It looks like you're new here. If you want to get involved, click one of these buttons!

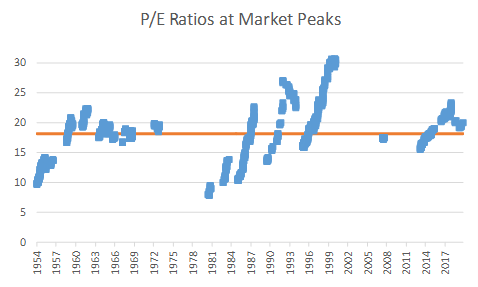

https://seekingalpha.com/article/4299923-p-e-ratios-market-peaksTo me, this analysis suggests that the current earnings multiple with the market at an all-time high is fair to slightly elevated. Given still low rates and monetary accommodation and political capital being spent to forestall an economic downturn, the economy may once again manage to extend its historic expansion. High equity multiples, low interest rates, and perhaps slower earnings growth all suggest lower forward returns on average. I would expect market participants to continue to reprice the stage of the business cycle, which will create episodic volatility.

I can’t answer that Catch. But thank you for the opportunity to correct my earlier post above. I mistakenly assumed I-Bonds were the same as TIPS. Of course they aren’t (though I assume the inflation protection works similarly). So it was TIPS funds I was talking about - not I-Bonds.@Simon and @msf

I'm attempting to determine the value of purchasing the I-bonds vs STPZ , LTPZ or a TIP's fund, be it active managed or ETF.

I-bonds, direct purchase have an annual dollar limit per individual, yes? I suppose an individual question would be whether the dollar limit would have a meaningful impact upon an overall portfolio.

TIP type funds have no dollar limit for purchase.

TIP funds will also follow in capital appreciation (price) in sentiment with yields when moving lower, as with most other bond types. TIP's are part of a safe haven investment along with other Treasury issues. And the investor may buy or sell when the trend changes.

ADD: account type was not noted, so I don't know whether the I-bonds are in taxable or tax sheltered account, if this matters.

Thanks for your time.

Catch

If you buy before Oct. 31, the bonds you receive will pay 1.90% through March of 2020. That's the way Series I savings bonds work. You get the current inflation adjustment (1.4%) for the first six months you own the savings bonds regardless of which month you purchase them in, then the you get the next inflation adjustment (2.0%) for six months, and so on.I Bonds, paying 2.5% from next month. You are guaranteed to earn 0.5% above the rate of inflation if you buy before Oct 31.

https://www.treasurydirect.gov/news/pressroom/currentibondratespr.htmThe 1.90% composite rate for I bonds bought from May 2019 through October 2019 applies for the first six months after the issue date.

https://www.depositaccounts.com/blog/inflation-treasury-series-i-savings-bonds/The current I Bond fixed rate is 0.5%. That is the highest it has been since early 2009 when it was 0.70%. In this falling interest rate environment with low Treasury yields, I think it’s likely that the I Bond fixed rate will fall. For five of the last ten years, the fixed rate has been zero.

If you buy I Bonds for the long-term, the fixed rate is the most important consideration, and it may be at a peak. We won’t know the next I Bond fixed rate until November 1st when the Treasury announces the changes.

Here’s a Bloomberg story about what some are calling the “repo mess.”Sold off one of my money market mutual funds since there has been news, of late, about liquidity concerns in the repo market.

Not only the data, but links as well, e.g. the KFF link in:For 2019, plans with annual deductibles of at least $1,350 for individuals and $2,700 for families are classified as high-deductible; for 2020, those numbers inch up to $1,400 and $2,800.

Thirty percent of workers were covered by a HDHP in 2019, according to data from the Kaiser Family Foundation; in 2014 20% of workers were covered by an HDHP.

Apparently that wasn't "flex"ible enough.It has been a policy of the Franklin California Growth Fund, under normal market conditions, to invest at least 80% of its net assets in equity securities of California companies. Effective September 1, 2002, Franklin California Growth Fund will change its name to "Franklin Flex Cap Growth Fund" and will eliminate the 80% investment policy. ... [replacement strategy] The Fund normally invests a majority of its assets in California companies

The successor fund was merged into FGRAX in August 2016.Effective October 1, 2004, the section "Goal and Strategies" ... is replaced with the following: ...

Under normal market conditions, the Fund invests primarily in equity securities of companies that the manager believes have the potential for capital appreciation. The Fund has the flexibility to invest in companies located, headquartered, or operating inside and outside the United States, across the entire market capitalization spectrum from small, emerging growth companies to well-established, large-cap companies.

Call it the home-team advantage.

"We're able to keep close tabs on our investments," said Conrad B. Herrmann, lead manager of the $1.58 billion Franklin California Growth fund, which focuses on California companies. "We read local newspapers in California and socialize and interact with people who might be employed in the companies in our universe."

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla