Curious...do you think the technicals would indicate something like $95B coming off the CBs balance sheets and the impact on stonks, rate hikes and the impact of policy errors contributing to inflation continuning on and on....why do many think the fed will pivot anytime soon with inflation still running so hot (and even hotter in reality than what the gov't says it is)....that 4% 1year Tbill looks purdy good to me right now...Baseball Fan

@Baseball_Fan - I’m trying to cut through your rambling macro analysis. Would you please address some of the following questions? Best Wishes

“Curious … Do you think the technicals … ”What technicals? Not everyone uses technical analysis. Please identify which “technicals” you watch and base your investment decisions on? I’ve tried to help out by listing a few common technical indicators below:

- Moving Averages

- Moving Average Convergence and Divergence

- Relative Strength Indicator (RSI)

- Bollinger Bands

- Volume

- Exponential Moving Average

- Money Flow Index

“ … would indicate something like $95B coming off the CBs balance sheets”Over what period of time? Do you have a source verifying this will be completed within a definite time period? It took over a decade for the Federal Reserve to amass their bond holdings, beginning with the near depression that threatened the economy between 2007 and 2009.

“and the impact on stonks” (sic?)

Not all stocks are the same. Financials? Commodities? Growth? Domestic or foreign? Also omitted here is any reference to time frame. Do you mean by the end or 2022 or are your concerns related to further out (5-

10 years)?

“rate hikes”Why would you consider rate hikes to be bad for equities? Financials tend to do very well when longer term rates rise. It is true that the

most speculative areas tend to suffer as the cost of borrowing increases. (However, many are already down 50-70% this year.) But it’s not as cut & dry as you would have us believe. Rates have been extremely low for many years now. Bound to rise some day. Yet you and many others have over that time invested in equities for the long term - even knowing rates would someday rise. What changed?

“the impact of policy errors”That’s a sweeping assertion based it seems on conjecture. Please explain why that risk is higher now than in March 2020 (the covid related financial crisis) or March 2009 (the beginning of the last bull market). Policy errors can occur at any point in time. So can other negative factors like war, political chaos, natural disaster. As investors in companies we’re accustomed to accepting those risks.

“inflation continuing on and on … “Says who? Do you have some psychic in mind who can forecast inflation years out?

“(Will) the fed pivot any time soon … ?” What particular “pivot” are you referencing? After you explain that, please explain why an equity investor should base long term decisions on this ill defined hypothetical concept.

“inflation still running so hot” That’s redundant as you referenced it above. Here you seem to prophesy inflation will remain “so hot”

? … There’s no definitive way I know of to confirm / predict the level of inflation

1, 2 or 3 years out. Shall we base our long term equity investment decisions on such speculation?

“even hotter in reality than what the gov’t says it is …”Isn’t this something folks have long ragged about on this forum and elsewhere? There’s been numerous threads over the years examining the various inflation measures (there are several). So, you’re entitled to your prejudice on that point. But why do you find the discrepancy between your own numbers and what the Federal Bureau of Statistics determines to be of greater importance today than it was 3 years ago or

10 years ago?

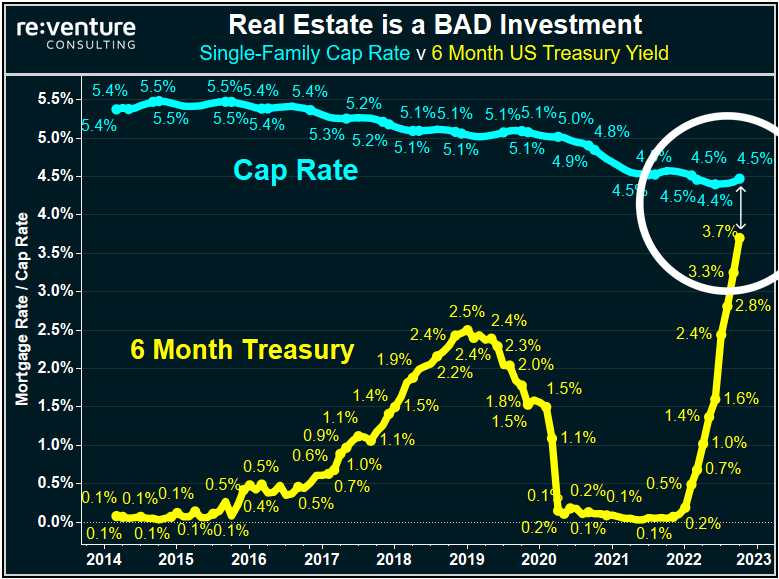

“that 4% 1 year TBill looks puffy good to me right now” Good. Glad you find TBills a good investment for your needs. Bear in mind that’s for just

1 year. Equity investors by nature are investing for much longer periods. Contemplate that if you harvest your 4% TBill a year from now, you might find that stocks in general have appreciated more than 4%. I don’t think it’s at all unreasonable to think they might. (Some I own move 4% in a single day.) In such case, you will have lost ground and possibly face buying in to equities than at a net loss. If inflation is running as “hot” as you think, why are you comfortable with just 4%?