Junk Sovereigns ?? A Real Reach?

Markets | Thu Apr 7, 2016 4:46pm EDT

After 15 years, Argentina set for bond market returnBy Joy Wiltermuth

Now it will hold a five-day roadshow in the UK and the US as it preps a new bond expected to raise $12 billion - or more - to help pay off holdouts who had rejected a debt restructuring.

Finance Secretary Luis Caputo and Undersecretary Santiago Bausili will each lead teams meeting with investors in London, Boston, New York, Washington and Los Angeles.

Deutsche Bank, HSBC, JP Morgan and Santander are arranging the meetings, but few other details were immediately available.

"The dealers on it are keeping it hush-hush until they are ready to come to market," said Sean Newman, a senior portfolio manager at Invesco Fixed Income.

One of the lead banks told IFR that investors had not yet been given any information about the ultimate size of the deal or the potential currencies of issuance.

At US$12bn, the transaction would be the largest ever from an emerging markets borrower, according to Thomson Reuters data."It does mean something really huge for Argentina," said Bianca Taylor, a senior sovereign emerging markets analyst at investment management firm Loomis, Sayles & Company.

"They are back in the game with the curing of this longstanding issue with the holdouts, and they once again have access to the foreign

capital markets."

One trader in New York said he had heard yields whispered in the 7.5 percent range, but said 8.5 percent on a 10-year bond was a more feasible target given the current climate.

But Taylor said a useful comparable would be a Brazil 10-year currently trading at 6.13 percent.

"The talk of 7.5 percent seems rich for a country still in a balance-of-payments crisis and just coming out of default."

In addition, after being unable to raise debt abroad for so long, Argentina might well come to market with a debt sale larger than US$12 billion in order to replenish its coffers and plug at least some of its fiscal deficit.

http://www.reuters.com/article/us-argentina-bonds-idUSKCN0X42O6@DanHardy You're not the only one expecting low rates to remain for some time.

Yield Curve MadnessPosted on April 6, 2016 by David Ott Acropolis Investment Management

,,yield on the 10-year US Treasury hit 1.73 percent. After starting the year at 2.24 percent, the benchmark yield dropped to 1.63 percent when the stock market bottomed out on February 11th and then climbed to 1.98 percent before falling again.

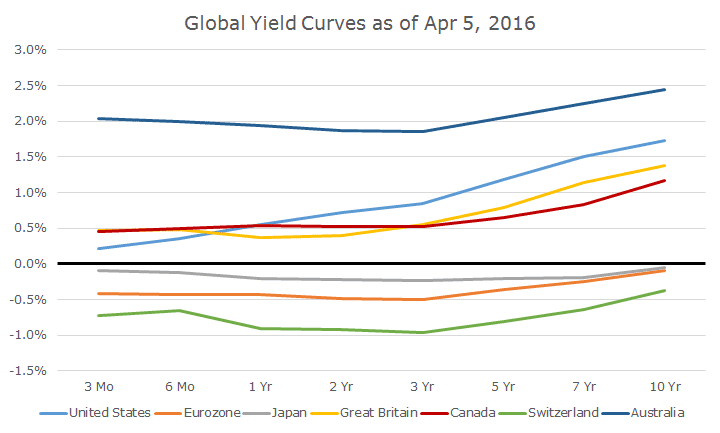

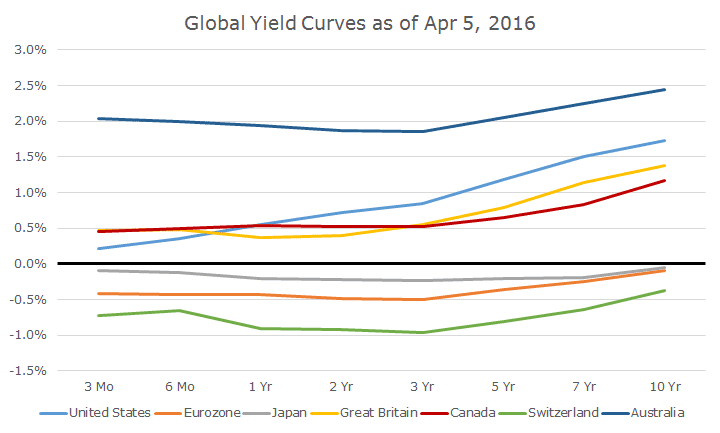

As low as your yields are today, they are among the highest in the developed world, as the chart below shows. The chart includes the G7 countries (with the benchmark eurozone rate representing Germany, France and Italy), Switzerland and Australia (each representing the highest and lowest rates in the developed world).

This chart is striking for at least three reasons. First, the overall level of rates is just appallingly low across the world. The idea that the highest rates are still a paltry 2.5 percent is troubling.

Second, and even more bothersome, is that three of the curves are negative all the way out to 10 years. There are other countries with negative yields like Denmark, but the idea that the euro benchmark curve is negative is striking.

Finally, there are only three ‘normal’ yield curves, where rates rise as the maturity goes out further into the future. The US has the steepest curve, although it’s far flatter now than it was six months ago.

http://acrinv.com/yield-curve-madness/