It looks like you're new here. If you want to get involved, click one of these buttons!

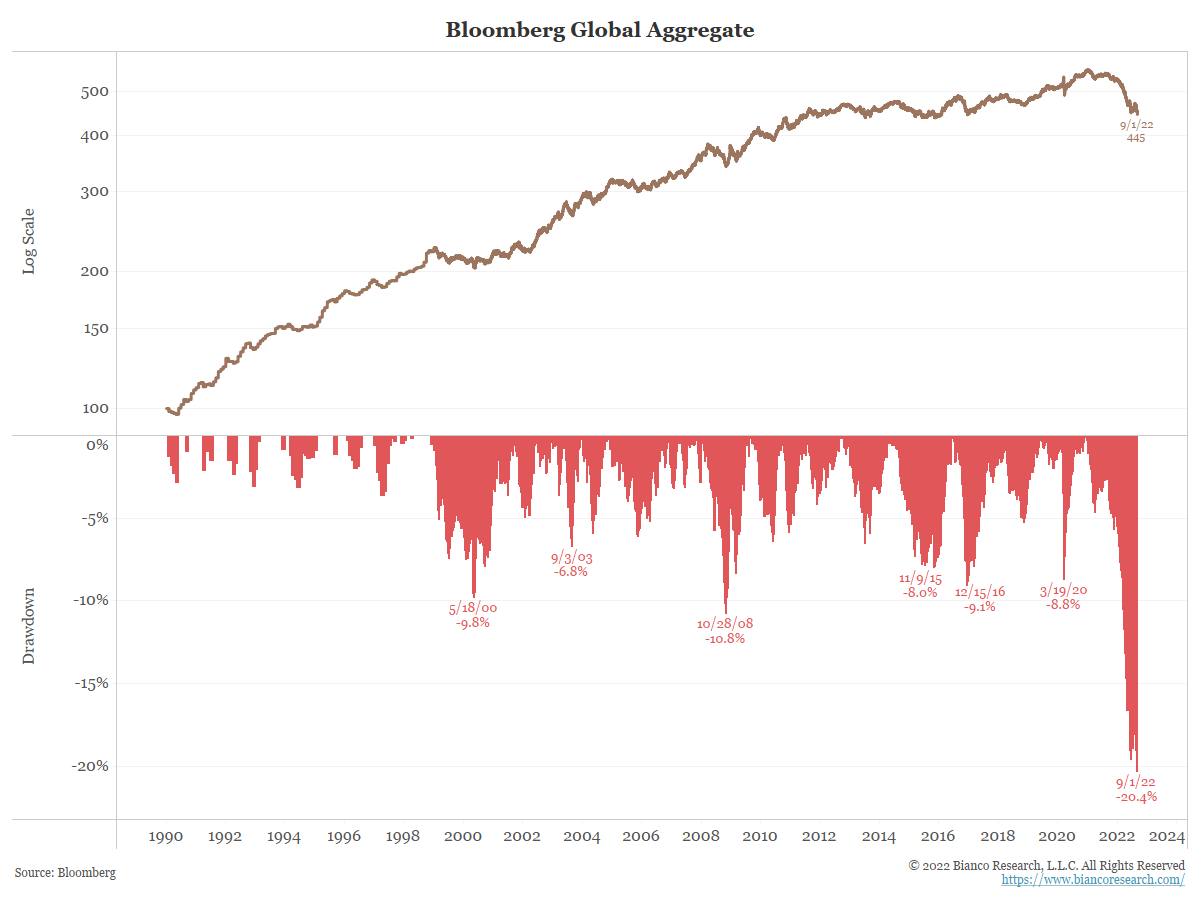

TUHYX junk bonds rose nicely in july and into august. getting chewed up and spit out, currently. in a big way. great yield. suck-ass share price. 9.41 percent SEC yield. and that's NOT the NCAA Southeastern Conference.@JohnN - I’m surprised how bonds have fallen so rapidly. My GNMA fund has been hit hard. However, I view it as a hedge of sorts. Obviously it hasn’t functioned in that manner lately. But the market is throwing lots of curve balls. Just try to duck once in a while. Should get better. :)

I don't understand how or why the Estimated Total Cost is $126,634.44. I'm sure that some of you who are eperienced in this sort of thing will be able to help on this.US Treasury TIP 0.125% 01/15/2023

Detailed Info

Maturity: January 15, 2023 (4 months and 14 days from today)

Quoted Price: $98.630

Yield to Maturity YTM: 4.028%

Coupon Rate 0.125%

Coupon Frequency Semi-annually

Order Summary

Buy $100,000 CUSIP 912828UH1 @ 98.630 Limit, Fill or Kill

Settlement Date: 09/06/2022

Market Price: $98,630.00

Estimated Markup: $0.00

Principal Amount: $98,630.00

Accrued Interest: $23.11

Estimated Total Cost: $126,634.44

retirement-survey-of-workers-four-generations-living-in-a-pandemica collaboration

between Transamerica Center for Retirement Studies and

Transamerica Institute, examines the retirement outlook of

Generation Z, Millennials, Generation X, and Baby Boomers. It

focuses on the experiences of employed workers of for-profit

companies and the impacts of the pandemic on their health,

employment, financial well-being, and their ability to save and

invest for retirement. The report is based on findings from the

21st Annual Transamerica Retirement Survey, one of the largest

and longest running surveys of its kind. The survey was

conducted in late 2020 when COVID-19 cases were surging, and

many businesses were shuttered or operating at limited capacity

because of the pandemic.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla