It looks like you're new here. If you want to get involved, click one of these buttons!

https://cnn.com/2020/07/20/investing/leon-cooperman-stock-market-overvalued/index.htmlRisks for the market

The nation's rapidly growing national debt is among Cooperman's biggest concerns.Instead of whittling down the federal deficit when the economy was strong, Trump directed the federal government pile on even more debt to pay for massive tax cuts and spending surged, which meant the country entered the coronavirus crisis in rough financial shape. Now, the national debt is exploding as Washington scrambles to rescue the US economy from the shock of the pandemic.

"I am focused on something the market is not focusing on at the present time and that is: Who pays for the party when the party is over?" Cooperman said. The deficit is growing at a rate "well in excess of the growth rate of the economy," he added. "To me, that means more of our nation's income will have to be devoted to debt service, which will retard economic growth in the long term."

The above is a good encapsulation of M*'s latest analyst review (not paywalled):I considered investing in PIMIX a while ago. In the multi-sector bond category, PIMIX had generated top-decile trailing returns with below average volatility. The fund's non-agency mortgage sector investments accounted for much of the strong performance after the financial crisis. However, the non-agency mortgage sector is much smaller today. Yet, Pimco refuses to close PIMIX which currently has ~ $120 Bil AUM. Matter of fact, I don't believe that PIMCO has ever closed a fund because it grew too large. This compaoblony policy is not in an investor's best interest.

PIMCO's funds have their issues, but so far they seem to have handled them better than I would have expected. I might put the fund on a watch list for more problems. But as I wrote above, if I had reasons before for liking the fund, I would examine those reasons before jumping ship.managers who use derivatives to express their market outlooks may be able to successfully manage more girth than managers who focus more on bond-picking to make a difference. PIMCO Total Return and its various clones, for example, were able to deliver peer-beating returns for many years even though the fund grew too large for bond-picking to make a significant difference in its returns. At its peak, PIMCO Total Return had nearly $300 billion in assets, and Gross managed various pools of money in that same style for other entities, too.

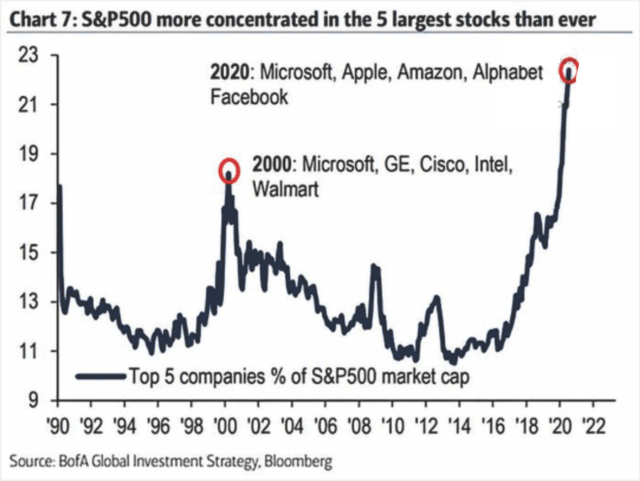

"It seems like we have dodged a bullet, yet a look under the surface reveals a much sicker market....the S&P 500 is still down 1.88%, but TPA's BIGTECH Index (the top 8 stock in the NASDAQ 100 by market cap) is up an astonishing 48.99% year to date (YTD)....these 8 stocks represent $8 trillion in market cap, which is 29% of the market cap of the S&P 500 ($27.3 trillion). TPA ran the numbers to see just what effect these 8 stocks have had on an index of 500 stocks. The BIGTECH effect has been to add 8.71% of performance to the S&P 500 YTD.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla