It looks like you're new here. If you want to get involved, click one of these buttons!

FD, what is the source for the chart you posted? Many thanks.Numbers as of 9/30/2020.

Observations for one month as of 9/30/2020:

Multi- Flat for the month but securitized shined with 1-2.9%/

HY Munis – Flat for the month but Nuveen (NHMAX,NVHAX) did better.

Inter term – (-0.1%) for the month. TGLMX (mostly securitized) did 0.4%.

Bank loans – up 0.3-4% for the month.

Uncontrain/Nontrad -0.2 for the month. Securitized(JASVX,DFLEX)

HY+EM – HY -0.9 and EM=-1.7% for the month with correlation to stocks.

Corp – down month. PIGIX -0.4%.

SP500(VFIAX)-Down monthth at -3.8, YTD=5.55%.

PCI-CEF huge upside at 7.1%. YTD still at -13.7%

My own portfolio

I started the month with IOFIX+DFLEX and replaced DFLEX with JASVX+NHMAX. It’s pretty obvious that funds loaded with securitized bonds are doing well. HY Munis don’t have a momentum yet but I bought NHMAX because it’s in my taxable and it showed a better momentum than others but the last 2 days are down, I was too early but now I’m watching closely. It was another good month for me.

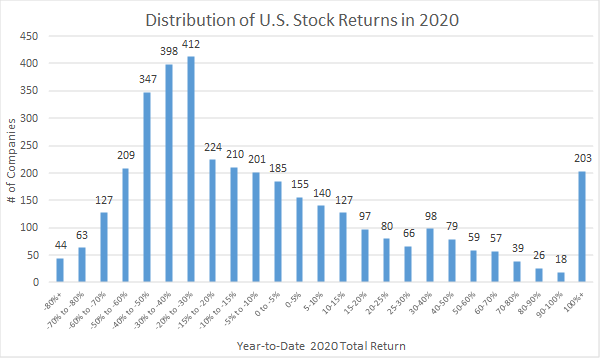

I decided to examine year-to-date returns of every component in the S&P Total Market Index (ITOT), including large caps, mid caps, small caps, and even smaller listed companies that do not qualify for the small-cap index.

https://seekingalpha.com/article/4377000-distribution-of-u-s-stock-returns-in-2020?utm_medium=email&utm_source=seeking_alpha&mail_subject=ploutos-distribution-of-u-s-stock-returns-in-2020&utm_campaign=rta-author-article&utm_content=link-0Of the nearly 3,664 listed stocks with full year 2020 returns, the median return (e.g. the 1832nd ranked return) is -14.75%. There is a large gap between the median return for U.S. stocks in 2020, and the weighted average mean performance for large cap stocks that are up between 4-5% on the year.

I'm a trader and don't recommend what I do to others. My posts are generic unless someone asks me specifically about my portfolio.@FD1000; I'm guessing you bought in around 3/25/20 ?

Derf

Nope, I sold over 90% at the end of 02/2020 and the rest days later.

Made several good trades with QQQ+PCI in 03/2020.

Start investing back in bond funds to over 99+% in 04/2020.

I had a huge % in GWMEX for several months. I owned IOFIX only in the last several weeks.

I wish I was brave enough to buy IOFIX on 3/25/2020. It made over 50% since then.

How do you square owning IOFIX with your later comment in this string to avoid risky funds?

You're right SFnative. Just googled and found the article below from April 2020. Two PMs actually not mentioned in the recent articles also left earlier in the year: Lydia So who was lead pm on the Asia Small Fund and had been with the firm for 15 years based on her linkedin, and Rahul Gupta who was co manager of Pacific Tiger fund (this is the one you referenced) both left the firm in April 2020. Tiffany Hsiao actually took over Asia Small when Lydia departed before leaving herself a few months later.Not trying to pile on Matthews, because I don't currently own any of their funds, but another PM recently departed after co-managing the Pacific Tiger fund for several years. He was replaced by two people, one of whom had earlier been at Matthews but then spent a short while at Seafarer (leaving there under what looked like less than the best of circumstances). Matthews appears to be a fund company in flux right now.

How do you square owning IOFIX with your later comment in this string to avoid risky funds?@FD1000; I'm guessing you bought in around 3/25/20 ?

Derf

Nope, I sold over 90% at the end of 02/2020 and the rest days later.

Made several good trades with QQQ+PCI in 03/2020.

Start investing back in bond funds to over 99+% in 04/2020.

I had a huge % in GWMEX for several months. I owned IOFIX only in the last several weeks.

I wish I was brave enough to buy IOFIX on 3/25/2020. It made over 50% since then.

Nope, I sold over 90% at the end of 02/2020 and the rest days later.@FD1000; I'm guessing you bought in around 3/25/20 ?

Derf

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla