It looks like you're new here. If you want to get involved, click one of these buttons!

I did similarly with shares of Mutual Shares when Max Heine died. Heine founded the firm and mentored Michael Price. Max Heine was an outstanding investor. Sold my Mutual Qualified shares when Price sold the firm to Templeton.That is why I migrated to index funds over time to minimize capital gains. Still have dividends to pay, but that is okay.

New manager(s) likes to change more than few stock holdings and capital gains are passed on. We left Mutual Discovery when Michael Price sold the company to Franklin Templeton.

Me too. I am a long time holder of Vanguard Dividend Growth and Vanguard Health Care in my taxable account. So far, VDIGX is not the same fund as when Don Kilbride managed it and VGHAX is certainly not the same fund as when Ed Owens managed it. And, both throw off considerable distributions which I would rather not have in my taxable account. I would love to trade VDIGX for VDADX and VGHAX for VTSAX, but I do not want to pay the capital gains.I learned the hard way with Mutual Discovery that if you hold a great fund for a long time in a taxable account, when the manger changes you can get hit pretty bad, either with lousy performance or taxes. For that reason I am reluctant to build huge positions in these types of funds in taxable accounts.

I wonder how many companies are opting to slowly boil that frog, by quietly and incrementally raising prices, without actually saying anything. To draw no attention to themselves.Schwab's Liz Ann Sonders' recent article asks the question:

"Complation"…Is there too much complacency regarding inflation?

"The rub is that much of the economic data outside of direct inflation readings suggest higher inflation ahead. Both key purchasing managers indexes (PMIs)—the Institute for Supply Management (ISM) and S&P Global—show that output prices have jumped to levels akin to the early part of the pandemic. The National Federation of Independent Business (NFIB) survey is also showing that a higher-than-average number of small businesses are raising prices, or plan to. Many high-profile larger companies have announced price increases as well—including Walmart, Macy's, Proctor & Gamble, Ford, Subaru, Volvo, Volkswagen, Mitsubishi, Mattel, Adidas, Ralph Lauren, Stanley Black & Decker, Best Buy, Microsoft, and Nintendo."

"What's also notable is the still-wide gap between the discretionary ("wants") and non-discretionary ("needs") components of the CPI. As shown below, although there has been some convergence between the two, needs' prices are running at about twice the level of wants' prices; disproportionately hurting lower-income consumers."

https://www.schwab.com/learn/story/whats-going-onwith-inflation

Top Executiveshttps://www.investing.com/funds/t.-rowe-price-capital-appreciation-company-profile

Name Title Since Until

David R. Giroux Vice President 2006 Now

Jeffrey W. Arricale Deputy Director 2006 2007

Stephen W. Boesel Managing Director and portfolio manager 2001 2006

Richard P. Howard Senior Vice President 1989 2001

Richard H. Fontaine Vice President, Portfolio Manager 1986 1989

https://www.nytimes.com/1996/05/19/business/mutual-funds-a-bear-on-stocks-who-s-outrunning-the-bulls.htmlA superstar at the helm of T. Rowe Price Capital Appreciation fund in the late 1980's, Mr. Fontaine anticipated the 1987 market crash and bought aggressively afterward, delivering average annual returns of nearly 40 percent.

This isn't included in the manager information because it hasn't happened yet.In the Summary Prospectus and Section 1 of the Prospectus, the portfolio manager table under “Management” is supplemented as follows:

Effective June 30, 2025, Vivek Rajeswaran, Mike Signore, and Brian Solomon will become co-portfolio managers of the fund. David R. Giroux will remain as the fund’s portfolio manager and sole chair of the fund’s Investment Advisory Committee. Mr. Rajeswaran joined T. Rowe Price in 2012, Mr. Signore originally joined T. Rowe Price in 2015 and returned in 2020, and Mr. Solomon joined T. Rowe Price in 2015.

Oooh, that's the kind of screening I like. :)I've been looking through LC Bl funds that have done well over the past three years without having gorged on the Mag 7, while also having turned in good performances YTD. Ideally I'd also like them to have more than a smattering of foreign stocks (indicating more flexibility).

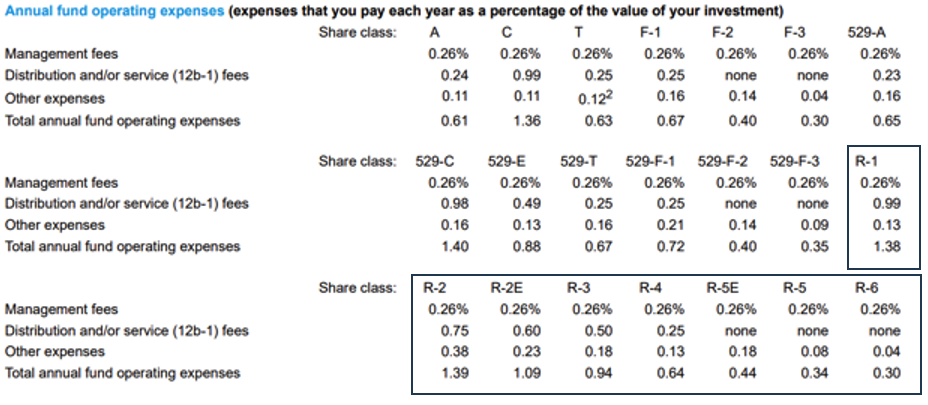

If I use 20% Mag 7 as a threshold (as of a couple of weeks ago), AFIFX comes in well under the wire at 17.5%. And it typically holds over 15% foreign (per M* analysis); currently 16.5%. In contrast, AICFX misses the cut at 22.5% Mag 7 (about 30% more), and it holds just half as much in foreign stocks (8.6%).

I've encountered MANY AI-generated papers. Heck, students will use AI to generate/type their emails to faculty, too. It's ugly with a capital-U. :(AI analysis always reminds me of the sort of stuff humans of my age generated in college papers that were required to fill ten pages when the human didn't really have much to say after two pages.

I have no idea what college students have to churn out these days, but I'm sure most old timers would agree that it isn't as good as it was in their day.

No particular reason to begin with. Funds accrete over time, and some slough off after a while. There are only 100 spaces, and I like to keep five open.@WABAC why AMFFX and not their corresponding ETF, CGCV?

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla