It looks like you're new here. If you want to get involved, click one of these buttons!

.Fan’s descent into forced labor began, as human trafficking often does, with what seemed like a bona fide opportunity. He had been a prep cook at his sister’s restaurant in China’s Fujian province until it closed, then he delivered meals for an app-based service. In March 2021, Fan was offered a marketing position with what purported to be a well-known food delivery company in Cambodia. The proposed salary, $1,000 a month, was enticing by local standards, and the company offered to fly him in. Fan was so excited that he told his older brother, who already worked in Cambodia, about the opportunity. Fan’s brother quit his job and joined him. By the time they realized the offer was a sham, it was too late. Their new bosses wouldn’t let them leave the compound where they had been put to work.

Unlike the countless people trafficked before them who were forced to perform sex work or labor for commercial shrimping operations, the two brothers ended up in a new occupation for trafficking victims: playing roles in financial scams that have swindled people across the globe, including in the United States.

Tens of thousands of people from China, Taiwan, Thailand, Vietnam and elsewhere in the region have been similarly tricked. Phony job ads lure them into working in Cambodia, Laos and Myanmar, where Chinese criminal syndicates have set up cyberfraud operations …..

….About 8,000 miles from Cambodia, an American who lives near San Francisco got a WhatsApp message on Oct. 7, 2021, from a stranger calling herself Jessica. She seemed to have reached him by mistake. Jessica asked the man, whose middle name is Yuen, if they knew each other; she said she had found his number on her phone and didn’t know why. Yuen responded that he didn’t know her. But Jessica was chatty and friendly, and her photo was alluring, so they kept talking….

At the moment Jessica initiated contact, Yuen was vulnerable. His father was in a hospital, dying from a lung disease. He had entrusted Yuen, the youngest of four siblings, with the power to decide whether to cut off his life support. It would also be up to Yuen to plan his father’s funeral and distribute his estate.

The family had immigrated to the U.S. from Hong Kong decades earlier. Yuen, who is in his early 50s and works as an accountant for a major university, was more affluent than his siblings, who are all older than him. He felt it was his duty to take care of them in old age, much as he was caring for his father and had cared for his late mother. Jessica told him she admired his commitment to his family. She shared her own tale of having a grandfather in the hospital….

Yuen made it clear he couldn’t afford to lose any money. If he did, he said, he’d have to kill himself. Jessica said there was no need to worry: Uncle was never wrong. Yuen owed it to his father to seize the opportunity.

On Oct. 26, the day he had to go to the hospital to discuss his father’s end-of-life care, Yuen put money on the line for the first time. A conservative investor and lifelong saver, he’d been petrified to put even $2,000 into the brokerage. Jessica convinced him to start with $10,000 and taught him the two-step process to fund his account. First, he wired money from his bank to buy a cryptocurrency called ethereum. Then he could transfer the ethereum to a crypto wallet, whose address she provided.

Jessica insisted that using a cryptocurrency would help Yuen minimize his tax burden. He admitted he had very little idea of what he was doing….

Jessica didn’t seem to grasp what a hospice was. When Yuen explained that it was a care facility for the terminally ill, she perked up: “You need to make more money.” Jessica told him he should raise his account balance to $500,000 so he could cover the cost more easily.

I decided years ago to stop using ALT funds. They are not reliable and inconsistent. I developed my own timing system(link) that worked very well for me. I started practicing it in 2013.Thanks FD. Yes $2500 min at Fido. And one more “fund performance site” to add to my collection and further mess with my brain.

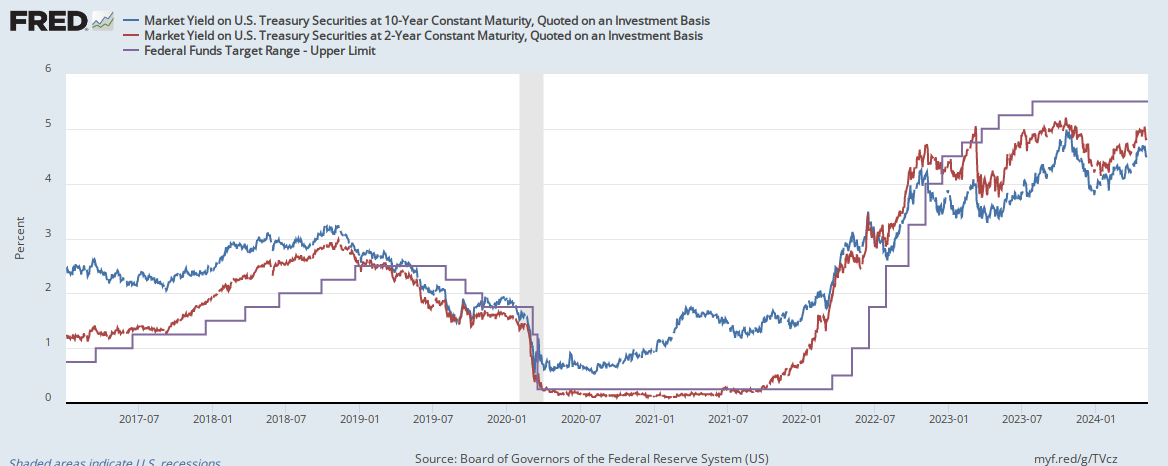

Good choice on the 26 week Ts. Right now my plan's to buy the 26 wk next week, after another bill matures.Submitted purchase for 26-week T-Bills (3.811% indicative yield) at tomorrow's auction.

All you got to do is check it out. Fidelity and Schwab have only $2500 min.FARIX seems like an interesting fund, but it has a $1 million minimum investment.

Since we are now in the new environment where rates are rising, I think it would be great to open a separate thread on buying and selling Agency bonds instead of bond funds.Just an FYI - on the question of commissions, most brokerages appear to charge a commission (e.g., 0.01%) in buying and selling Agency bonds. Today, Agency short term bonds were yielding nearly 50 pbs higher than Treasuries of the same maturities. If there is a wider interest in exploring Agency debt, we should open a separate thread to keep this thread on topic.

@LewisBraham - I was speaking as 1 individual investor, which I’m sure you realize. Not everyone possesses your depth of knowledge or my keen interest in investing.@hankI think unpredictability is good in sports and works of art, but am less enthused about it for the finances of millions of Americans whose retirements are tied to securities markets. It’s one of the reasons I’m a strong believer in Social Security and don’t think it should ever be tied to the stock market.Good! Makes investing more interesting.

© 2015 Mutual Fund Observer. All rights reserved.

© 2015 Mutual Fund Observer. All rights reserved. Powered by Vanilla