will include an ESG focus, it became clear that Thomas Kirchner’s event-driven fund would be something of an anomaly. Event arbitrage funds aim to profit from predictable but short-lived market anomalies when, for example, a firm announces a change of control or reorganization. Limiting himself to relatively rare events in a relatively limited slice of the equity universe makes very little sense, so QEAAX/QEAIX is trying to join the Continue reading →

Charles sends his regrets for being unable to join us this issue, but he’s retreated deep underground to the MFO Premium command center.

At Charles’s request, the good folks at Thomson Reuters have substantially (vastly, enormously) expanded the amount of data they provide each month. The new datafeed will not only allow MFO Premium users to access a new level of detail about the composition and performance of mutual funds and ETFs, but it will also allow us to expand our coverage to closed-end funds and insurance products. Continue reading →

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

There’s something almost Biblical about this Continue reading →

There’s something almost Biblical about this Continue reading →

Lately, new fund and active ETF launches have been rare – only seven new retail funds launched in the first five months of 2018 – and occasionally silly. Last month saw a registration filing for an active “pet parents” fund; this month saw a filing for a passive “pet care” ETF. You need neither (and should avoid both), so we’ll say no more about them. While this is a slow month for new fund registrations, at least it’s not a silly one. In the main, these funds will be available for purchase by August 1.

Adler Value Fund, will seek Continue reading →

At first glance, it appears that about 61 funds saw partial or substantial manager changes this year but more than 40 other funds are masked by our designation “various” in the ticker column. It’s the total Chip uses when she encounters one manager departure that resonates across, say, 20 target date funds or a half dozen funds all calibrated to slightly different levels of risk (Isolde Very Very Conservative Fund, Isolde Very Conservative Fund, Isolde Conservative …).

The most consequential of the changes comes to Ivy Cundill Global Value (ICDAX) where the change of sub-adviser will change the Continue reading →

In October 2016, Dennis Baran profiled City National Rochdale Emerging Markets (RIMIX/CNRYX). His bottom line on the fund,

CNRYX offers an investor exposure to emerging markets by its concentrated strategy in Asia. Since inception, the fund has adhered to its six-country Asian allocation and not included other EM Asian countries or EM countries outside of that region in any meaningful way. The manager believes that the long-term positives of the region discussed here can become a virtuous cycle that could last for decades and lead to fund outperformance. The results thus far support that thesis: the fund has earned a five-star designation from Morningstar, is ranked highest by Lipper in total return, consistent return, tax efficiency, expense, and is a MFO Great Owl.