At what point will the Fed cry “Uncle”?

My thoughts on the topic:

-The Fed would prefer to just jawbone the capital markets to do the heavy lifting of slowing demand. (i.e. talk tough, but carry a wet noodle).

-That might have worked if Jay "Helicopter Cash" Powell had begun tightening in mid-2021, instead of mid-2022. But Jay was all about being re-appointed to a 2nd term. By waiting a year ("transitory" talk), inflation expectations are now strongly embedded in the behavior of economic actors.

-The only way to "kill" inflation is to kill demand. The asset bubbles need to be "pricked" to do so. Obviously some of that has happened. The Fed has a lousy history of avoiding recessions. To be fair, its a tough, nearly impossible job to "thread the needle" -- dampening demand "just enough", without pushing the economy into recession. Frankly, I wish Ben Bernanke were still running the show.

If not for the scheduled Q/T, I would think the bond market would be through correcting. It still may be: if stocks continue to grind lower --- due to downward earnings revisions -- a good chunk of the capital may move into bonds -- thus offsetting the Fed's Q/T sales.

_if the Fed is serious about killing demand -- and doesn't waiver, then a recession is my "base case". OTOH, if the Fed chickens out and "pivots", then a recession may be avoided --- but the cost will be higher, longer inflation, and a loss of confidence in the USD.

[[An aside: there may be bigger issues than "just" the economy this time, geopolitical issues. How can the West "de-fang" Putin? - crashing oil prices. How might that happen? -- a global recession. And which currency benefits from a de-risk trade? The USD. The USD has been very strong (against fiats, but not commodities). But a higher USD (prompted by higher rates) would tend to exert further downward pressure on oil prices. This would put incrementally more "hurt" on Russian oil revenues.

-So, I think bonds will find their final bottom b4 stocks. (Though stocks can have a countertrend rally any time, and July is usually an up month.)

- I always remind myself to "be mindful of the calendar". Even if we get a relief rally, the damage YTD has been extensive. -- Traders will want to register tax losses b4 year-end. (For many institutions, the tax year ends 10/31). So price-action in the weeks before Halloween may provide an opportunity to put money to work as institutional sellers close out their loss-positions.

-Mid-term election results may also provide a boost to the market in November -- assuming the SCOTUS Roe-reversal doesn't jinx a Red Wave result.

-Housing prices have not fallen yet. But that is one big asset bubble which needs to be popped to dampen inflation. If mortgage rates continue to climb, I would expect some of the corporate buyers (e.g. Blackstone, etc) to unload some of their holdings, in favor of bonds. That might precipitate downward price action, as inventory (finally) expands.

Given how 2022 is unfolding, 2023 may be lining up to be a good year. (3rd years of the Presidential cycle usually are)

Just my 8 cents.

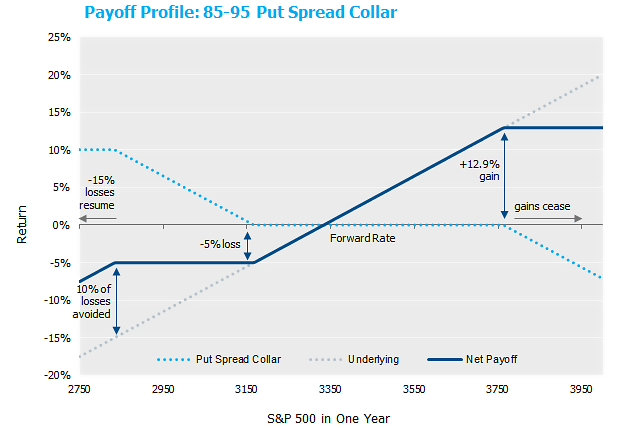

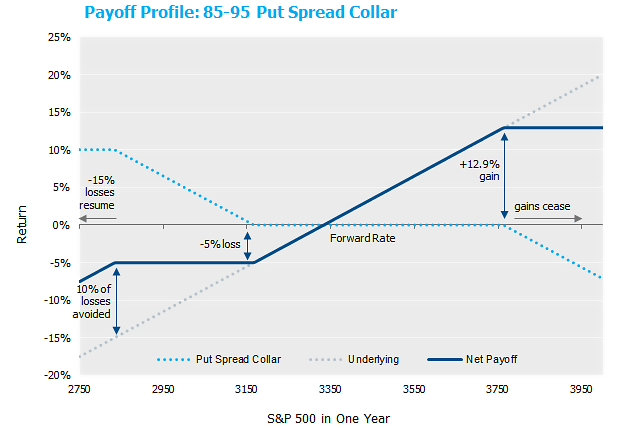

jp morgan hedged equity stategy funds I agree that seems like one part of the issue. Another perhaps related part may be the way the put spread collar works.

Because the three month collars have different start and end months in each of the funds, it's possible for one fund to be in the "protected" area, where market declines don't affect the payoff value, while another fund could have already blown through the protection.

See diagram below. In this example, where the collar kicks in after a 5% loss at which point it provides 10% loss "insurance". Suppose two months ago the market went up 5%, and in the past month it dropped 10%.

A collar that started two months ago would be protecting a fund with a net 5% market loss. That is, the collar would just be kicking in now. But a collar that started just one month ago would be half used up. It would be protecting a fund with a net 10% market loss. (5% of that loss would be covered by the higher strike price put option.)

After another 5% drop in the market, its protection would be used up. At that point, the value of the latter fund would follow the market down, while the former fund would still have some protection.

Oldest mutual funds: name changes Here are a couple of threads that may help:

Oldest Mutual Funds Still in Existence (2019 thread)

Second Oldest Stock Fund Is As Nimble As A Teenager (2014 thread)

As to the merger of Quarterly Income Shares into American Business Shares in 1944, you can find the NYTimes story reporting it

here. This was a case of the minnow ($5M company) swallowing the whale ($21M).

According to a

1942 NYTimes article, American Business Shares was sponsored by Lord, Abbett Co., Inc.

According to the SEC, American Business Shares changed its name on April 4, 1976 to Lord Abbett Income Fund, Inc., and from that to Lord Abbett US Government Securities Fund, Inc. on January 27, 1986.

Again

according to the SEC, that first change involved a "change from Delaware to Maryland corporation accompanied by change in name, fundamental investment objective and institution of policy requiring automatic redemption of small accounts"

In 1997, the SEC announced the fund's impending demise:

A notice has been issued giving interested persons until May 13 [1997] to request a hearing on an application filed by Lord Abbett U. S. Government Securities Fund, Inc. (formerly American Business Shares, Inc.) for an order under Section 8(f) of the Investment Company Act declaring that applicant has ceased to be an investment company.

https://www.sec.gov/news/digest/1997/dig042297.pdfAs to Affiliated Fund, Inc. that's easy. Do a search on the name, you'll come up with Lord Abbett Affiliated Fund. That fund's webpage gives its inception date as 5/14/34, noting that the fund changed its investment strategy on 1/1/50.

https://www.lordabbett.com/en/strategies/mutual-funds/affiliated-fund.class-a.html

Dead Cat Bounce Some interesting ideas from one of my advisors

20% declines not caused by electronic trading (1987) or Pandemic ( 2020)

1970 down 35% Recovered 20 months later

1973 down 48% rec 2114 days later !!!

1982 down 26% rec 68 days

2001 down 42% rec 1842

2008 down 56% rec 1435 days

1970 Recession driven with high inflation

1973 high inflation but "misguided fiscal policies" prolonged decline

1980s inflation surge ppt bear market Fed hiked rates

2001 Tech bubble little inflation

2008 housing bubble little inflation

So if 1970 and 1982 are most applicable comparisons, we might be close to bottom, based on the decline, but neither started at 2022 valuations

1/1/2022 23

PE 16 at 1/1/1969 at start of the decline in 70s ( 30% cheaper to start than now)

and 7 to 9 1/1/1981 to 1/1/1982

International: Thnking about switching Don't like to jump around, but losing my confidence in Int'l fund managers. Hold VWILX and MGGPX. Thinking of reducing positions and adding to VTSAX, a smoother ride. These guys did weather 2020 pretty well, but are getting beat up now. Stay the course? Thoughts needed!! Thanks!

I've owned VWILX for several years.

The fund has experienced significant losses YTD (-31.11%) and over the trailing 12 months (-34.31%).

I don't have any plans to sell VWILX in the short-term.

Guess I'm a glutton for punishment!

10-Year CDs @ 4% I've purchased Brokered CD's from BMO Harris,Discover Bank,Goldman Sachs,JPMorgan Chase and Capital One recently at Fidelity-all of which include FDIC insurance. If all these banks fail, then the world is in a financial armageddon where the most valuable assets are guns, bullets, prepper food and toilet paper !

M* screwing everything up again @Ben. I sympathize, following your messages down this thread. Others have asked if there are any good alternatives. I will TRY Personal

Capital. If they want a phone, I'll give them the spam number I saved once, a spoof Area Code from back East. In the past, I've tried Yahoo and Google finance pages, where you can create a watchlist or portfolio. I found them both to be very clunky. I just looked over at INVESTOPEDIA. They seem to have everything EXCEPT a PORTFOLIO MANAGER of the sort we're talking about here. There is a "SIMULATOR" game, where you compete a

gainst a billion faceless other people in the market, choosing stocks and funds. I suppose someone could choose to use the Simulator for REAL, instead?

I still plan to use the "New and Improved" version (LOL) because the premium version is provided for free to me via TRP, because I have X amount of money invested with TRP. But I'd love to find something simpler, less aggravating and just plain handy. This current nonsense has the look and feel of a cluster-fuck. AGAIN.