For those of you at home keeping score by Andrew Bary, Barron's article:

The biggest keep getting bigger and more dominant.

The five technology giants that dominate the S&P 500 index -- Apple ( AAPL ) , Microsoft ( MSFT ) , Alphabet (GOOG), Amazon.com ( AMZN) , and Facebook ( FB ) -- accounted for a combined 22.9% of the index Friday, an apparent record. The data are from S&P Dow Jones Indices.

Three of the tech leaders -- Microsoft ( MSFT ), Alphabet, and Facebook ( FB ) -- hit new highs Friday as the S&P 500 reached a record.

Rarely has the S&P 500 been so concentrated at the top. The Big Five were a combined 21.7% at the end of 2020.

At year-end 2019, the five largest stocks in the index totaled 17.2% of the index. At that time, Berkshire Hathaway (BRK.B) was No. 5., not Facebook ( FB ), which now ranks fifth. At year-end 2018, the top five were 15.4% of the S&P 500 index (Berkshire again was fifth).

It is notable that at the end of 1999, right before the peak in tech stocks, the top five companies were 16.8% of the S&P 500. Those five stocks in order of size were Microsoft ( MSFT ), General Electric (GE), Cisco Systems (CSCO), Walmart (WMT), and Exxon Mobil (XOM). GE, Cisco, and Exxon are now nowhere near the top.

So far this year, Microsoft ( MSFT ) (up 30.2% through Friday), Alphabet (up 57.3% based on the nonvoting shares, GOOG) and Facebook ( FB ) (up 35.4%) are powering the leaders. Apple ( AAPL ) and Amazon ( AMZN ) were up about 12% year-to-date through Friday, behind the S&P 500's 17.5% gain.

Time to Repaper the Debt Ceiling Again

An international match for PRWAX You might also look at MIOPX's sibling fund, MFAPX, also managed by Kristian Heugh. A very similar fund though with some differences. I'm inclined to agree with

@stillers that Morgan Stanley looks like it has some of the most complementary funds for PRWAX. That's under the assumption that you're looking for an all cap international growth fund to pair with an all cap domestic growth fund. (Lipper classifies both the MS funds as all cap.)

MFAPX has a somewhat less emphatic growth orientation (74% in growth stocks vs. 88% for MIOPX). Perhaps commensurate with that, it is less volatile (3 year std deviation of 14.84 vs. 19.65) and has a smaller max drawdown (17.26% vs. 23.43% June-Sept 2011).

OTOH, that lower volatility also translates into less upside capture (99% vs 119% average over the past three years).

Over the 10+ year lifetime of MFAPX (the shorter-lived fund), the two have reached nearly the same point with cumulative returns of 296.82% for MFAPX and 308.70% for MIOPX. MFAPX held a slight, fairly consistent edge until

2020. MIOPX has done significantly better recently (and significantly worse in March

2020), again consistent with its somewhat more growthy nature.

Lots of overlap. What works better in the pairing depends on what you're looking for.

Note that both these funds sport very compact portfolios, holding 31 and 37 stocks. In contrast, PRWAX holds 82.

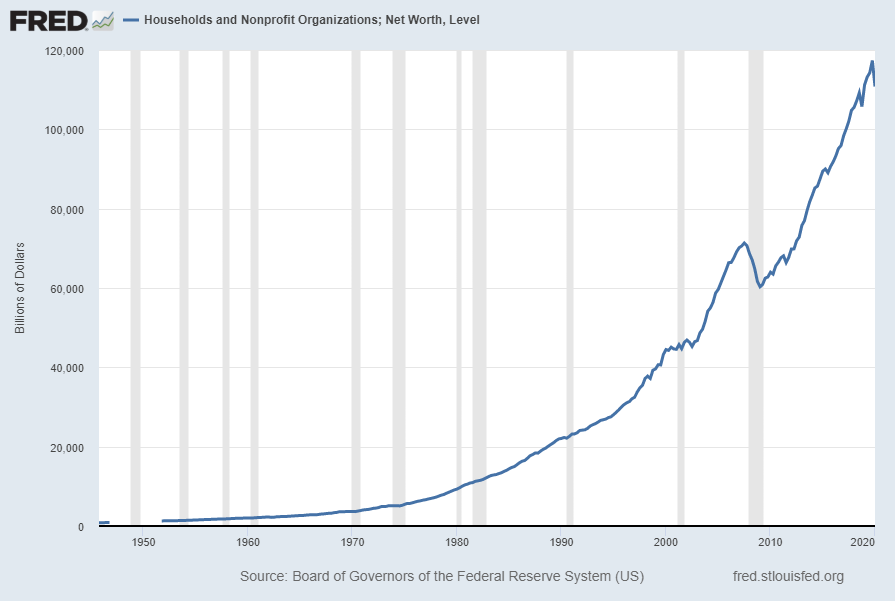

Is it smart to for retirees to get out of the stock market entirely? I don't understand why this is considered a "silly question, silly answer". It's a question that I've asked myself many, many times over the last couple of years as I've watched the equity market continually rack up gains.

OJ,

You have seriously asked if you should bail 100%? Okay.

Are you in their circumstance?

In any case, their not-question was even worse.

retired ... pension .., house paid off ... income greatly exceeds ... expenses.

... gotten to a point [where] we want to be done with stock market investing altogether. ... don't want bonds ... annuities ... just want to be done. Are we being foolish?There is only one answer then, and we should take them at their word and assume they are serious, and have the mattress ready. (The first answer before this is to the only posed question, which is yes, but they have already said they are clear about that, meaning they do wish to be foolish.)

The answer is to do something asap with all these unwanted moneys, meaning give them away. Charity, kids, gov entity local or elsewhere,

Imagine being in this predicament and writing into a site or authority or newspaper.

A nonserious question and a nonserious answer.

Is it smart to for retirees to get out of the stock market entirely? I don't understand why this is considered a "silly question, silly answer". It's a question that I've asked myself many, many times over the last couple of years as I've watched the equity market continually rack up gains.

Wall Street Is Throwing Cheap Credit at Ultra-Wealthy Clients A few of the perks that come with being ultrawealthy.

“Families with wealth of $100 million or more can borrow at less than 1%,” said Dan Gimbel, principal at NEPC Private Wealth....Yachts and private jets have been especially popular buys in the past year

Loans also allow the ultra-wealthy to avoid the hit of capital gains taxes....“Asset-backed loans are one of the principal tools that the ultra-wealthy are using to game their tax obligations down to zero,”

Some private banks offer mortgages on homes for as long as 20 years with fixed interest rates as low as 1% for the period.

Cheap Credit

Aerospace: Raytheon, UTC and Mach 20 Weapons FSDAX has tracked VIS (VINAX) pretty closely historically, but over the last 18 months FSDAX trails VINAX by 30%.

How much of this is virus related?

Prior to the virus (looking back 5 years) FSDAX was out performing VINAX by 47% and from that perspective has retraced those

gains to a March

2020 lows. Since March

2020 the two have moved in lock step again.

Aerospace: Raytheon, UTC and Mach 20 Weapons I was for a few years, but cut it lose in 2019 or 2020 as part of a portfolio redo. I liked the holdings but was surprised BA was still (at the time) the #1 or 2 holding - not sure where it is now, but that company is hurting and IMO shouldn't be that high up on the fund.

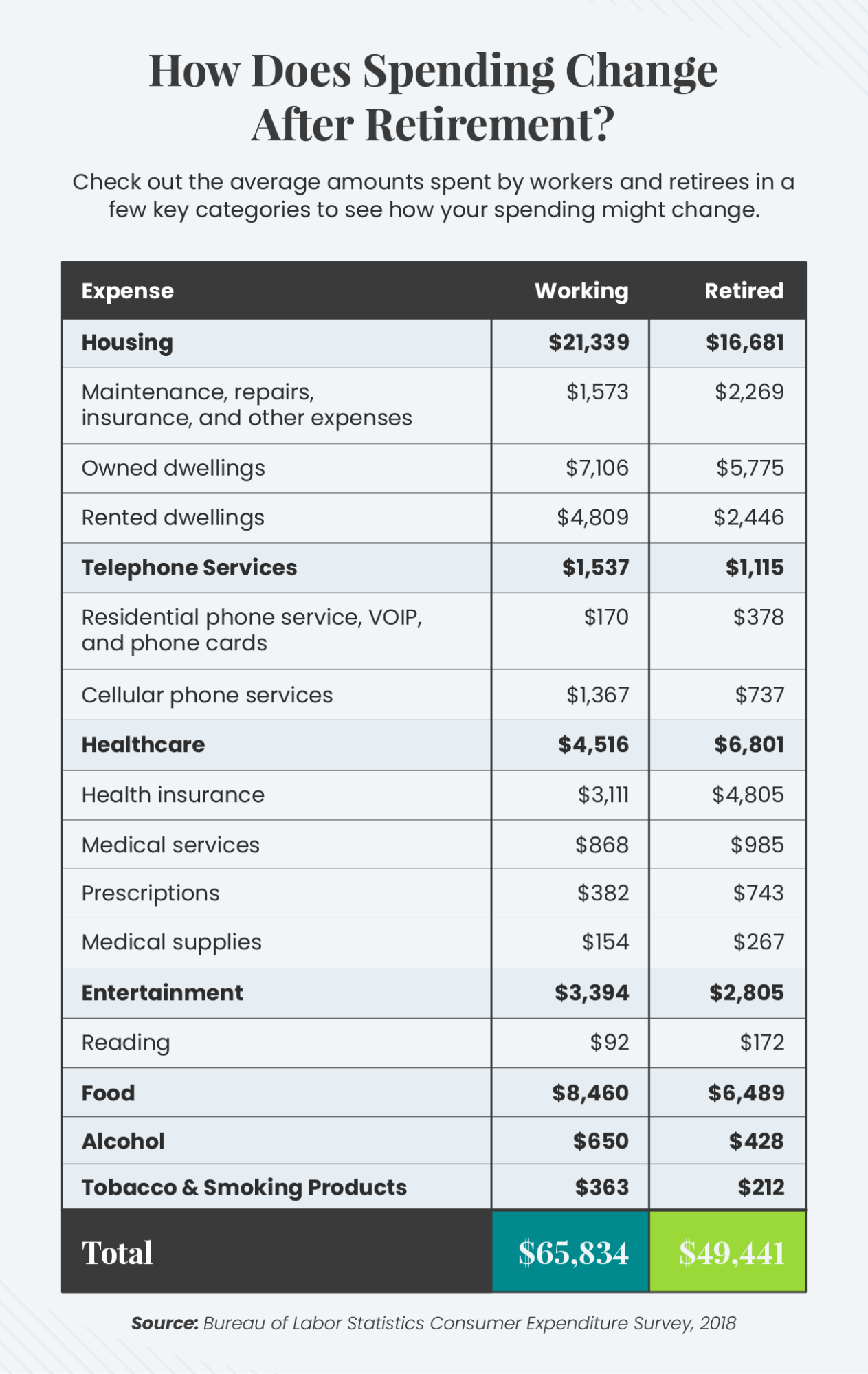

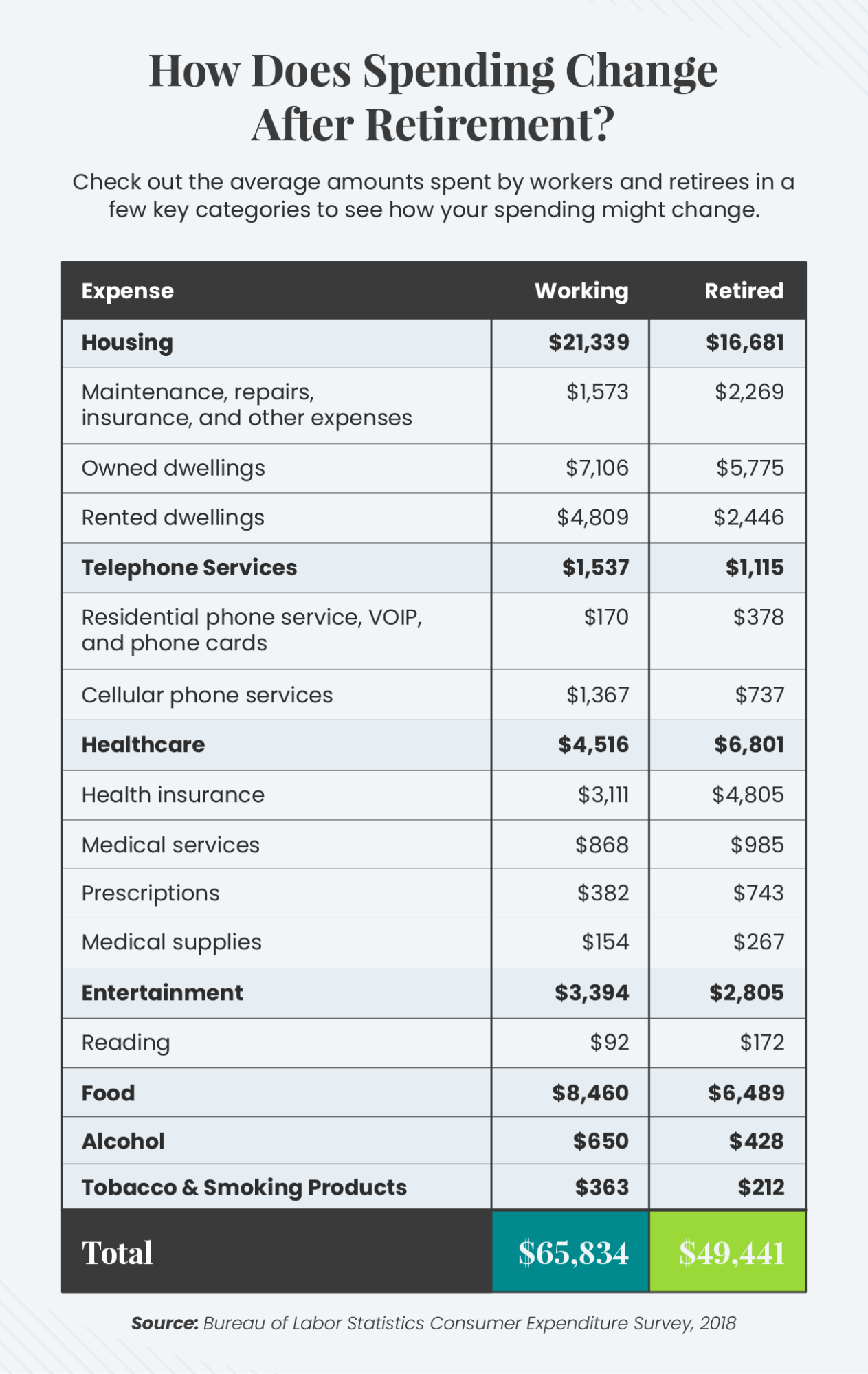

50 Essential Retirement Statistics for 2020 Three-quarters of Americans agree the country is facing a retirement crisis, making research around the topic more relevant than ever. We dug into the data on every angle of retirement and compiled the most important statistics below. Read on to learn about what today’s retirees face, from financial challenges to lifestyle decisions and more.

https://annuity.org/retirement/retirement-statistics/Does the chart below appear to be for a couple or an individual? If single, $100K / yr (for a couple) in retirement spending seems like a high hurdle to achieve. But wait... housing costs wouldn't double, would they for a couple? Are these studies forgetting that, in reality, many retirees have a wife, life partner, or family member that share many of these expenses. Also, some of these numbers are additive (take a look at telephones services...the subgroup costs add up to the bold number. The housing numbers don't add up...what gives?

Vanguard Global Wellington I like RPGAX too. I believe the Blackstone investment serves as a hedge against black swan events as in March 2020. Other than cash all asset classes fell in that time period. A few rebounded quickly and the others followed after the Fed intervened. So I question the value of the 10% Blackstone investment versus having the equivalent amount in cash. Also how much Blackstone contributes to the total return over say a 10 year period.

This fund is more growth oriented than Vanguard. If rotation from growth to value style holds, VGWAX will stay competitive. For now I have too many overlapp with the top 10 holdings of TRP. Thus I will stay with VGWAX.

Does TRP say *what* that 10% hedge fund black box is? Hedge? Risk premia? Long/Short? etc....

Vanguard Global Wellington I like RPGAX too. I believe the Blackstone investment serves as a hedge against black swan events as in March 2020. Other than cash all asset classes fell in that time period. A few rebounded quickly and the others followed after the Fed intervened. So I question the value of the 10% Blackstone investment versus having the equivalent amount in cash. Also how much Blackstone contributes to the total return over say a 10 year period.

This fund is more growth oriented than Vanguard. If rotation from growth to value style holds, VGWAX will stay competitive. For now I have too many overlapp with the top 10 holdings of TRP. Thus I will stay with VGWAX.

Time to sell or buy ? Think I am heading to my bunker which is well stocked with beers, wine and tiolet paper. More seriously, several good fund managers i used did very well through this year's ups and downs (and last year). Very impressed with PRWCX and VWINX. Being patient helped to let everything recovered in fall after 2020's drawdown. FRIFX came back strongly this year. For bonds we like bank loans.

Time to sell or buy ? There is nothing wrong to rebalance a bit after a run up like we had this year. Stocks are fully priced and bonds are not doing so great either. Having some cash is always good if we have a pullback in the second half of this year.

For now I am holding still. Reviewed our portfolio carefully and believe we are better in positioning than that of last February. Earning reporting is here and let see how it fares.

Remember, the Delta variants is rising rapidly across US, especially in regions with low vaccination rates. This triggers fear of the possibility of returning to Feb 2020 and we all know how that impact the economy. I think we are not out of the wood with COVID. The Olympic event is a good example what we are facing going forward.

Time to sell or buy ? I dialed down a few funds over the last 4 or 5 weeks & now looking to dial some value funds I bought at Vanguard , down. These were purchased in Nov. 2020. Thankfully they were in tax advantage account.

Are you in the sell, buy, or holding pattern ???

Stay Kool, Derf

Vanguard Global Wellington @bee, thank you. Should included the ticker symbols in my discussion.

Thanks for remindering VMVFX. I left the fund when the original manager left and the portfolio underwent considerable changes that did not make sense. Moved the asset to a growth oriented international small cap several years ago. More volatile for sure, but the fund has a shorter recovery period and about the same % drawdown as VMVFX in

2020. GISOX has a hard close when the fund is held outside of Grandeur Peaks.

PRIDX is closed to new investors. There are not many good international small cap funds.

Osterweis Strategic Income - OSTIX @Derf,

The data Charles posted is only 6 months long from 2021, Jan to 2021, June. MFO risk ranking reflected the fund has not done well in 2021 as the rotation of growth stocks to the value funds (large and small stock funds) started in late

2020. A small pullback in May 2021 is reflected in the -6.2% MAXDD. Many small cap growth funds are volatile. You can review the longer track record of OSTGX in MFO Premium.

OSTGX has been profiled by David Snowball on September

2020 in the link below.

https://mutualfundobserver.com/2020/09/osterweis-emerging-opportunity-ostgx/#more-14549 Jim Callinan the fund manager has an excellent and long track record in small cap growth stocks. When the environment favors this asset class, the fund excels comparing to his peers.

OSTIX was a recommended bond fund for his clients by BobC who retired from his advisory business. I invested with this fund as well for the same reason as

@fred495 stated - consistency for year-to-year.

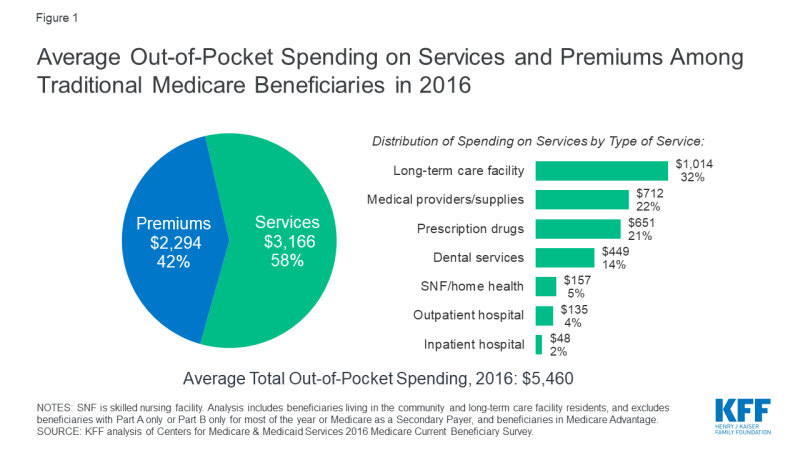

Let the SS COLA Projections for 2022 Begin What's shocking about the table is that they would not only cherry pick data, but double and triple count it. And not even label entries the same as in the study. And did you notice that this list of top ten costs has eleven items (see #8)? Makes one wonder about the basic arithmetic in the study.

#6, "Total medical out-of-pocket costs". In the study, that's called "Total medical expenses, not including premiums." Either way, one would naturally expect that to represent, well, everything that a "typical" senior paid for health care (doctors, hospitals, pharmaceuticals, durable (and not so durable) medical equipment, etc.). Everything outside of insurance premiums; at least that's what "out-of-pocket" usually means.

So many things are wrong with this line:

- If this counts all medical expenses other than premiums, then including line 1, "prescription drug ... out-of-pocket" is a double count.

- In reality, this line supposedly represents how much the government pays for Medicare expenses. So it's what seniors don't pay. According to the study, these figures come from the 2020 Medicare Trustee report, Table V.D1, p. 118 (pdf p.124). Further, while the 2020 figure matches the Trustee report, the 2000 figure doesn't quite.

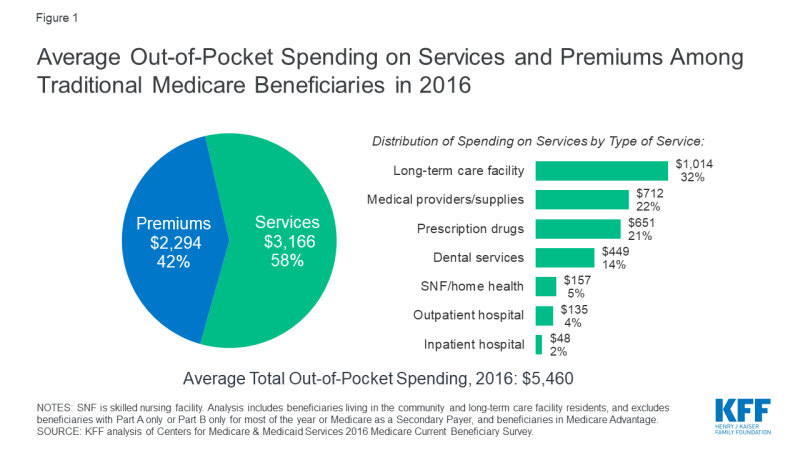

- If one really compares Medicare out-of-pocket costs with Medicare premiums, they're much closer to 1-to-1 (2-1 if one excludes Medigap) than the 10-to-1 suggested by lines 2 and 6 in the top ten table). Here's a KFF graph from 2016 with a pie chart comparing the two. I doubt the ratios have shifted radically since then, especially given the way premiums are set.

https://www.kff.org/medicare/issue-brief/how-much-do-medicare-beneficiaries-spend-out-of-pocket-on-health-care/

I'll take KFF any day over an advocacy group that doesn't explain how it comes up with its numbers and misrepresents what they mean.

In their supposed

methodology document, the Senior Citizens League does not provide the criteria for selecting the 39 "typical" categories.

In saying that it "uses somewhat similar weightings" to CPI-E, it fails to explain why it deviates from the CPI-E weightings, let alone how it calculates the deviations. While it gives you broad categories weightings (e.g. it weights medical 14.1% vs. CPI-E's 12.2%), it doesn't give you a breakdown of weights for the various medical components like the aforementioned lines #2 (Part B premiums) and #1 (prescription drugs), or its several other "typical" medical categories.

But the worst part, the very worst, is that it prices 10 pound of potatoes (line item #7) at Sam's Club in Charlottesville Virginia. Now I ask you, how many seniors belong to Sam's Club and buy 10 pound sacks of potatoes at at time? :-)

Let the SS COLA Projections for 2022 Begin One thought on

@bee 's comment. I finally realized I will not live forever as I looked at turning 70. After considering reasonable life cycle needs and set-aside goals for relatives and non-profits, I decided it was time to loosen up a bit on my equity side limit (mostly through more dividend producing equity investments) and to also loosen up a little bit on my withdrawal rate. Will digest changes made for a while. Don't know if I will increase equity percent further later but am comfortable with the increase implemented in 2019-

2020. (I have enough flexibility to substantially decrease withdrawal rate if market conditions dictate this is advisable.)

Cash Flow Strategy I've had limited vicarious experience (POA, executor) with investment real estate property including depreciating and inheriting it, and with using a margin account to borrow a

gainst securities (drawing out cash). So I've gone through the processes, but that's about all.

The buy/borrow/die strategy seems to be to tap (borrow) money gradually as needed (without incurring taxes). Not so much to leverage for more investing whether in stocks or real estate. When the strategy is followed in moderation over time margin calls should not be a concern. That's because as the assets appreciate, the loan to value ratio drops, enabling one to safely borrow more.

The

Navy Fed conventional mortgage rate you mentioned is almost surely for an owner-occupied home. That's different from investment property. You can't depreciate your home and you can't take a loss on it if you sell it for less than cost.

But what one can do with owner occupied property and not with investment property is flip it to avoid cap

gains taxes. One does not need to buy/borrow/die. One can exclude up to $250K (individual)/$500K (joint) of gain from income. Rinse and repeat. This is not a cash flow strategy. However the point of the buy/borrow/die strategy is not so much to generate cash flow as it is to avoid taxes on the needed cash.

I've rarely looked at IB, because it is targeted at active traders, and because historically it was not hospitable to mutual fund investors. From what I see now, some of that has changed. In general I'm not a good source of info on IB. Perhaps the more active traders here can provide better insight.

One thing I did find is that IB just (July 1) dropped its inactivity fees on IB Pro.

https://finance.yahoo.com/news/interactive-brokers-makes-waves-inactivity-132135973.htmlMy limited experience with borrowing cash on margin was suggesting this to a friend to use as a bridge loan between closing on the purchase of one property and on the sale of another. The payments made on the loan were pure interest. Since the entire amount was repaid once the sale closed, I can't say for certain that a partial repayment would have been okay, though I don't see why not.

Cash Flow Strategy From the first piece:

You’ll want to put this money into the stock market, real estate, or another asset class that appreciates. ...

Real estate is almost perfect for this because:

- its value tends to go up,

- it is not volatile

- you can depreciate it, which reduces your income tax

- it’s easily accepted as collateral.

Given that the idea is for you to never sell and that it would be extremely painful for you to sell (with cap

gains and net investment income taxes due on both the appreciation and the depreciation), volatility of a buy/hold/die asset seems irrelevant.

Depreciation is permitted only for income producing property, so you couldn't just buy land and depreciate it. You'd have to either manage rental property yourself or pay someone else to do this. Either way, another added cost.

IRS Pub 522, Chapter 2,

Depreciation of Rental Propertyhttps://www.irs.gov/publications/p527#en_US_2020_publink1000219022Collateral? It's at least as easy to to get a margin loan on securities as a real estate loan. Liar loans are still available for investment properties so I guess you could cash out that way. But it would probably cost you more than a margin loan.

IB offers rates of 2.6% variable or lower depending on your type of account.

What about property taxes? If this added cost was mentioned in either piece, I missed it. (There was note in the comment section on Calif. property taxes in the first piece, but not in the context of a current cost.)

Though the resemblance is largely superficial, the cited pieces call to mind pitches for whole (or universal) life insurance - you can borrow a

gainst the investment tax free and its value passes tax free (aside from estate taxes) to heirs. From the closing paragraph of the second piece:

The result, therefore, is a life without taxes. The principal investment provides, through appreciation, additional wealth, which the Patriotic American Citizen then matches in debt.