It looks like you're new here. If you want to get involved, click one of these buttons!

Their Retirement Plan:

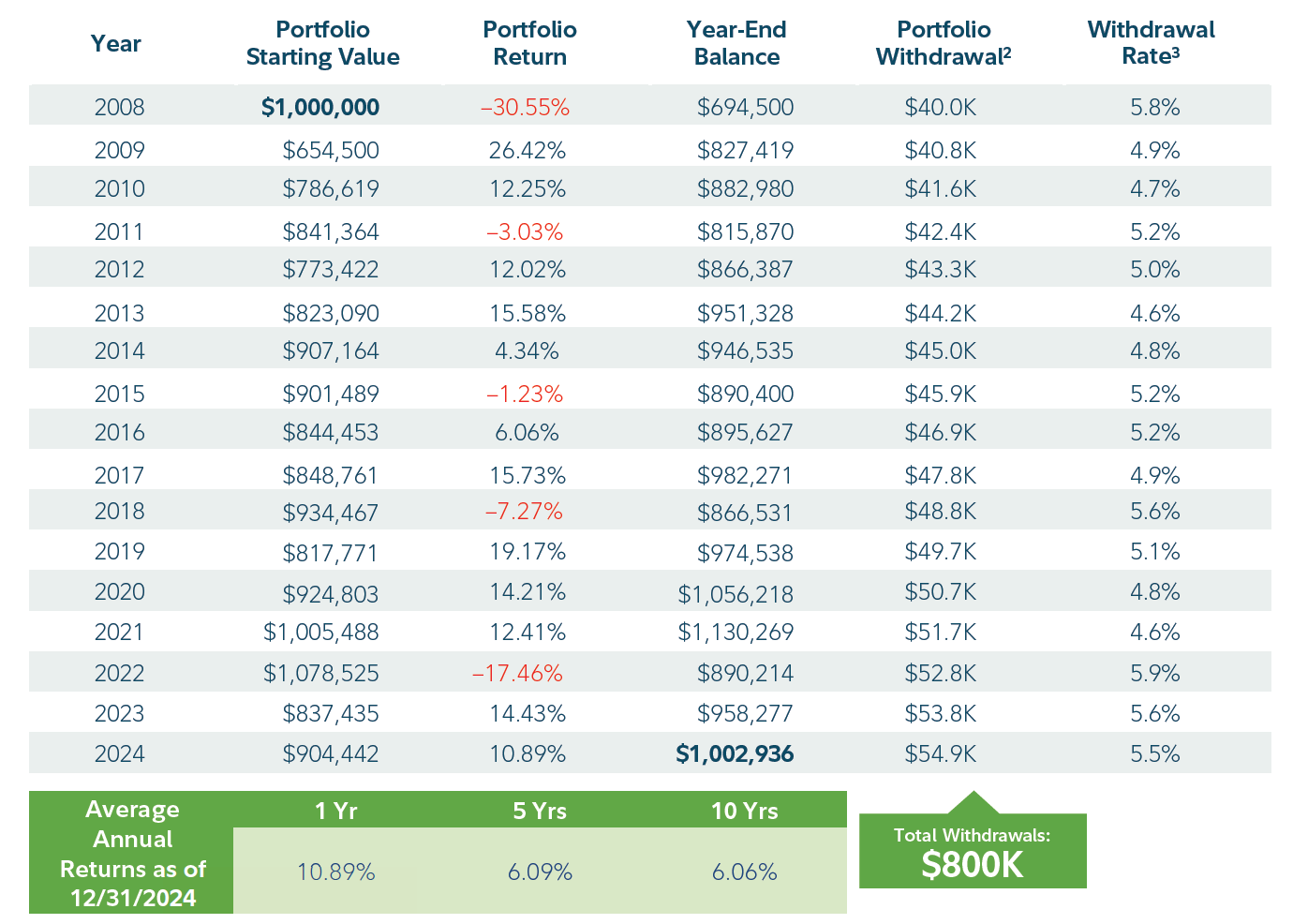

After talking it over with their advisor, Jordan and Shawna decided to invest $1 million in a diversified, professionally managed account. "When devising a plan for a client, we start by evaluating their needs," says McAdam. "We want to know what their goal is and what it is they’re saving for, so we can better understand their tolerance for risk. When we can determine how much money they might need to achieve that goal, that helps us design a portfolio that’s equipped to help them reach it." Based on Jordan and Shawna’s expected needs, the couple determined that they would need to withdraw $40,000 in the first year of retirement to fund their lifestyle and planned to increase their withdrawal amount by 2% each year, to account for inflation.

Market Turns Bear-ish the First Year of Their Retirement Plan:

Jordan and Shawna’s million-dollar investment runs headfirst into the 2008 financial crisis. In the very first year of their retirement, Jordan and Shawna watched their portfolio—their hard-earned savings—lose more than 30% of its value. And after withdrawing the $40,000 to pay their day-to-day expenses, they were left with about $650,000 and a feeling of unease about what the future might hold for them and their portfolio.

Same. I was in it probably 10 years ago and sold out ... should have just set it and forgot about it. Wish they'd make an ETF version of it, though.If you had bought GLOFX a while ago you would be laughing now to see it running ahead of the 500 these past 12 months.

I have a modest slice in the taxable I bought in 2022. Dumping it from the IRA in the quest for "simplification" was one of the dumber things I have done with my retirement investments recently.

That's when you are already took Social Security early. And that isn't tax, but a reduction in SSA payments being received."If you will reach full retirement age in 2026, the limit on your earnings for the months before full retirement age is $65,160, we deduct $1 in benefits for every $3 you earn above this limit."

If I am reading this correctly, They will only tax SS at the 1/3 rate on earned income above $65,160?

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla