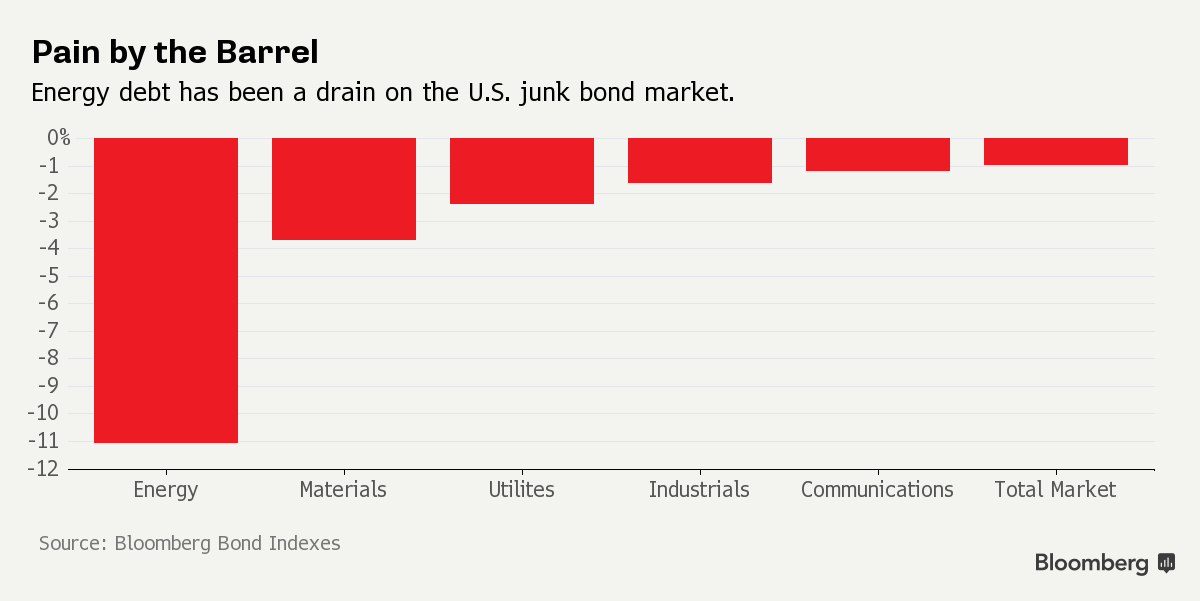

@Junkster Bought some Junk yesterday on down draft.

BGH

Oil And Gas 17.17%

10/31/15 Fact Sheet

http://www.babsoncapital.com/funds/closed-end-funds/babson-capital-global-short-duration-high-yield-fundReminder

DoubleLine Total Return Webcast titled "Tick, Tick, Tick..."

Hosted by Jeffrey Gundlach

Tuesday, December 8, 2015 1:15 pm PT /4:15 pm ET/3:15 CT

http://www.prnewswire.com/news-releases/jeffrey-gundlach-to-hold-webcast-today-on-doubleline-total-return-bond-fund-300187399.html08/12/2015

Energy Intelligence Report

In this week’s newsletter, we will take a quick look at some of the critical figures and data in the energy markets this week.

We have followed the EIA crude oil inventories closely, as they represent a rough proxy for oil supply/demand balance. Rising inventories indicate production outstripping demand.

• The chart shows that inventory levels in 2014 began to detach from the five-year average, rising at an accelerated rate at the beginning of the year as U.S. oil production continued to climb. The jump above the five-year average corresponds with the beginning of the decline of oil prices from the June 2014 peak.

• About 55 percent of the U.S.’ oil storage capacity is located along the Gulf Coast. Cushing looms large because of its basis for the WTI benchmark. But it holds just 13 percent of the country’s storage capacity.

• The EIA says that the crude oil storage utilization at Cushing and the Gulf Coast is at 70.2 percent, a touch below the record utilization rate of 71.2 percent set in April 2015. Near record-high inventory levels continue to weigh on oil prices.

Tuesday December 8, 2015

Crude oil prices plunged to new lows on December 7, following on the heels of OPEC’s decision to scrap its production target last week. The markets are reaching new depths of pessimism, with WTI and Brent breaking fresh seven-year lows, dipping below the nadir from earlier this year.

The decision to scrap its production target stems from the increasing competition between Saudi Arabia and Iran. As Iran has the intention of bringing 500,000 to 1 million barrels of oil per day back online within the next year, Saudi Arabia decided to abandon all pretense of a production ceiling. As we reported in last week’s newsletter, the practical effect of removing the ceiling will likely be minimal – OPEC members were ignoring it anyways.

But by erasing the production target from its official policy, Saudi Arabia and Iran could engage in increasing pricing competition and fights for market share. All OPEC members, except for Saudi Arabia, are producing flat out. Iran will soon be doing the same.

http://oilprice.com/newsletters/free/opintel08122015